Are you ready to embark on a thrilling journey into the world of cryptocurrency trading, where fortunes are made and the financial landscape is forever transformed? If you’re intrigued by the idea of harnessing the power of digital assets, then you’re in the right place.

Welcome to a comprehensive guide that will demystify the art of cryptocurrency trading, from the basics to advanced strategies, regulatory considerations, and future trends. Whether you’re a curious novice or a seasoned trader, this guide will equip you with the knowledge and tools you need to navigate the exhilarating and sometimes treacherous waters of cryptocurrency trading.

Join us as we unravel the mysteries, explore the strategies, and uncover the potential of cryptocurrency trading. Your journey to financial freedom begins here.

Highlights

| Section Title | Key Takeaways |

| The Basics of Cryptocurrency Trading | Understand the different types of cryptocurrency trading: Day trading, Swing trading, and HODLing. |

| Cryptocurrency vs Traditional Banking | Learn how cryptocurrency trading offers a decentralized, faster, and more inclusive alternative to traditional banking. |

| Market Analysis | Discover the three pillars of market analysis: Fundamental, Technical, and Sentiment. |

| Trading Platforms | Explore the pros and cons of centralized vs decentralized trading platforms. |

| Trading Strategies | Get insights into various trading strategies like Trend Following, Mean Reversion, and High-Frequency Trading. |

| Risk Management | Learn essential risk management techniques like setting stop losses and diversification. |

| Trading Psychology | Understand the importance of emotional discipline and how to avoid cognitive biases. |

| Regulatory Considerations | Get informed about the legal and tax implications of cryptocurrency trading. |

| Tools and Resources | Find out about useful tools like trading bots and educational resources. |

| Case Studies | Learn from real-world success stories and failures in cryptocurrency trading. |

| Trends | Stay ahead with knowledge about upcoming trends like NFTs and DeFi in cryptocurrency trading. |

| Common Mistakes and How to Avoid Them | Avoid common pitfalls in cryptocurrency trading through informed strategies. |

The Basics of Cryptocurrency Trading

Cryptocurrency trading is a dynamic field that has captured the imagination of millions. But what exactly is it? Let’s break it down.

What is Cryptocurrency Trading?

Cryptocurrency trading involves buying and selling digital assets with the aim of making a profit. Unlike traditional stock markets, the crypto market operates 24/7, offering endless opportunities for traders.

Types of Cryptocurrency Trading

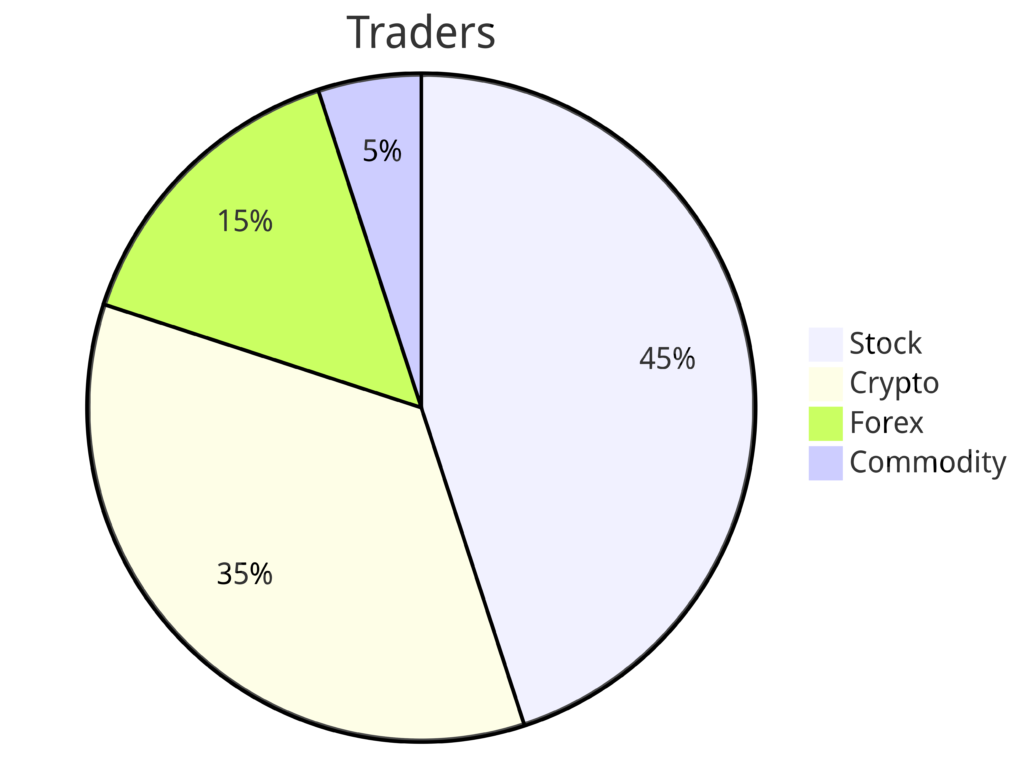

There are mainly three types of cryptocurrency trading:

- Day Trading: Buying and selling on short-term movements within the market.

- Swing Trading: Taking advantage of price “swings” in the market.

- HODLing: A long-term investment strategy, where you hold the asset for several months or years.

Trading Pairs

In cryptocurrency trading, you’ll often hear about “trading pairs,” which refer to the two currencies being exchanged. For example, if you’re trading Bitcoin for Ethereum, the trading pair would be BTC/ETH.

For a deeper understanding of how crypto can be stored, check out our article on Crypto Wallets.

Market Orders vs Limit Orders

When it comes to executing a trade, you have two main options:

- Market Orders: Immediate trades at current market prices.

- Limit Orders: Trades executed at a future price set by you.

| Order Type | Advantages | Disadvantages |

| Market Orders | Quick execution | May incur slippage |

| Limit Orders | Price control | May not get filled |

Risks Involved

Cryptocurrency trading is not without its risks. Market volatility, regulatory changes, and potential hacks are some of the risks involved.

To learn more about managing these risks, visit our section on Risk Management.

Cryptocurrency vs. Traditional Banking

The financial world has been abuzz with discussions comparing cryptocurrency and traditional banking. Let’s dissect the key differences and similarities.

Accessibility and Inclusion

Traditional banking systems often require numerous documents and verifications. On the other hand, cryptocurrency trading platforms are generally more accessible and inclusive, requiring minimal documentation.

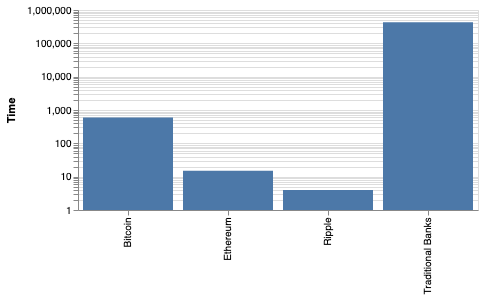

Speed and Efficiency

One of the most glaring differences is the speed of transactions. Traditional banking systems can take days for cross-border transactions, while cryptocurrencies can accomplish this in a matter of minutes – see the bar chart below bearing in mind that the Time axis is logarithmic.

Security Measures

Both systems have robust security measures, but they differ in approach. Traditional banks rely on centralized systems and physical infrastructure, whereas cryptocurrencies use decentralized blockchain technology.

| System | Security Measures |

| Traditional Banking | FDIC insurance, Two-factor authentication |

| Cryptocurrency | Blockchain, Private keys |

Cost-Effectiveness

Traditional banking often involves various fees, including account maintenance and transaction fees. Cryptocurrency trading can be more cost-effective, although it’s essential to consider transaction fees and the cost of “gas” for certain networks.

For more on transaction fees in the crypto world, read our Unveiling the Crypto Mystery article.

Regulatory Landscape

The regulatory environment for traditional banking is well-established, while cryptocurrency is still navigating a complex and ever-changing regulatory landscape.

To understand the regulatory aspects of cryptocurrency, read the section on Regulatory Compliance.

Market Analysis

Understanding the market is crucial for anyone involved in cryptocurrency trading. This section will guide you through the essential aspects of market analysis.

Types of Market Analysis

There are mainly three types of market analysis in cryptocurrency trading: Fundamental, Technical, and Sentimental. Each has its own set of indicators and methods.

| Type | Key Indicators |

| Fundamental | Market Cap, Volume, Adoption |

| Technical | Moving Averages, RSI |

| Sentimental | Social Media Trends, News |

Market Trends

Understanding market trends is vital. Trends can be broadly classified into bullish, bearish, and sideways.

Volatility in Cryptocurrency Trading

Cryptocurrency markets are known for their high volatility. While this presents opportunities for high returns, it also comes with increased risk.

Tools for Market Analysis

Various tools can assist you in market analysis. These range from charting tools to news aggregators. Here’s a list of some must-have tools for effective market analysis in cryptocurrency trading:

Charting Tools

- TradingView: For advanced charting and live market data.

- CryptoCompare: Offers a variety of charts tailored for cryptocurrencies.

News Aggregators

- CoinDesk: Provides the latest news and trends in the crypto world.

- CryptoSlate: Another reliable source for cryptocurrency news.

Analytics Platforms

- Nomics: Offers transparent crypto market cap rankings.

- Messari: Provides crypto news, pricing, and research.

| Tool Type | Examples |

| Charting Tools | TradingView, CryptoCompare |

| News Aggregators | CoinDesk, CryptoSlate |

| Analytics Platforms | Nomics, Messari |

Risk Management

Effective risk management strategies can mitigate potential losses. These include setting stop-loss orders and diversifying your portfolio.

| Strategy | Purpose |

| Stop-loss orders | Limit losses |

| Portfolio Diversification | Reduce risk |

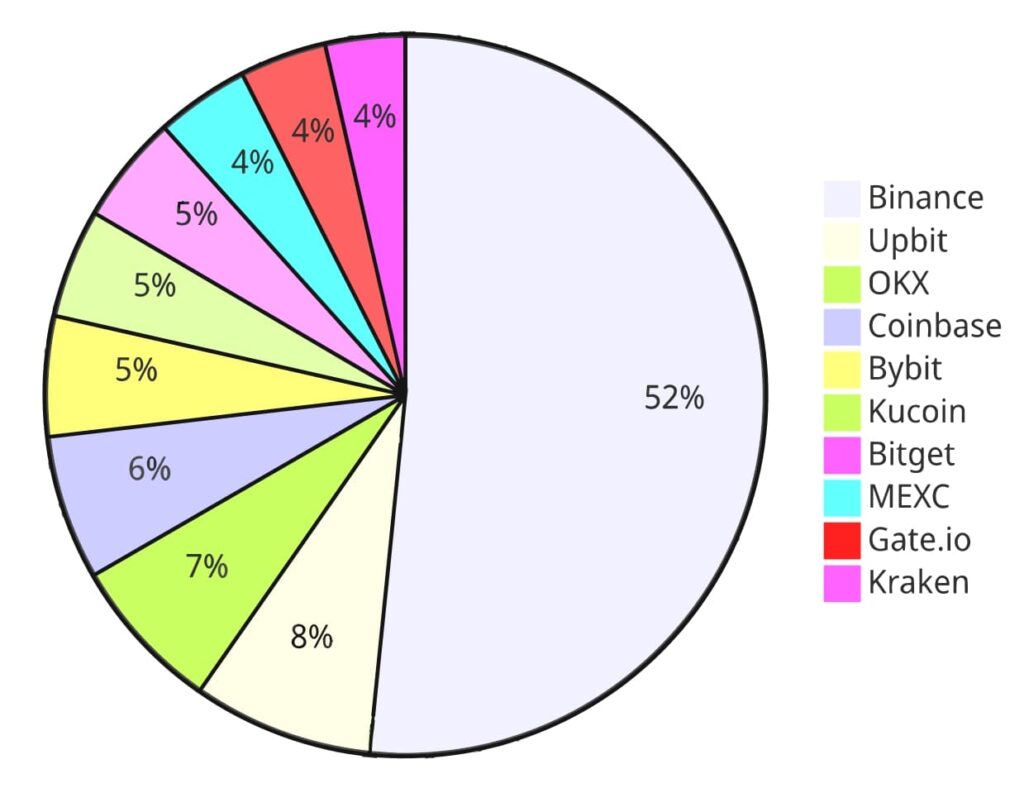

Trading Platforms

Choosing the right trading platform is crucial for success in cryptocurrency trading. This section will guide you through the various options available and what to look for in a trading platform.

Types of Trading Platforms

Centralized Exchanges

Platforms like Coinbase and Binance fall under this category. They act as intermediaries between buyers and sellers.

Decentralized Exchanges

Platforms like Uniswap and Sushiswap allow for direct peer-to-peer trading without the need for an intermediary.

Broker Platforms

These are platforms like eToro that allow you to trade cryptocurrencies but do not offer a wallet service.

Features to Consider

- Security: Look for platforms with strong security measures.

- Fees: Be aware of transaction and withdrawal fees.

- User Interface: A user-friendly interface can make or break your trading experience.

| Feature | Importance |

| Security | High |

| Fees | Medium |

| User Interface | Medium |

For more on security, check out our article on Crypto Wallets.

Popular Trading Platforms

- Coinbase: Known for its user-friendly interface.

- Binance: Offers a wide range of cryptocurrencies.

- Kraken: Known for its security features.

Trading Strategies

In the world of cryptocurrency trading, having a solid strategy is half the battle won. This section will introduce you to some of the most effective trading strategies that traders employ to maximize their profits.

Fundamental Analysis

What is it?

Fundamental analysis involves evaluating a cryptocurrency’s intrinsic value. This could involve studying the team behind the coin, the problem it aims to solve, and its real-world applications.

How to Use it?

- Research the cryptocurrency’s whitepaper.

- Analyze market sentiment.

- Evaluate the team and advisors.

Technical Analysis

What is it?

Technical analysis involves studying price charts and using statistical measures to predict future price movements.

How to Use it?

- Identify trends using indicators like Moving Averages.

- Use tools like Fibonacci retracement for entry and exit points.

| Indicator | Purpose |

| Moving Averages | Identify Trends |

| Fibonacci Retracement | Entry and Exit Points |

For a deeper dive into market analysis, check out our section on Market Analysis.

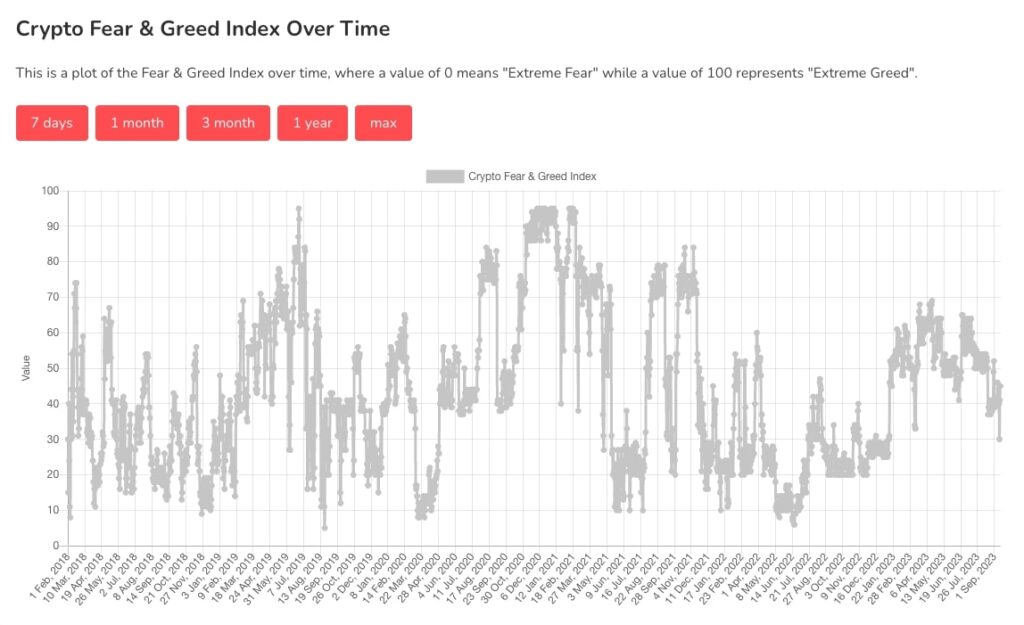

Sentiment Analysis

What is it?

Sentiment analysis involves gauging market sentiment by studying factors like news articles, social media posts, and public opinion.

How to Use it?

- Monitor news related to the cryptocurrency market.

- Use tools to analyze social media sentiment.

Risk Management

Effective risk management is crucial in trading. Always set stop-loss orders and only invest what you can afford to lose.

| Strategy | Risk Level |

| Stop-loss orders | Low |

| Diversification | Medium |

Risk Management

Risk management is the backbone of any successful trading strategy. It’s not just about maximizing profits; it’s also about minimizing potential losses. In this section, we’ll discuss various risk management techniques that can help you trade more effectively.

Stop-Loss and Take-Profit Orders

What are they?

Stop-loss and take-profit orders are automated commands you set in your trading platform to buy or sell when a certain price point is reached.

How to Use Them?

- Set a stop-loss order to minimize losses.

- Set a take-profit order to secure gains when a certain price is reached.

Diversification

What is it?

Diversification involves spreading your investments across various assets to reduce risk.

How to Use it?

- Don’t put all your eggs in one basket.

- Invest in different types of cryptocurrencies and other asset classes.

| Asset Class | Risk Level |

| Bitcoin | High |

| Bonds | Low |

For more on asset classes, refer to our section on Trading Platforms.

Position Sizing

What is it?

Position sizing is determining how much of your total portfolio to allocate to a single trade.

How to Use it?

- Never risk more than 1-2% of your portfolio on a single trade.

- Use tools to calculate the optimal position size based on your risk tolerance.

Risk-to-Reward Ratio

Understanding the risk-to-reward ratio can help you set realistic profit targets and stop-loss levels.

| Risk to Reward Ratio | Description |

| 1:1 | Equal risk and reward |

| 1:2 | Double the reward for the risk taken |

Trading Psychology

Trading psychology is the emotional and mental state that traders are in when making trading decisions. It’s a critical factor that can either make or break your trading career. In this section, we’ll explore key psychological elements that every trader should be aware of.

Emotional Discipline

What is it?

Emotional discipline refers to the ability to keep your emotions in check while trading.

How to Achieve it?

- Stick to your trading plan.

- Avoid impulsive decisions based on market rumors or sudden price movements.

Fear and Greed

What are they?

Fear and greed are the two most dominant emotions that affect trading decisions.

How to Manage Them?

- Recognize the signs.

- Use risk management tools like stop-loss orders to mitigate fear.

| Emotion | Impact on Trading | Management Strategy |

| Fear | Hasty selling | Use stop-loss |

| Greed | Overbuying | Set take-profit levels |

Overconfidence and Underconfidence

What are they?

Overconfidence can lead to excessive trading, while underconfidence can result in missed opportunities.

How to Balance Them?

- Keep a trading journal.

- Review your trades to identify patterns of overconfidence or underconfidence.

The Importance of a Trading Plan

A well-thought-out trading plan can serve as your emotional anchor. It outlines your trading strategy, risk tolerance, and financial goals.

For more on creating a trading plan, check out our section on Risk Management.

Regulatory Considerations

The regulatory landscape for cryptocurrencies is continually evolving. To navigate the world of cryptocurrency trading successfully, it’s crucial to understand and comply with relevant regulations. In this section, we’ll delve into some key regulatory considerations.

Legal Aspects

What are they?

Cryptocurrency regulations vary from country to country. Some nations have embraced cryptocurrencies, while others have imposed strict regulations or even banned them.

How to Navigate Them?

- Research the legal status of cryptocurrencies in your country.

- Ensure you comply with tax regulations related to cryptocurrency transactions.

Tax Implications

What are they?

Cryptocurrency transactions may have tax implications. This includes capital gains tax, income tax, and reporting requirements.

How to Handle Them?

- Keep records of all your cryptocurrency transactions.

- Consult a tax professional to ensure compliance with tax laws.

| Tax Type | Tax Rate |

| Capital Gains | Varies by country and state |

| Income Tax | Varies by individual’s income |

To learn more about tax implications, visit our section on Risk Management.

Evolving Regulations

The cryptocurrency regulatory landscape is dynamic. It’s essential to stay updated on new regulations that could impact your trading activities.

How to Stay Informed?

- Follow cryptocurrency news sources.

- Join online forums and communities to discuss regulatory changes.

Tools and Resources

Successful cryptocurrency trading often relies on the tools and resources at your disposal. In this section, we’ll explore some essential tools and resources that can enhance your trading experience.

Trading Bots

What are they?

Trading bots are automated software programs that execute trades on your behalf based on predefined criteria.

How to Use Them?

- Select a reputable trading bot.

- Configure the bot with your trading strategy.

Educational Resources

What are they?

Educational resources include books, courses, websites, and forums that offer valuable insights into cryptocurrency trading.

How to Utilize Them?

- Read books and articles related to cryptocurrency trading.

- Enroll in online courses or webinars.

- Join online forums to learn from experienced traders.

| Resource Type | Examples |

| Books | “The Crypto Trader” by Glen Goodman |

| Courses | Udemy cryptocurrency trading courses |

| Websites | Investopedia’s cryptocurrency section |

News Sources

What are they?

Staying updated with the latest cryptocurrency news is crucial. Reliable news sources provide information about market trends, regulatory changes, and more.

How to Access Them?

- Follow reputable cryptocurrency news websites.

- Subscribe to cryptocurrency newsletters.

Case Studies

Real-world case studies provide valuable insights into successful and not-so-successful cryptocurrency trading strategies. In this section, we’ll examine a couple of noteworthy case studies to understand the dynamics of cryptocurrency trading better.

Case Study 1: Bitcoin’s Meteoric Rise

Background

In 2017, Bitcoin experienced a historic bull run, reaching an all-time high of nearly $20,000 per BTC. Many traders and investors profited handsomely during this period.

Strategy

HODLing (holding onto Bitcoin for the long term) was a common strategy during this bull run. Traders who bought Bitcoin at lower prices and held onto it saw substantial gains.

Case Study 2: The Mt. Gox Hack

Background

In 2014, Mt. Gox, one of the largest cryptocurrency exchanges at the time, suffered a massive hack resulting in the loss of 850,000 Bitcoins.

Lessons Learned

- The importance of secure exchanges and wallets.

- The risks of keeping large amounts of cryptocurrency on exchanges.

Key Takeaways

- Diversify Your Portfolio: Case studies show that having a diverse portfolio can help mitigate risks.

- Stay Informed: Be aware of the latest news and developments in the cryptocurrency market.

- Secure Your Assets: Use secure wallets and exchanges to protect your investments.

For more case studies and lessons, refer to our section on Risk Management.

Trends

Cryptocurrency is a dynamic space, and staying ahead of the curve is crucial for traders and investors. In this section, we’ll discuss some emerging trends that are shaping the future of cryptocurrency trading.

Decentralized Finance (DeFi)

What is it?

DeFi refers to a set of financial services and applications built on blockchain technology, aiming to replace traditional financial intermediaries.

Why it Matters?

- DeFi offers decentralized lending, borrowing, and trading.

- It removes the need for banks and intermediaries, giving access to financial services to the unbanked.

Non-Fungible Tokens (NFTs)

What are they?

NFTs are unique digital assets that represent ownership of a specific item or piece of content, often used in art, gaming, and collectibles.

Why they Matter?

- NFTs open new opportunities for creators to monetize digital content.

- They offer provable ownership and provenance of digital assets.

Central Bank Digital Currencies (CBDCs)

What are they?

CBDCs are digital versions of a country’s national currency issued and regulated by the central bank.

Why they Matter?

- CBDCs aim to enhance the efficiency and security of transactions.

- They can provide greater financial inclusion and transparency.

| Country | Status of CBDC |

| China | Launched |

| United States | In Development |

To explore more on CBDCs, refer to our section on Regulatory Considerations.

Common Mistakes and How to Avoid Them

Cryptocurrency trading offers immense opportunities, but it’s also rife with pitfalls. To become a successful trader, it’s essential to recognize and avoid these common mistakes.

Mistake 1: Lack of Research

What is it?

Many beginners jump into trading without understanding the assets they’re investing in.

How to Avoid it?

- Research thoroughly before investing.

- Understand the technology and the team behind the cryptocurrency.

Mistake 2: Emotional Trading

What is it?

Making impulsive decisions based on emotions like fear and greed can lead to significant losses.

How to Avoid it?

- Stick to your trading plan.

- Use tools like stop-loss orders to automate decisions.

| Emotion | Impact on Trading | Avoidance Strategy |

| Fear | Hasty selling | Use stop-loss orders |

| Greed | Overbuying | Set take-profit levels |

To dive deeper into trading psychology, read our section on Trading Psychology.

Mistake 3: Neglecting Security

What is it?

Failing to secure your cryptocurrency holdings can result in theft or loss.

How to Avoid it?

- Use hardware wallets for long-term storage.

- Enable two-factor authentication on exchanges.

Mistake 4: Overtrading

What is it?

Overtrading occurs when traders make too many transactions, often in response to short-term price fluctuations.

How to Avoid it?

- Stick to a well-defined trading plan.

- Limit the number of trades per day.

| Frequency of Trades | Impact on Returns | Avoidance Strategy |

| Excessive Trading | Decreases returns | Follow a trading plan |

| Controlled Trading | Improves returns | Stick to a set strategy |

Embrace the Cryptocurrency Revolution

The world of cryptocurrency trading is as thrilling as it is challenging. As we’ve journeyed through the fundamentals, strategies, and future trends, one thing has become clear: cryptocurrencies are here to stay, and they offer a world of possibilities.

In your quest to become a successful cryptocurrency trader, remember these key takeaways:

- Knowledge is Power: Never stop learning. Understanding the assets you trade is paramount.

- Master Your Emotions: Emotional discipline is your best friend. Stick to your plan and let reason guide your decisions.

- Safety First: Secure your assets with the utmost care. Use trusted wallets and exchanges and implement robust security measures.

- Diversify and Strategize: Explore different trading strategies and diversify your portfolio to manage risk effectively.

- Stay Informed: The cryptocurrency landscape evolves rapidly. Stay up-to-date with the latest news and trends.

As you embark on your cryptocurrency trading journey, always be cautious, but don’t be afraid to seize the opportunities presented by this exciting, decentralized world. The future of finance is being shaped right before our eyes, and you have a chance to be a part of it.

So, equip yourself with knowledge, stay vigilant, and embrace the cryptocurrency revolution. Happy trading!

Frequently Asked Questions

Here are some common questions about cryptocurrency trading along with concise answers:

| Question | Answer |

| What is cryptocurrency trading? | Cryptocurrency trading is the act of buying, selling, or exchanging cryptocurrencies like Bitcoin, Ethereum, or Ripple. |

| How do I get started with cryptocurrency trading? | To get started, you’ll need to choose a reputable exchange, create an account, deposit funds, and start trading. |

| What is the best cryptocurrency to trade? | The “best” cryptocurrency varies depending on your goals. Bitcoin and Ethereum are popular choices for beginners. |

| Is cryptocurrency trading risky? | Yes, cryptocurrency trading carries risks due to price volatility. It’s essential to use risk management strategies. |

| What is a cryptocurrency wallet, and do I need one? | A cryptocurrency wallet is a digital tool to store your assets securely. It’s advisable to use one for added security. |

| How do I know when to buy or sell cryptocurrencies? | Timing the market is challenging. Many traders use technical and fundamental analysis to inform their decisions. |

| Can I make a living from cryptocurrency trading? | While some traders have made a living from it, it’s highly speculative. Most people use it as a supplementary income. |

| Are there tax implications for cryptocurrency trading? | Yes, tax regulations vary by country, and cryptocurrency transactions may have tax implications. Consult a tax advisor. |

| What’s the difference between day trading and HODLing? | Day trading involves frequent buying and selling for short-term profits, while HODLing means holding for the long term. |

| Is cryptocurrency trading suitable for beginners? | Yes, but it’s essential to start with a small investment, learn, and practice with caution before committing larger sums. |