Are you intrigued by the potential of earning passive income through cryptocurrency lending but feel lost in the maze of options and jargon? You’ve landed on the perfect guide to decrypt the complexities of this fascinating financial frontier. From the basics to expert advice and future trends, this comprehensive article leaves no stone unturned, offering you the insights you need to make informed decisions in the world of crypto lending. Read on to become a pro at turning your digital assets into a lucrative investment!

Quick Takes

| Section Title | Key Takeaways |

| Basics of Cryptocurrency Lending | Gain a foundational understanding of what cryptocurrency lending is, how it works, and the types of platforms available. |

| Risks and Rewards | Learn about the potential risks involved, such as market volatility and default risks, as well as how to mitigate them. Also, understand the rewards, including passive income through interest. |

| Advanced Strategies | Dive into advanced tactics like yield farming, staking, and liquidity pools, offering you more avenues for earning. |

| Comparison of Popular Crypto Lending Platforms | Get a detailed comparison of leading platforms based on interest rates, supported cryptos, and more, helping you choose the right platform for your needs. |

| Regulatory and Tax Concerns | Understand the legal landscape of crypto lending, including regulations that could impact your investments, and the tax implications. |

| Expert Advice and Future Trends | Get insights from industry experts and explore future trends in cryptocurrency lending to stay ahead of the curve. |

Basics of Cryptocurrency Lending

In this section, we delve into the fundamentals of cryptocurrency lending, exploring what it is, how it operates, the types of platforms available, and the pros and cons involved.

What is Cryptocurrency Lending?

Cryptocurrency lending enables individuals to lend their crypto assets, either through decentralized or centralized platforms, earning interest over a period of time. This practice has become a pivotal aspect of decentralized finance (DeFi), offering a new avenue for earning passive income on cryptocurrency holdings.

How Does It Work?

The mechanics of cryptocurrency lending are simple yet effective. Lenders deposit their cryptocurrencies into a lending platform, allowing borrowers to take out loans using their own cryptocurrencies as collateral. The interest accrued during the loan tenure is then returned to the lender, thus making it a profitable venture for crypto asset holders.

Types of Crypto Lending Platforms

Crypto lending platforms fall into two primary categories:

- Centralized Platforms: These are platforms that are operated by centralized organizations and serve as intermediaries between lenders and borrowers. They offer various advantages such as user-friendly interfaces and a wide array of supported cryptocurrencies. Examples include Nexo and Aqru.

- Decentralized Platforms: Also known as DeFi lending platforms, these operate without a central governing body. They offer greater control to the user and typically have fewer restrictions. Notable examples are Aave and Compound.

| Parameters | Centralized Platforms | Decentralized Platforms |

|---|---|---|

| Interest Rates | Typically offer fixed interest rates, often higher to attract users. | Variable interest rates based on supply and demand dynamics. |

| Supported Cryptocurrencies | Wide range, including mainstream and various altcoins. | Often limited to tokens that are native or closely related to the platform’s blockchain. |

| Security Protocols | Central authority for security; often insured; susceptible to single point of failure. | Security relies on smart contracts; no central point of failure but may have code vulnerabilities. |

Advantages of Cryptocurrency Lending

- High Returns: One of the significant advantages of crypto lending is the potential for high-interest rates, often much higher than traditional financial avenues.

- Accessibility: These platforms are generally open to anyone with an internet connection, making it a universally accessible option.

- Transparency: The use of blockchain technology ensures a transparent system where all transactions can be independently verified and audited.

Risks and How to Mitigate Them

Cryptocurrency lending comes with its set of risks, including market volatility and the risk of borrower default. It’s crucial to conduct thorough due diligence and possibly diversify your lending portfolio to mitigate these risks. For a more detailed discussion on risk management, refer to our guide on cryptocurrency security.

Risks and Rewards

Cryptocurrency lending offers a compelling mix of opportunities and challenges. This section delves into the associated risks and rewards, equipping you with the knowledge needed to make well-informed decisions.

The Rewards of Crypto Lending

High Interest Rates

One of the most compelling advantages of cryptocurrency lending is the promise of high interest rates. Compared to traditional financial institutions, crypto lending platforms often offer significantly higher returns on investments, sometimes up to double-digit percentages annually.

Flexibility and Accessibility

Crypto lending platforms offer the flexibility to choose your loan terms, interest rates, and the type of cryptocurrencies you wish to lend or borrow. Moreover, these platforms are often accessible globally, providing financial services without the constraints of geographic limitations.

Passive Income

For those looking to generate a steady stream of income, crypto lending can serve as a reliable method for earning passive returns. With minimal effort, you can continuously earn interest on your deposited assets.

The Risks in Crypto Lending

Market Volatility

The cryptocurrency market is highly volatile, and prices can fluctuate dramatically in short periods. This volatility impacts both lenders and borrowers, as it can affect the value of collateral and change interest rates.

Default Risk

There’s always the risk that a borrower may default on their loan. While many platforms mitigate this risk by over-collateralizing loans, being aware of this potential pitfall is crucial.

Regulatory and Compliance Risks

As the regulatory landscape for cryptocurrencies is still evolving, there are risks associated with potential future regulations that could affect the legality or profitability of crypto lending.

For more insights into the regulatory landscape, you can refer to our guide on cryptocurrency regulations.

Mitigating Risks

Diversification

Just as with any investment, diversification can help mitigate risks. Don’t put all your eggs in one basket; diversify your lending across different platforms and cryptocurrencies.

Due Diligence

Always perform thorough research before choosing a lending platform. Look for platforms that are transparent, have good security measures, and preferably, are insured against losses.

Advanced Strategies

In the realm of cryptocurrency lending, there are several advanced strategies that can amplify your returns and diversify your investment portfolio. This section will explore some of these tactics, including yield farming, staking, and liquidity pools.

Yield Farming

What is Yield Farming?

Yield farming, also known as liquidity mining, is a practice where users lend their assets to a DeFi protocol in exchange for rewards. These rewards are typically in the form of governance or utility tokens.

How to Get Started

The process involves depositing your cryptocurrency into a liquidity pool, and in return, you receive liquidity tokens. These tokens can then be staked to earn additional rewards.

Risks and How to Mitigate Them

Yield farming is not without risks, such as impermanent loss and smart contract vulnerabilities. To mitigate these, always choose well-audited protocols and consider insuring your investments through platforms like Nexus Mutual.

Staking

What is Staking?

Staking involves holding a cryptocurrency in a digital wallet to support the network’s operations, such as transaction validation and block creation. In return, participants receive additional tokens as rewards.

Popular Coins for Staking

Coins like Ethereum 2.0, Cardano, and Polkadot offer staking options. The rewards and conditions vary from one blockchain to another.

Suggested Table: A table listing popular cryptocurrencies for staking, along with their annual percentage yield (APY), minimum holding period, and other relevant details.

Liquidity Pools

What are Liquidity Pools?

Liquidity pools are smart contracts that contain reserves of two tokens, allowing users to trade directly with the contract rather than with each other. By providing liquidity to these pools, you can earn a share of the trading fees.

How to Participate

To participate, you need to deposit an equivalent value of the two tokens in the pool. In return, you receive liquidity provider (LP) tokens, which can be staked to earn additional rewards.

Risks Involved

The main risks include impermanent loss and the potential for smart contract failures. As with yield farming, due diligence and proper risk management strategies are essential.

For those interested in diving deeper into decentralized finance, our guide on the rise of DeFi offers more comprehensive insights.

Comparison of Popular Crypto Lending Platforms

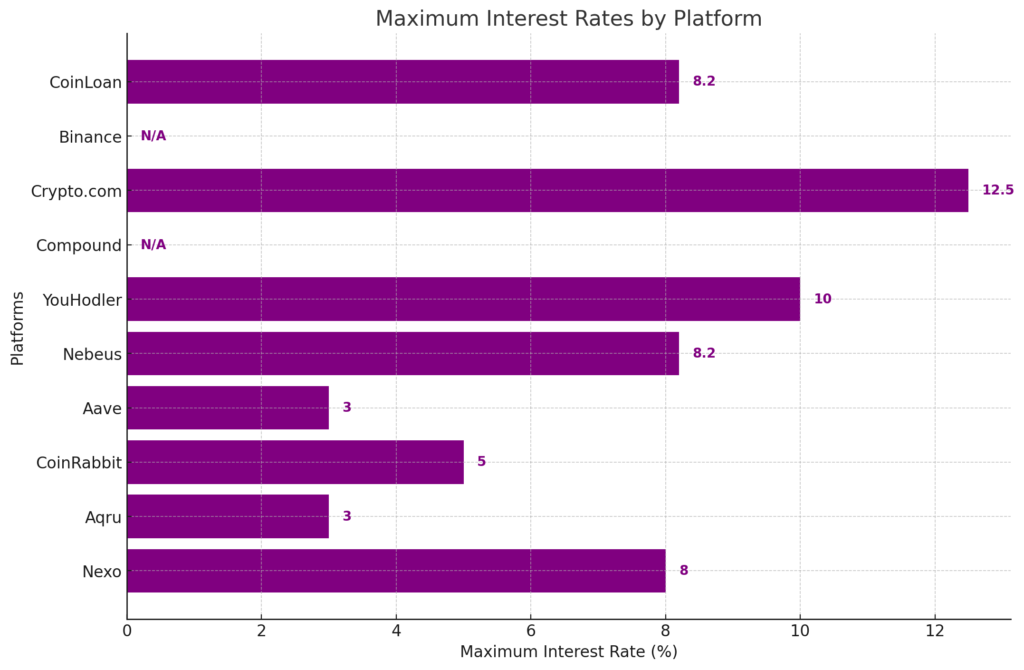

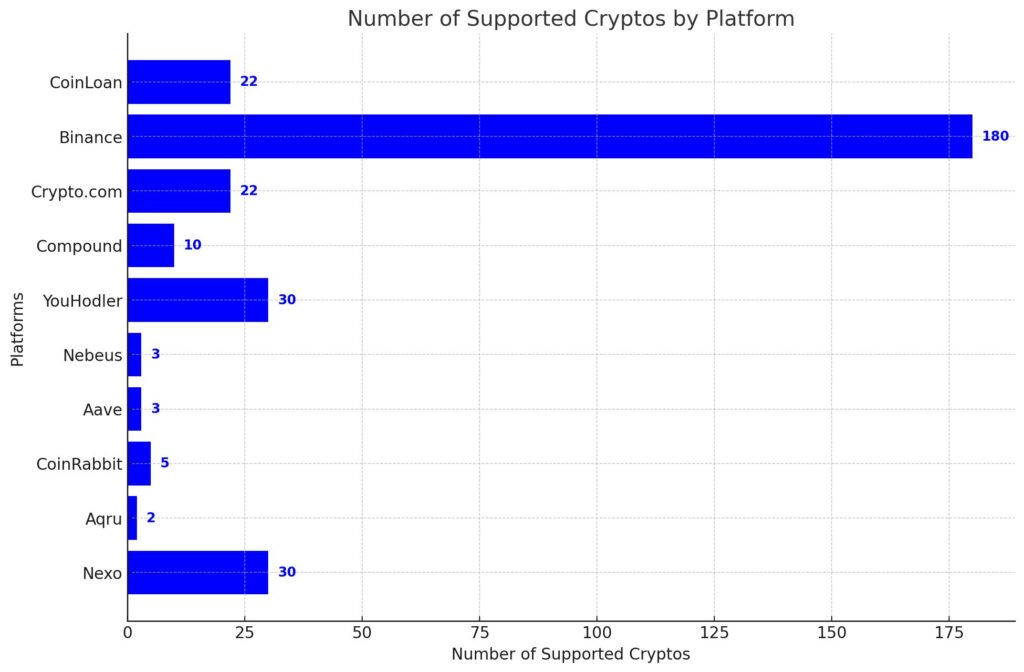

Choosing the right platform is crucial for maximizing your returns and minimizing risks in cryptocurrency lending. This section provides an in-depth comparison of popular crypto lending platforms based on various parameters such as supported cryptos, interest rates, and more.

Criteria for Comparison

When evaluating different platforms, consider the following criteria:

- Supported Cryptocurrencies

- Interest Rates

- Minimum Deposit Requirements

- Interest Payout Frequency

- Lock-in Periods

| Platform | Type | Interest Rates | Supported Cryptos | Security |

|---|---|---|---|---|

| Nexo | Centralized | Up to 8% | 30+ coins | 256-bit encryption, cold storage |

| Aqru | Centralized | Up to 3% | USDC, Ethereum | Two-factor authentication |

| CoinRabbit | Centralized | 5% | USDC, USDT, Binance USD, BSC, USD Coin | Cold Wallet Storage |

| Aave | Decentralized | 0-3% | ETH, MATIC, AVAX, etc. | Smart Contracts |

| Nebeus | Centralized | 5% or 8.2% | USDC, USDT, and others | Multi-signature wallets |

| YouHodler | Centralized | 7%-10% | 30 cryptos | Two-factor authentication, Cold storage |

| Compound | Decentralized | Variable | 10+ cryptos | Smart Contracts |

| Crypto.com | Centralized | 0.1-12.5% | 22+ cryptos | ISO/IEC 27001:2013, PCI:DSS |

| Binance | Centralized | Variable | 180+ cryptos | SAFU fund, Two-factor authentication |

| CoinLoan | Centralized | Up to 6.2% or 8.2% | 22+ cryptos | 256-bit encryption, Cold storage |

Nexo

Nexo offers a wide range of supported cryptocurrencies and attractive interest rates. The platform also provides daily interest payouts, making it a popular choice for many investors.

Key Features

- Supported Cryptos: 30+ coins

- Interest Rates: Up to 8%

- Minimum Deposit: Varies

- Interest Payout: Daily

- Lock-in Period: 1 or 6 months

Aqru

Aqru is known for its straightforward approach, offering interest rates up to 3% on USDC and up to 2% on Ethereum with no minimum deposit requirement.

Key Features

- Supported Cryptos: USDC, Ethereum

- Interest Rates: Up to 3%

- Minimum Deposit: None

- Interest Payout: Daily

- Lock-in Period: None or 90 days

CoinRabbit

CoinRabbit specializes in stablecoins, offering a flat 5% interest rate on popular options like USDC, USDT, and Binance USD.

Key Features

- Supported Cryptos: USDC, USDT, Binance USD, BSC, USD Coin

- Interest Rates: 5%

- Minimum Deposit: $100

- Interest Payout: Daily

- Lock-in Period: None

Aave

Aave stands out for its decentralization and range of supported assets, including ETH, MATIC, and AVAX. However, the interest rates can vary and are usually between 0-3%.

Key Features

- Supported Cryptos: ETH, MATIC, AVAX, etc.

- Interest Rates: 0-3%

- Minimum Deposit: None

- Interest Payout: Weekly

- Lock-in Period: N/A

YouHodler

YouHodler offers a wide variety of supported cryptos with interest rates ranging between 7% and 10%, making it one of the more lucrative options.

Key Features

- Supported Cryptos: 30 different cryptos

- Interest Rates: 7%-10%

- Minimum Deposit: $100

- Interest Payout: Weekly

- Lock-in Period: None

Nebeus

Nebeus offers flexible terms with a special focus on stablecoins like USDC and USDT. The platform has a tiered interest rate system depending on the crypto and the lock-in period.

Key Features

- Supported Cryptos: USDC, USDT, and others

- Interest Rates: 5% or 8.2% on USDC and USDT, 3% and 6.5% on other cryptos

- Minimum Deposit: Varies

- Interest Payout: Monthly

- Lock-in Period: 1 or 4 months

Compound

Compound is a decentralized platform that allows you to earn interest directly through its smart contract, without a middleman. It offers a range of supported cryptocurrencies but the rates can vary.

Key Features

- Supported Cryptos: 10+ types

- Interest Rates: Vary depending on the market

- Minimum Deposit: None

- Interest Payout: N/A

- Lock-in Period: N/A

Crypto.com

Crypto.com offers a wide variety of supported cryptos, with interest rates ranging from 0.1% to 12.5%. It provides flexibility with its no lock-in option or varying lock-in periods for higher interest.

Key Features

- Supported Cryptos: 22+ types

- Interest Rates: 0.1–12.5%

- Minimum Deposit: Varies

- Interest Payout: Weekly

- Lock-in Period: None, 1 or 3 months

Binance

Binance is one of the largest crypto exchanges that also offers lending services. With over 180 supported cryptocurrencies, it offers one of the most extensive ranges of options for both lenders and borrowers.

Key Features

- Supported Cryptos: 180+ types

- Interest Rates: Vary depending on the market

- Minimum Deposit: Varies

- Interest Payout: Daily

- Lock-in Period: Flexible or fixed (up to 120 days)

CoinLoan

CoinLoan is a European-based platform that offers a good mix of interest rates and supported cryptos. It also provides flexibility with its no lock-in option and varying lock-in periods.

Key Features

- Supported Cryptos: 22+ types

- Interest Rates: Up to 6.2% or 8.2%

- Minimum Deposit: $100

- Interest Payout: Monthly

- Lock-in Period: None or 1, 3, 6, 9, and 12 months

For a deeper understanding of how to secure your investments, you may want to consult our guide on cryptocurrency security.

Regulatory and Tax Concerns

Cryptocurrency lending is not just about earning high yields; it also involves navigating a complex web of regulations and tax obligations. This section aims to shed light on the key regulatory and tax concerns you should be aware of when engaging in crypto lending.

Regulatory Landscape

Global Regulations

Cryptocurrency regulations vary significantly from one jurisdiction to another. While some countries are crypto-friendly, others have stringent regulations or even outright bans.

Compliance Requirements

Financial authorities often require crypto lending platforms to adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Failure to comply could result in penalties or legal actions against the platform and, in some cases, its users.

Regulatory Risks

The regulatory environment for cryptocurrencies is still evolving. New laws and regulations can be introduced that may affect the legality or profitability of crypto lending.

Suggested Table: A table summarizing the regulatory stance of different countries towards cryptocurrency lending, including any licensing requirements.

For more detailed information on crypto regulations, you can refer to our comprehensive guide on cryptocurrency regulations.

Tax Implications

Tax on Interest Earnings

In many jurisdictions, the interest earned from crypto lending is considered taxable income. The rate can vary depending on your country of residence and the amount earned.

Capital Gains Tax

If you sell your cryptocurrencies after they have appreciated in value, you may be liable for capital gains tax. The tax rate and reporting requirements differ from country to country.

Record-Keeping

Proper record-keeping is essential for tax compliance. Ensure you maintain detailed records of your transactions, interest earnings, and any fees incurred.

Tax Compliance Tools

Various software tools and platforms can assist with tax reporting for crypto transactions. These tools can calculate your liabilities and even generate tax reports that can be submitted to authorities.

Expert Advice and Future Trends

The landscape of cryptocurrency lending is fast-evolving, influenced by technological innovations, market demand, and regulatory changes. This section offers expert advice and sheds light on the future trends that could shape this burgeoning industry.

Expert Advice

Risk Management

Financial experts often stress the importance of risk management in crypto lending. Diversifying your lending portfolio across different platforms and cryptocurrencies can mitigate potential losses.

Due Diligence

Before committing to any lending platform, conduct thorough research. Experts advise looking for platforms that are transparent, have robust security measures, and preferably, are insured against losses.

Regulatory Compliance

Keeping abreast of the regulatory landscape is crucial. Consult with a legal advisor to ensure you are complying with current laws and regulations, especially if you are lending or borrowing substantial amounts.

Future Trends

Integration with Traditional Finance

As blockchain technology matures, experts predict increased integration between cryptocurrency lending platforms and traditional financial institutions. This could open up new avenues for both lenders and borrowers.

Smart Contract Innovations

Advancements in smart contract technology could lead to more automated and secure lending platforms, reducing the need for intermediaries and potentially lowering fees.

Sustainability and Environmental Concerns

With increasing scrutiny on the environmental impact of cryptocurrencies, future platforms may focus more on sustainability, possibly favoring proof-of-stake (PoS) and other energy-efficient consensus algorithms.

For those interested in the environmental aspects of blockchain technology, our comprehensive guide on popular cryptocurrencies delves into this topic in greater detail.

Wrapping Up Your Crypto Lending Journey

And there you have it—a comprehensive guide to mastering the art of cryptocurrency lending. From understanding the basics to diving deep into advanced strategies, regulatory concerns, and future trends, we’ve covered it all.

Cryptocurrency lending offers a plethora of opportunities for those willing to venture into this complex yet rewarding domain. It serves as a testament to how far financial systems have evolved, offering a blend of traditional lending models with the power of blockchain technology.

However, as with any financial endeavor, it’s essential to tread carefully. Always keep abreast of the latest regulations, be mindful of tax implications, and never cease to educate yourself further.

Looking to explore more topics in the cryptocurrency universe? Don’t forget to check out our other in-depth guides on buying crypto, cryptocurrency trading, and the rise of DeFi to widen your crypto knowledge.

Thank you for joining us on this crypto lending journey. Here’s to your success in this fascinating world of digital finance!

Additional Resources

To further enhance your understanding and skills in cryptocurrency lending, we’ve compiled a list of valuable resources that are worth exploring:

Books and Academic Papers

- “The Basics of Bitcoins and Blockchains” by Antony Lewis: A beginner-friendly guide to understanding blockchain technology and its applications, including lending.

- “Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond” by Chris Burniske and Jack Tatar: This book delves into various crypto assets, including how they can be used in lending scenarios.

Websites and Blogs

- Unveiling the Crypto Mystery: Our own comprehensive guide that covers a wide range of crypto topics.

- CoinMarketCap Blog: Features various articles on crypto lending and other financial strategies.

Online Courses

- “Blockchain Basics” by Coursera: Provides a foundational understanding of blockchain technology, which is crucial for crypto lending.

- “Cryptocurrency Investment and Retirement Planning” by Udemy: This course covers different investment strategies in crypto, including lending.

Podcasts and Webinars

- “The Daily Stoic”: Offers episodes that delve into financial wisdom, some of which are applicable to crypto lending.

- “Unchained”: A podcast that often features experts discussing various aspects of cryptocurrencies, including lending.

Forums and Social Media Groups

- Reddit’s Cryptocurrency Community: A vibrant community where you can find discussions, advice, and news about crypto lending.

- Twitter Crypto Influencers: Follow hashtags like #CryptoLending and #DeFi to keep up with the latest trends and tips.

Frequently Asked Questions (FAQs)

| Question | Answer |

|---|---|

| Are crypto loans good? | Crypto loans can be beneficial due to their lower interest rates, faster approval processes, and the opportunity for earning passive income. However, they carry risks due to market volatility and platform security concerns. |

| Which crypto lending is best? | The best crypto lending platform depends on your needs. Centralized platforms offer more traditional banking services, while decentralized platforms offer more competitive rates and flexibility. Research is key to find the best fit. |

| How does Bitcoin loan work? | A Bitcoin loan involves using your Bitcoin as collateral to secure a loan. The amount you can borrow usually depends on the loan-to-value ratio set by the lender. If you fail to repay, your Bitcoin may be liquidated to cover the loan. |

| Can I borrow against my Bitcoin? | Yes, you can borrow against your Bitcoin by using it as collateral in a crypto lending platform. The loan amount and terms will depend on the lender’s policies and the current market value of your Bitcoin. |

| What are the risks of crypto lending? | The primary risks include market volatility, potential platform insolvency, hacking, and regulatory changes. Borrowers face the risk of margin calls, while lenders risk losing their assets if the borrower defaults or the platform fails. |

| Is crypto lending regulated? | Crypto lending regulation varies by region. Some countries have strict regulations, while others have little to no oversight. It’s important to check the regulatory status in your area and the platform’s compliance. |

| How do I choose a crypto lending platform? | Evaluate factors such as platform security, interest rates, collateral requirements, lending duration, fees, and user reviews. Also, consider the platform’s track record and regulatory compliance to make an informed decision. |