In a world where cryptocurrency markets exhibit extreme volatility, finding the best stablecoin to invest in has become a focal point for many budding crypto enthusiasts.

Stablecoins offer a semblance of tranquility in the otherwise tumultuous crypto waters, making them a preferable choice for those seeking to preserve capital while staying invested in the cryptoverse.

This article delves into the top stablecoins that have carved a niche for themselves by consistently maintaining their peg to underlying assets amidst market adversities.

Key Takeaways

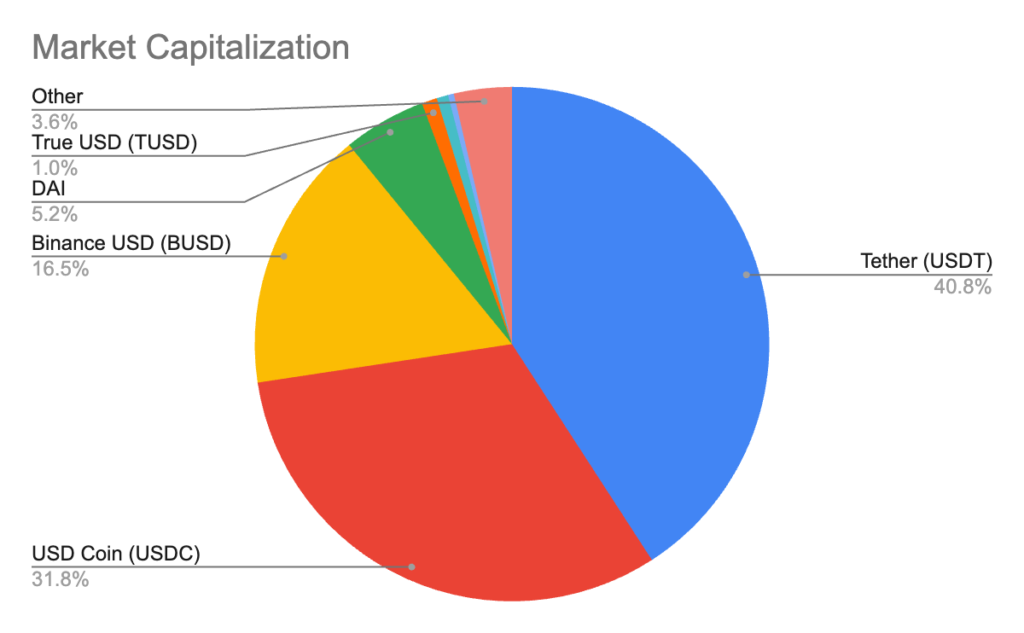

Key Point Details Market Cap of Stablecoins Over $153 billion as of 2022, a testament to their growing popularity【13†source】. Types of Stablecoins Variants like Fiat-backed, Commodity-backed, Crypto-backed, and Algorithmic stablecoins cater to different risk appetites【13†source】. Top 3 Stablecoins Tether (USDT), USD Coin (USDC), and Binance USD (BUSD) lead the pack with substantial market capitalizations【13†source】. Stability Analysis A deep dive into the stability aspects reveals not all top-ranked stablecoins are the most stable, an insight crucial for informed investment decisions【13†source】. Investment Considerations A prudent analysis of risks, rewards, and regulatory landscapes is indispensable for aspiring stablecoin investors.

Embark on a journey to discover the best stablecoins that not only promise stability but also open doors to the exciting world of cryptocurrency without the associated high risks.

Understanding Stablecoins

Stablecoins act as a bridge between the traditional financial realm and the burgeoning crypto ecosystem, offering a less volatile avenue for investors and traders.

Their design aims at pegging their value to stable assets like fiat currencies or commodities, thus providing a relative price stability.

Types of Stablecoins

There are primarily four types of stablecoins, each with its unique mechanism to maintain price stability:

- Fiat-backed Stablecoins:

- E.g., Tether (USDT), USD Coin (USDC)

- These stablecoins are backed by reserve assets like the US Dollar or Euro.

- They offer a 1:1 exchange rate with the underlying fiat currency, providing a high degree of price stability.

- Commodity-backed Stablecoins:

- E.g., PAX Gold (PAXG)

- Pegged to commodities like gold or oil.

- They allow investors to gain exposure to the commodity market while enjoying the benefits of digital assets.

- Crypto-backed Stablecoins:

- E.g., DAI

- These stablecoins are over-collateralized with other cryptocurrencies.

- Their stability is maintained through smart contracts that automatically adjust the collateral.

- Algorithmic Stablecoins:

- E.g., Ampleforth (AMPL)

- Their supply is automatically adjusted using algorithms based on supply and demand dynamics.

Each of these types has its merits and demerits, and the choice depends on the individual investor’s risk tolerance and investment strategy.

Understanding the different types of stablecoins will help you make an informed decision on which stablecoin to invest in.

Stability Mechanisms

The stability of a stablecoin is primarily derived from its backing asset or mechanism. F

or fiat and commodity-backed stablecoins, the value is directly pegged to the underlying asset, providing a tangible basis for their stability.

On the other hand, crypto-backed and algorithmic stablecoins rely on more complex mechanisms like over-collateralization and supply adjustments to maintain their peg.

“The stability of a stablecoin is not just about the asset backing it, but also the mechanism ensuring that peg is maintained.”

By delving deeper into the stability mechanisms, investors can better gauge the risks associated with each type of stablecoin, aligning their investments with their risk tolerance and long-term financial goals.

Top Stablecoins by Market Capitalization

The market cap of a stablecoin is often a reflection of its stability and acceptance in the crypto community.

These stablecoins have varying degrees of stability, transparency, and backing assets, which contribute to their position in the market.

For a more comprehensive understanding on stablecoins, delve into this informative piece.

Criteria for Ranking

Stablecoins are ranked based on various criteria such as:

- Collateral Type: The asset that backs the stablecoin, be it fiat, commodity, or cryptocurrency.

- Volatility: The degree to which the price of the stablecoin fluctuates.

- Market Capitalization: The total value of the stablecoin in the market.

- Regulatory Compliance: Adherence to legal and regulatory requirements.

- Transparency: The level of openness regarding the operations, reserves, and financial health.

Understanding these criteria can aid in making a well-informed decision on the best stablecoin to invest in, aligning with one’s financial goals and risk tolerance.

Analyzing Stability

The stability of stablecoins is paramount, especially for investors seeking a safe haven amidst the crypto market’s volatility. This section delves into the stability analysis of prominent stablecoins.

Stability Metrics

Various metrics can gauge the stability of a stablecoin:

- Price Stability: The consistency in price over time.

- Collateral Stability: The reliability of the underlying assets backing the stablecoin.

- Market Liquidity: The ease with which the stablecoin can be bought or sold without affecting its price.

Comparative Analysis

Investors should compare the stability of various stablecoins to make an informed choice.

This comparison should encompass the stablecoin’s historical performance, the robustness of its collateral, and its reaction to market adversities.

Understanding the stability of a stablecoin is crucial as it reflects the asset’s ability to maintain its peg, thus safeguarding the investor’s capital from extreme market fluctuations.

Delve deeper into the world of stablecoins and explore how they bridge the gap between traditional finance and the crypto realm in this insightful article.

By comprehending the stability metrics and conducting a thorough comparative analysis, investors position themselves better in the cryptoverse, ensuring their journey is less tumultuous and more rewarding.

Investment Considerations

Before diving into the stablecoin realm, understanding the following facets is crucial for a well-informed investment strategy:

Risks and Rewards

- Risks:

- Price deviation from the peg

- Regulatory changes

- Collateral volatility

- Rewards:

- Price stability

- Capital preservation

- Enhanced liquidity

Tax Implications

Investing in stablecoins carries tax implications, varying based on jurisdiction.

It’s imperative to stay abreast of the tax laws pertaining to crypto assets in your region.

Regulatory Landscape

The regulatory framework around stablecoins continues to evolve.

Ensuring compliance with the existing laws is paramount to avoid legal repercussions.

Navigating Stable Waters

As the crypto market continues to mature, stablecoins play a pivotal role in bridging the traditional and digital finance realms.

By investing in stablecoins, you’re not only safeguarding your capital but also embracing the transformative potential of cryptocurrencies.

The voyage to finding the best stablecoin to invest in is laden with learning and opportunities.

Armed with the right knowledge, navigating through the stable waters of stablecoins can lead to a rewarding and enlightening experience in the crypto realm.

Your journey into the stablecoin domain is a step towards fostering a more stable and accessible financial future.

Frequently Asked Questions

| Question | Answer |

| What are stablecoins? | Stablecoins are digital assets pegged to stable assets like fiat currencies or commodities, providing price stability. |

| Why invest in stablecoins? | They offer price stability, capital preservation, and enhanced liquidity compared to volatile cryptocurrencies. |

| What are the types of stablecoins? | There are four main types: Fiat-backed, Commodity-backed, Crypto-backed, and Algorithmic stablecoins. |

| How are stablecoins ranked? | They are ranked based on collateral type, volatility, market capitalization, regulatory compliance, and transparency. |

| What are the tax implications of investing in stablecoins? | Tax implications vary by jurisdiction; it’s crucial to understand the tax laws pertaining to crypto assets in your region. |

| How do stablecoins maintain price stability? | They maintain price stability through their backing assets or algorithmic mechanisms that adjust supply and demand. |