Are you intrigued by the world of cryptocurrencies but unsure how to dive in? Whether you’re a novice or a seasoned trader, the process of buying crypto can seem daunting. This comprehensive guide is designed to demystify the complexities of cryptocurrency trading, from buying and selling strategies to understanding regulations and mitigating risks. We’ve got you covered with step-by-step tutorials, expert insights, and actionable tips to help you make informed, data-driven decisions in the crypto market. Let’s embark on this exciting journey together!

Quick Takes

The following table summarizes the key takeaways from each section of the blog post. This will give you a quick overview of what you’ll learn and why each section is important.

| Section Title | Key Takeaways |

| Why Invest in Cryptocurrency? | Learn about the potential for high returns and how crypto can diversify your investment portfolio. |

| Understanding the Basics | Get to know key terms and concepts essential for anyone entering the crypto space. |

| How to Choose the Right Cryptocurrency | Discover the factors to consider when choosing which cryptocurrencies to invest in. |

| Setting Up a Crypto Wallet | Understand the types of crypto wallets and how to set one up securely. |

| Where to Buy Cryptocurrency | Overview of platforms where you can buy cryptocurrencies and how to choose the right one for you. |

| Step-by-Step Guide to Buying Crypto | A detailed walkthrough of the buying process, including payment methods. |

| How to Secure Your Investments | Learn best practices for securing your cryptocurrencies against potential risks. |

| Where to Sell Cryptocurrency | Know your options for platforms and methods to sell your cryptocurrencies. |

| Step-by-Step Guide to Selling Crypto | A detailed guide on how to sell your cryptocurrencies, including tax implications. |

| Trading Strategies for Buying and Selling | Understand various trading strategies and decide whether you’re a short-term or long-term investor. |

| Regulatory Considerations | Be aware of the legal aspects and regulations surrounding buying and selling cryptocurrencies. |

| Risks and How to Mitigate Them | Understand the risks involved in crypto investments and how to mitigate them. |

Why Invest in Cryptocurrency?

Investing in cryptocurrency has become a hot topic in recent years, especially as digital assets like Bitcoin and Ethereum have shown significant growth. But why should you consider buying crypto as part of your investment strategy? Let’s dive into the key reasons.

High Potential for Returns

One of the most compelling reasons for buying cryptocurrency is the potential for high returns. Unlike traditional investment avenues, cryptocurrencies have shown the ability to deliver exponential gains. For instance, Bitcoin, which started at less than a dollar, reached an all-time high of over $60,000 in 2021.

Diversification of Investment Portfolio

Diversification is a cornerstone of any sound investment strategy. Adding cryptocurrencies to your portfolio can provide the diversification you need to mitigate risks associated with traditional markets. This is especially relevant in times of economic uncertainty.

| Asset Type | Average Annual Return (%) | Volatility (Standard Deviation) | Risk Level | Liquidity |

|---|---|---|---|---|

| Cryptocurrency | 50-200% | Very High | High | High |

| Stocks | 7-10% | Moderate to High | Moderate | High |

| Bonds | 3-5% | Low to Moderate | Low | Moderate |

| Real Estate | 8-12% | Moderate | Moderate | Low |

| Gold | 1-2.5% | Low | Low | High |

Note: The figures are approximate and can vary based on market conditions.

Ownership and Control

When you invest in cryptocurrencies, you have complete ownership and control over your assets without the need for intermediaries like banks. This is possible through crypto wallets, which allow you to store, send, and receive cryptocurrencies securely.

Liquidity and Accessibility

Cryptocurrencies are traded 24/7 on various exchanges, providing high liquidity and the ability to trade at any time. This is a significant advantage over traditional markets, which have set trading hours.

Future Potential

The blockchain technology underlying cryptocurrencies has a wide range of applications beyond digital assets, including smart contracts, decentralized finance (DeFi), and more. Investing in crypto now could position you well for these future developments.

Risks and Considerations

While buying crypto offers numerous advantages, it’s essential to be aware of the risks involved. Market volatility, regulatory uncertainties, and security concerns are some factors you should consider before making an investment.

Understanding the Basics

Before diving into the world of buying and selling crypto, it’s crucial to understand the basic concepts that underlie this digital asset class. This section aims to provide you with a foundational understanding of cryptocurrencies.

What is Cryptocurrency?

A cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology.

How Do Cryptocurrencies Work?

Cryptocurrencies work on a technology called blockchain, a public ledger containing all transaction data from anyone who uses a particular cryptocurrency. The transactions are added to the “block” and then linked to the “chain” in a linear, chronological order.

Types of Cryptocurrencies

There are thousands of cryptocurrencies available in the market, each with its unique features and use cases. The most popular ones include Bitcoin, Ethereum, and altcoins like Litecoin, Cardano and Ripple.

How to Buy and Sell Cryptocurrency

Buying and selling cryptocurrency is generally done through cryptocurrency exchanges. These platforms allow you to trade various types of cryptocurrencies using different payment methods. It’s essential to choose an exchange that is secure, has a good reputation, and offers the cryptocurrencies you are interested in buying or selling.

Wallets and Storage

Once you’ve bought cryptocurrencies, you’ll need a secure place to store them. This is where crypto wallets come in. Wallets can be hardware-based or software-based, and they keep your cryptocurrencies safe from unauthorized access.

Regulatory and Tax Implications

Before you start buying and selling crypto, it’s crucial to understand the regulatory and tax implications in your jurisdiction. Failure to comply with these can result in penalties and legal issues.

How to Choose the Right Cryptocurrency

Choosing the right cryptocurrency is a critical step in your investment journey. With thousands of options available, making an informed decision can be overwhelming. This section will guide you through the key factors to consider when selecting a cryptocurrency for buying or selling.

Market Capitalization and Liquidity

One of the first things to look at is the market capitalization of the cryptocurrency. A higher market cap generally indicates a more stable and widely accepted coin. Liquidity is another crucial factor; it determines how easily you can buy or sell the cryptocurrency without affecting its market price.

Use-Case and Utility

Understanding the use-case of a cryptocurrency can provide insights into its long-term viability. Does the coin solve a real-world problem or is it just a ‘pump and dump’? Make sure to research the utility of the coin in the broader ecosystem.

Community and Developer Support

A strong community and active developer support are good indicators of a cryptocurrency’s reliability and future growth. Check forums, social media, and other platforms to gauge community sentiment.

Security and Technology

Before buying or selling any cryptocurrency, it’s essential to consider its security features. Look for cryptocurrencies that use advanced cryptographic techniques to secure transactions and control the creation of new units.

Regulatory Compliance

Ensure that the cryptocurrency you choose complies with regulatory standards. Non-compliance can lead to legal issues and could affect the coin’s market value.

Fees and Transaction Speed

Different cryptocurrencies have varying transaction fees and speeds. While some offer instant transactions with minimal fees, others might take longer and cost more. Choose based on your specific needs.

Reviews and Expert Opinions

Lastly, don’t forget to check reviews and expert opinions. Many cryptocurrency trading platforms offer detailed analyses and reviews that can help you make an informed decision.

Choosing the right cryptocurrency involves a careful analysis of various factors. Whether you’re buying crypto for the first time or looking to diversify your portfolio, these guidelines will help you make a choice that aligns with your investment goals.

Setting Up a Crypto Wallet

Setting up a crypto wallet is an essential step for anyone looking to buy, sell, or hold cryptocurrencies. A crypto wallet allows you to securely store your digital assets and manage transactions. This section will guide you through the different types of wallets and the steps to set one up.

Types of Crypto Wallets

There are various types of crypto wallets, each with its own set of features and security measures. Here’s a quick rundown:

- Hot Wallets: These are internet-connected wallets and are suitable for daily transactions.

- Cold Wallets: These are offline wallets, ideal for long-term storage of cryptocurrencies.

- Hardware Wallets: Physical devices that store your private keys offline.

- Software Wallets: Applications or software installed on your computer or mobile device.

- Paper Wallets: Physical paper containing your cryptocurrency information, usually a QR code.

How to Choose the Right Wallet

When choosing a wallet, consider the following factors:

- Security: Opt for wallets with robust security features like two-factor authentication (2FA) and encryption.

- User Interface: The wallet should be user-friendly, especially if you’re a beginner.

- Compatibility: Ensure the wallet supports the cryptocurrencies you intend to use.

- Backup & Recovery: Check if the wallet offers backup and recovery options.

Steps to Set Up a Wallet

- Select the Type of Wallet: Decide between hot or cold storage based on your needs.

- Download or Purchase: For software wallets, download the application. For hardware wallets, you’ll need to purchase the device.

- Installation and Setup: Follow the on-screen instructions to set up the wallet.

- Backup: Always backup your wallet’s essential information.

- Secure Your Wallet: Enable security features like 2FA.

- Test: Send a small amount of cryptocurrency to your new wallet to ensure it’s working correctly.

Best Practices for Wallet Security

- Regular Updates: Keep your wallet software up to date.

- Use Strong Passwords: Opt for complex passwords and change them regularly.

- Be Cautious of Phishing Attacks: Always double-check URLs and email addresses.

By following these guidelines, you’ll be well-equipped to select and set up a crypto wallet that suits your needs, ensuring the safe storage and management of your digital assets.

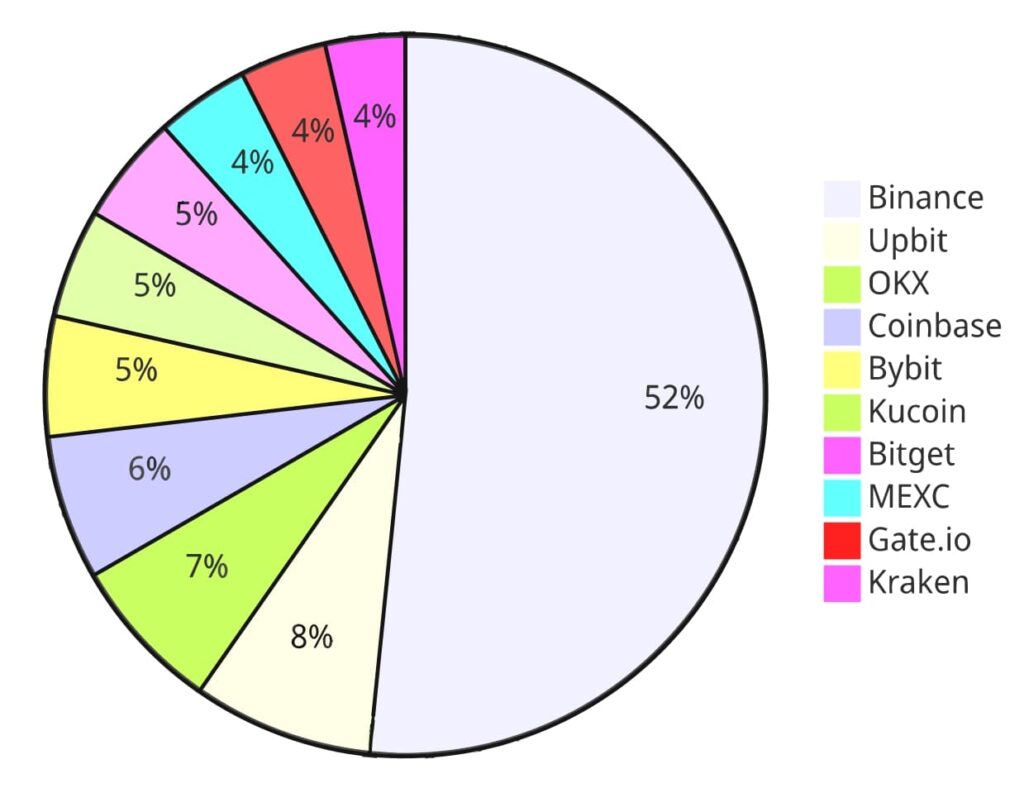

Where to Buy Cryptocurrency

Purchasing cryptocurrency is a crucial step in entering the world of digital assets. This section will guide you through the various platforms and methods available for buying cryptocurrency, helping you make an informed decision.

Types of Platforms to Buy Cryptocurrency

There are several types of platforms where you can buy cryptocurrencies:

- Cryptocurrency Exchanges: Online platforms like Coinbase, Binance, and Kraken.

- Peer-to-Peer (P2P) Platforms: Websites that facilitate direct transactions between individuals.

- ATMs: Specialized ATMs that allow you to buy cryptocurrencies.

- Brokerage Firms: Traditional financial firms offering cryptocurrency investment options.

Factors to Consider When Choosing a Platform

Before settling on a platform, consider the following:

- Fees: Transaction and withdrawal fees can vary widely.

- Security: Look for platforms with strong security measures, such as 2FA.

- User Experience: A user-friendly interface is especially helpful for those new to cryptocurrency.

- Supported Cryptocurrencies: Make sure the platform supports the cryptocurrencies you want to buy.

Payment Methods

Various payment methods are available, including:

- Bank Transfers

- Credit/Debit Cards

- PayPal

- Cryptocurrency Transfers

Each method comes with its own set of fees and processing times, so choose wisely.

By understanding these aspects, you’ll be better prepared to buy cryptocurrency from a platform that aligns with your needs. For more information on exchanges, you can visit our comprehensive guide on cryptocurrency exchanges.

Step-by-Step Guide to Buying Crypto

Buying cryptocurrency may seem daunting at first, but with the right guidance, it becomes a straightforward process. This step-by-step guide aims to simplify the journey from selecting a platform to owning your first digital asset.

Choosing the Right Platform

Your first step is to choose a platform that aligns with your needs. Consider factors like fees, supported cryptocurrencies, and user experience. For a detailed comparison, refer to our section on Where to Buy Cryptocurrency.

Account Creation and Verification

- Sign Up: Visit the chosen platform and sign up using your email.

- Verification: Submit identification documents for verification.

- Security Setup: Enable two-factor authentication (2FA) for added security.

Depositing Funds

Once your account is set up, you’ll need to deposit funds:

- Navigate to Deposit Section: Usually found under ‘Wallet’ or ‘Account’.

- Select Payment Method: Choose between bank transfer, credit card, or other options.

- Confirm Deposit: Follow the prompts to complete the deposit.

Buying Your First Cryptocurrency

After depositing funds, you’re ready to make a purchase:

- Search for Cryptocurrency: Use the search bar to find the cryptocurrency you want.

- Select Amount: Decide how much you want to buy.

- Review and Confirm: Double-check the fees and total cost before confirming the purchase.

Transferring to a Secure Wallet

For long-term storage, it’s advisable to transfer your cryptocurrency to a secure wallet. Learn more about different types of wallets and how to set them up in our crypto wallets guide.

- Navigate to Withdraw Section: Usually found under ‘Wallet’ or ‘Account’.

- Enter Wallet Address: Paste the address of your secure wallet.

- Confirm Transfer: Review the details and confirm the transfer.

By following these steps, you’ll go from a crypto novice to a confident investor, capable of buying and securely storing your digital assets.

How to Secure Your Investments

Securing your cryptocurrency investments is crucial for both short-term traders and long-term investors. The digital nature of cryptocurrencies makes them susceptible to various risks, including hacking and fraud. This guide will walk you through essential steps to safeguard your assets.

Use a Secure Wallet

The first line of defense in securing your investments is choosing a reliable wallet. Hardware wallets are generally considered the safest. For more information on selecting a wallet, check out our crypto wallets guide.

Enable Two-Factor Authentication (2FA)

Always enable 2FA for your accounts, whether it’s your wallet, exchange, or any platform where your cryptocurrencies are stored.

- Setting Up 2FA: Usually found under ‘Account Settings’.

- Authentication Methods: Choose between SMS, authenticator app, or hardware token.

- Backup Codes: Store these in a secure location.

Regularly Update Security Measures

Security is not a one-time setup but a continuous process. Keep your software updated and periodically review your security settings.

- Software Updates: Always update to the latest versions.

- Security Audit: Conduct regular audits of your accounts.

- Change Passwords: Regularly update your passwords.

Be Cautious of Phishing Attempts

Be vigilant about phishing attempts that aim to steal your credentials. Always double-check URLs and email addresses.

- Check URL: Make sure the website is secure (https).

- Verify Email: Be cautious of emails from unknown or suspicious sources.

Diversify Your Investments

Putting all your eggs in one basket is risky. Diversify your investments across different cryptocurrencies and financial instruments. For more on this, refer to our section on How to Choose the Right Cryptocurrency.

By implementing these security measures, you can significantly reduce the risks associated with cryptocurrency investments. Always remember, that the key to securing your investments is constant vigilance and regular updates.

Where to Sell Cryptocurrency

Selling cryptocurrency is an essential aspect of the crypto trading process. Whether you’re a seasoned trader or a beginner, knowing where and how to sell your assets can make a significant difference in your returns. This guide will help you navigate the various platforms and methods available for selling cryptocurrency.

Cryptocurrency Exchanges

Cryptocurrency exchanges are the most common platforms for buying and selling digital assets. They offer a wide range of cryptocurrencies and are generally easy to use.

- Centralized Exchanges: Platforms like Coinbase, Binance, and Kraken.

- Decentralized Exchanges (DEXs): Platforms like Uniswap and Sushiswap.

Peer-to-Peer (P2P) Platforms

P2P platforms allow you to sell your cryptocurrency directly to another individual. These platforms act as intermediaries to ensure the transaction is secure.

- LocalBitcoins: Primarily for Bitcoin transactions.

- Paxful: Supports multiple cryptocurrencies.

Broker Services

Broker services are platforms that facilitate the buying and selling of cryptocurrencies but at a price set by the broker.

- Coinmama: Known for quick transactions.

- eToro: Offers a range of financial instruments.

ATMs and Kiosks

Cryptocurrency ATMs and kiosks allow you to sell your digital assets for cash or other cryptocurrencies. However, they usually have higher fees.

- Bitcoin ATMs: Mostly for Bitcoin transactions.

- CoinFlip: Supports multiple cryptocurrencies.

Factors to Consider

Before choosing a platform, consider the following factors:

- Fees: Transaction and withdrawal fees can vary widely.

- Security: Always opt for platforms with strong security measures.

- Ease of Use: The platform should be user-friendly.

For a deeper dive into choosing the right platform, refer to our comprehensive guide on cryptocurrency exchanges.

Step-by-Step Guide to Selling Crypto

Selling cryptocurrency can seem daunting, especially for newcomers. This step-by-step guide aims to simplify the process, ensuring you get the best value for your digital assets while maintaining security.

Choose the Right Platform

Your first step is to select a platform that aligns with your needs. You can choose from:

- Cryptocurrency Exchanges: Like Coinbase or Binance.

- P2P Platforms: Such as LocalBitcoins or Paxful.

- Broker Services: Like Coinmama or eToro.

Prepare Your Wallet and Assets

Before you can sell, you need to transfer your cryptocurrency to the chosen platform. Make sure your assets are in a wallet that you control.

- Transfer Funds: Move your cryptocurrency to the platform’s wallet.

- Confirm Transfer: Always double-check the transaction details.

Set Your Selling Parameters

Once your assets are in place, you can set up your sale.

- Choose the Cryptocurrency: Select the asset you wish to sell.

- Set the Price: Decide on a selling price based on current market conditions.

- Place the Order: Confirm and place your selling order.

Execute the Sale

After placing the order, you’ll need to wait for a buyer.

- Monitor the Market: Keep an eye on price fluctuations.

- Confirm the Sale: Once a buyer is found, confirm the transaction.

Withdraw Your Funds

The final step is to safely withdraw your funds.

- Choose Withdrawal Method: Options usually include bank transfer, PayPal, or other cryptocurrencies.

- Confirm Withdrawal: Double-check all details before confirming.

For more information on how to secure your transactions, you can read our guide on cryptocurrency security.

By following these steps, you can sell your cryptocurrency in a secure and efficient manner. Whether you’re a seasoned trader or a beginner, this guide aims to simplify the selling process for everyone.

Trading Strategies for Buying and Selling

Trading cryptocurrency involves more than just buying low and selling high. It requires a well-thought-out strategy to maximize profits while minimizing risks. This section will delve into various trading strategies that can be employed for buying and selling cryptocurrencies.

Fundamental Analysis

Fundamental analysis involves evaluating a cryptocurrency’s intrinsic value. This can include studying the whitepaper, team, technology, and market demand.

- Whitepaper: Understand the project’s vision and utility.

- Team: Research the team’s background and expertise.

- Technology: Assess the blockchain technology and its scalability.

- Market Demand: Evaluate the problem the project aims to solve.

Technical Analysis

Technical analysis focuses on statistical trends from trading activity. Traders use various indicators like moving averages, RSI, and Fibonacci retracements.

- Moving Averages: Helps identify the asset’s trend direction.

- RSI (Relative Strength Index): Indicates overbought or oversold conditions.

- Fibonacci Retracements: Helps identify potential reversal levels.

Sentiment Analysis

Sentiment analysis involves gauging market sentiment by studying news articles, social media posts, and public opinion.

- News Monitoring: Keep an eye on news that could impact price.

- Social Media: Use platforms like Twitter to gauge public sentiment.

- Public Opinion: Forums like Reddit can provide valuable insights.

Risk Management

Effective risk management is crucial for successful trading.

- Set Stop-Losses: To limit potential losses.

- Diversify Portfolio: Don’t put all your eggs in one basket.

- Leverage: Use cautiously, as it can amplify both gains and losses.

For a deeper understanding of how to secure your investments, check out our guide on cryptocurrency security.

By employing these trading strategies, you can make more informed decisions when buying and selling cryptocurrencies. Whether you’re a day trader or a long-term investor, these strategies offer a structured approach to cryptocurrency trading.

Regulatory Considerations

Navigating the regulatory landscape is a crucial aspect of cryptocurrency trading. Different countries have varying regulations, and failing to comply can result in severe penalties. This section will guide you through the key regulatory considerations you need to be aware of when trading cryptocurrencies.

Know Your Customer (KYC) and Anti-Money Laundering (AML)

Most reputable cryptocurrency exchanges require users to complete KYC and AML checks. This usually involves submitting identification documents and proof of residence.

- Identification: Passport, driver’s license, or national ID.

- Proof of Residence: Utility bill or bank statement.

Tax Implications

Understanding the tax implications of your trades is essential. In many jurisdictions, cryptocurrencies are considered taxable assets.

- Capital Gains Tax: On profits from selling cryptocurrencies.

- Income Tax: On mining or receiving cryptocurrencies as payment.

For more information on crypto-related taxes, visit our comprehensive guide on crypto tax.

Securities Regulations

Some cryptocurrencies and tokens may be classified as securities, subjecting them to specific regulations.

- ICO Regulations: Initial Coin Offerings often come under scrutiny.

- Token Classification: Whether a token is a security can impact its legality.

Jurisdictional Differences

Regulations can vary significantly from one jurisdiction to another. Always be aware of the local laws pertaining to cryptocurrency trading.

- Banned Countries: Some countries have outright banned cryptocurrencies.

- Regulated Markets: Countries like the U.S. have specific regulations.

Compliance and Reporting

Always keep records of your transactions for compliance and reporting purposes. Failing to do so can result in penalties.

- Transaction History: Keep track of all trades and transfers.

- Reporting: File any necessary reports with tax authorities.

By understanding these regulatory considerations, you can trade cryptocurrencies more confidently and responsibly. Always stay updated with the latest crypto regulations to ensure you’re in compliance with the law.

Risks and How to Mitigate Them

Trading cryptocurrencies comes with its own set of risks. While the rewards can be substantial, it’s crucial to understand the potential pitfalls and how to mitigate them. This section will guide you through various risks associated with cryptocurrency trading and offer strategies to minimize them.

Market Volatility

Cryptocurrencies are known for their extreme volatility. Prices can skyrocket, but they can also plummet.

- Diversification: Don’t put all your eggs in one basket. Diversify your portfolio.

- Limit Orders: Use limit orders to buy or sell at predetermined prices.

Security Risks

The digital nature of cryptocurrencies makes them susceptible to hacking and fraud.

- Two-Factor Authentication (2FA): Always enable 2FA on your accounts.

- Cold Storage: Store your cryptocurrencies in a hardware wallet.

For more on securing your assets, check out our guide on cryptocurrency security.

Regulatory Risks

As discussed in the Regulatory Considerations section, failing to comply with regulations can result in penalties.

- Stay Informed: Keep up-to-date with the latest regulations.

- Record-Keeping: Maintain detailed records of your transactions.

Liquidity Risks

Some cryptocurrencies are not as easily convertible to cash, posing liquidity risks.

- Market Research: Stick to well-known, widely-accepted cryptocurrencies.

- Exit Strategy: Have a plan for converting your cryptocurrencies back to fiat.

Psychological Risks

The emotional highs and lows of trading can impact your decision-making.

- Set Boundaries: Decide in advance how much you’re willing to invest or lose.

- Avoid FOMO: Fear of missing out can lead to rash decisions. Stay disciplined.

By being aware of these risks and taking proactive steps to mitigate them, you can make more informed and safer trading decisions. Always remember to consult our comprehensive guide on cryptocurrency trading for more insights.

Wrapping Up Your Crypto Trading Journey

You’ve made it to the end of this comprehensive guide, and you’re now equipped with the knowledge to navigate the complex but rewarding world of cryptocurrency trading. From understanding where to sell your assets and how to do it step-by-step, to diving into trading strategies and being aware of regulatory considerations, you’re well on your way to becoming a savvy crypto trader.

Remember, the key to successful trading lies not just in the technical aspects but also in managing risks effectively. Always stay updated with the latest trends and regulations in the crypto world to make informed decisions.

Thank you for taking the time to read this guide. We wish you the best of luck in your cryptocurrency trading endeavors. For more in-depth articles and guides, feel free to explore CryptoMindPro.

Additional Resources for Further Learning

To continue your journey in mastering the art of cryptocurrency trading, here are some additional resources that can provide you with more in-depth knowledge and insights:

Books

- “The Basics of Bitcoins and Blockchains” by Antony Lewis – A great starting point for understanding the technology behind cryptocurrencies.

- “Cryptoassets: The Innovative Investor’s Guide” by Chris Burniske and Jack Tatar – This book focuses on how to evaluate the potential of different crypto assets.

Online Courses

- Cryptocurrency Investment Course 2023: Fund Your Retirement! – A Udemy course that covers everything from buying to investing in cryptocurrencies.

- Blockchain Basics – Offered by Coursera, this course provides a foundational understanding of blockchain technology.

Websites

- CryptoMindPro – Your one-stop resource for all things crypto, from trading strategies to security measures.

- CoinMarketCap – A reliable source for checking real-time cryptocurrency prices and market capitalizations.

Tools

- Google Analytics – For tracking the performance of your crypto investments.

- Google Keyword Planner – Useful for researching what cryptocurrencies are trending.

Forums and Communities

- Reddit’s r/cryptocurrency – A community where you can discuss the latest trends and news in the crypto world.

- Crypto Twitter – Follow hashtags like #crypto and #blockchain for real-time updates.

Regulatory Bodies

- U.S. Securities and Exchange Commission (SEC) – For updates on crypto regulations in the United States.

- Financial Conduct Authority (FCA) – For UK-based regulations.

Feel free to dive into these resources to expand your knowledge and skills in cryptocurrency trading. Happy learning!

Frequently Asked Questions (FAQs)

Here’s a table of common questions and answers to help you navigate the complexities of cryptocurrency trading.

| Question | Answer |

| What is cryptocurrency trading? | Cryptocurrency trading involves buying and selling digital assets with the aim of making a profit. |

| How do I start trading cryptocurrencies? | You can start by opening an account on a cryptocurrency exchange, depositing funds, and then buying or selling digital assets. |

| What are the most popular cryptocurrencies to trade? | Bitcoin, Ethereum, and Binance Coin are among the most popular cryptocurrencies for trading. |

| Is cryptocurrency trading safe? | While trading itself is risky, you can take various security measures to protect your assets. |

| How do I store my cryptocurrencies? | You can store your digital assets in a crypto wallet, which can be hardware-based or software-based. |

| What are trading strategies? | Trading strategies are plans that traders use to determine when to buy or sell assets. They can be based on technical analysis, fundamental analysis, or both. |

| Are there any regulations for crypto trading? | Yes, cryptocurrency trading is subject to regulations that vary by country. It’s important to be aware of these regulations to trade legally. |

| How are crypto gains taxed? | In most countries, cryptocurrency gains are considered taxable income. For more information, check our guide on crypto tax. |

| What is DeFi? | DeFi stands for Decentralized Finance. It’s a subset of the crypto market that aims to recreate traditional financial systems (like lending and borrowing) on blockchain. More details can be found here. |

| Can I stake my cryptocurrencies? | Yes, some cryptocurrencies allow you to earn additional tokens by staking your existing ones in a wallet. |