Ever found yourself overwhelmed by the dizzying array of crypto wallets out there? You’re not alone. Choosing the right wallet is like picking a lock—you need the perfect key for seamless access and impenetrable security. In this comprehensive guide, we’ll demystify the world of crypto wallets, diving deep into hot and cold storage options, security measures, and much more.

Key Takeaways: Your Quick-Start Guide to Wallet Wisdom

- Understanding Wallet Types: Hot storage is convenient but less secure, while cold storage offers high security but is less user-friendly.

- Security Measures: Regardless of the type of wallet, implementing robust security measures like two-factor authentication and strong passwords is crucial.

- Popular Choices: Wallets like Coinbase and Ledger Nano S are popular because they offer a balance of convenience and security.

- Community Wisdom: Always consult community recommendations and reviews before choosing a wallet.

- Continuous Learning: The crypto landscape is ever-changing. Stay updated with books, online courses, and community forums.

The global crypto wallet market is expected to expand at a CAGR of 24.8% from 2023, highlighting the growing importance of making informed choices in wallet selection.

What are Crypto Wallets?

Crypto wallets are digital tools that allow you to store, send, and receive cryptocurrencies like Bitcoin, Ethereum, and many others. Think of them as your digital bank account for crypto assets. Unlike traditional bank accounts, however, crypto wallets give you full control over your funds, without the need for an intermediary like a bank.

Why Do You Need One?

If you’re diving into the world of cryptocurrencies, a wallet is indispensable. It’s your gateway to the decentralized world, enabling you to participate in various crypto transactions and activities. Whether you’re buying Bitcoin, sending Ethereum to a friend, or participating in a decentralized finance (DeFi) project, you’ll need a cryptocurrency wallet to get started.

How Do They Work?

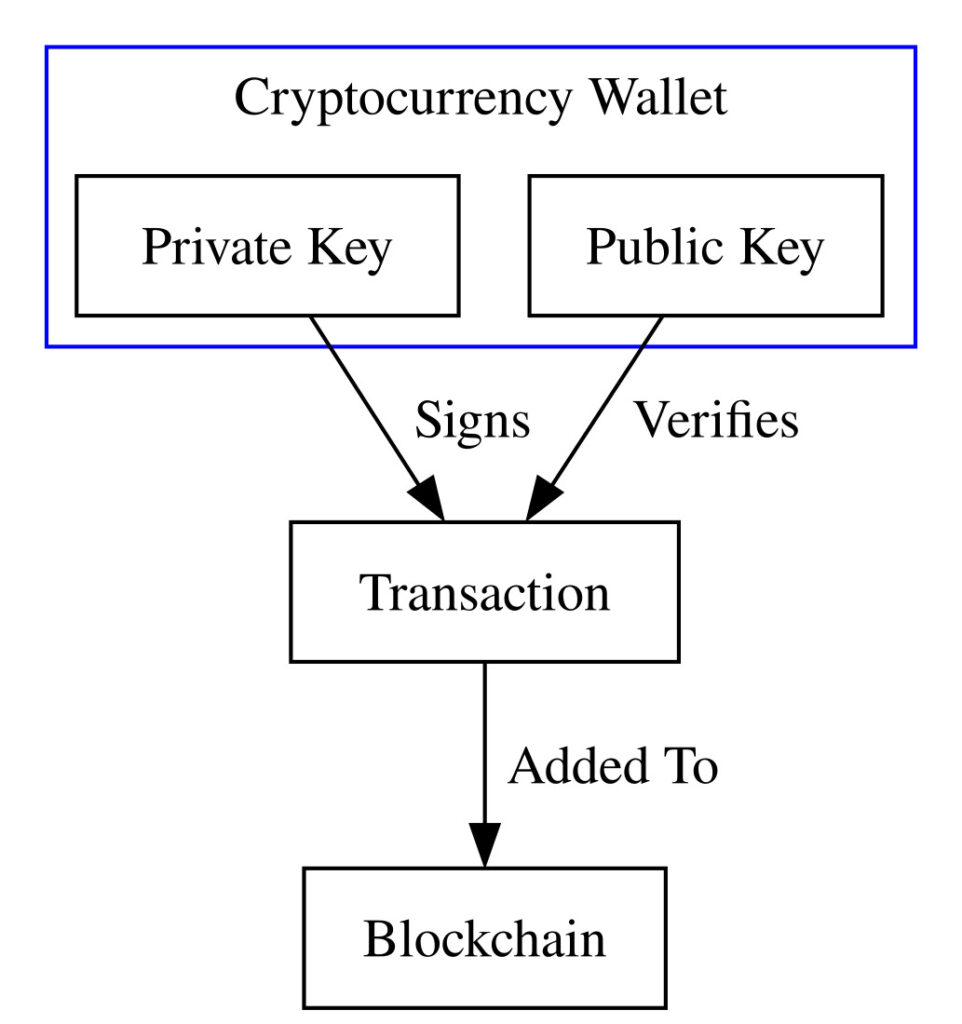

Crypto wallets work by generating a pair of cryptographic keys: a public key, which is like your email address, and a private key, which is like your email password. The public key is what you share with others to receive funds, while the private key is kept secret and is used to authorize outgoing transactions.

- Cryptocurrency Wallet: This is where your public and private keys are stored.

- Private Key: This is known only to you and is used to sign transactions. Never share this with anyone!

- Public Key: This is your ‘address’ in the blockchain network. It’s used to verify transactions signed by your private key.

- Transaction: When you send or receive cryptocurrency, a transaction is created.

- Signs: The private key signs the transaction to authenticate it.

- Verifies: The public key verifies the signature to ensure it’s a legitimate transaction.

- Blockchain: The verified transaction is added to the blockchain, making it a part of the public ledger.

As of August 2022, the number of crypto wallet users reached 84.02 million worldwide, indicating the growing importance of these digital tools.

Types of Wallets

There are various types of crypto wallets, each with its own set of features and security measures. These can be broadly classified into hot wallets, which are connected to the internet, and cold wallets, which are offline. We’ll delve deeper into these types in the following sections.

Types of Crypto Wallets

When it comes to storing your cryptocurrencies, not all wallets are created equal. There are various types of crypto wallets, each offering different levels of security, accessibility, and functionality. Understanding these types is crucial for anyone involved in the crypto space.

Hot Wallets

Hot wallets are digital wallets that are connected to the internet. They are convenient for quick transactions and are often used for storing smaller amounts of cryptocurrency. However, being online makes them more susceptible to hacks.

Cold Wallets

Cold wallets are the opposite of hot wallets; they are not connected to the internet. This makes them more secure but less convenient for quick transactions. Cold wallets are ideal for storing large amounts of cryptocurrency for the long term.

Stat: Wallet safety is essential, as cryptocurrencies are high-value targets for hackers. Some safeguards include encrypting the wallet with a strong password and storing any large amounts you have offline.

Hardware Wallets

Hardware wallets are physical devices that store your cryptocurrency offline. They are considered the most secure type of wallet because they are immune to online hacking attempts.

Software Wallets

Software wallets are applications or software programs installed on your computer or mobile device. They are more convenient than hardware wallets but are generally less secure due to their online nature.

Paper Wallets

Paper wallets are physical pieces of paper that contain your cryptocurrency’s public and private keys. They are considered obsolete and are not recommended due to their susceptibility to physical damage and loss.

Hot Storage

Hot storage refers to crypto wallets that are connected to the internet. These wallets are ideal for everyday transactions and are often the go-to choice for beginners in the cryptocurrency space. However, their online nature makes them vulnerable to cyber-attacks.

Advantages of Hot Storage

Hot storage wallets offer unparalleled convenience. They allow for quick and easy transactions, making them ideal for daily use. Features like QR code scanning and integration with online services make hot storage wallets user-friendly.

According to a report by Triple-A, as of 2022, it is estimated that there will be more than 320 million cryptocurrency users worldwide. This statistic underscores the need for convenient and accessible hot storage options.

Disadvantages of Hot Storage

While hot storage offers convenience, it comes with its own set of risks. Being connected to the internet makes these wallets susceptible to hacking, phishing scams, and malware attacks. It’s crucial to implement security measures to mitigate these risks.

Real-Life Examples

- Coinbase Wallet: Popular for its user-friendly interface and integration with the Coinbase exchange.

- MetaMask: Widely used for accessing decentralized applications (dApps) on the Ethereum network.

- Trust Wallet: Known for its multi-currency support and built-in decentralized exchange.

Currently, 23% of Americans own cryptocurrency, up from 18%, as reported in an April 2023 survey. This growing user base highlights the popularity of hot storage wallets like Coinbase and MetaMask.

Cold Storage

Cold storage refers to crypto wallets that are not connected to the internet. These are the Fort Knox of the crypto wallets, offering the highest level of security for your digital assets. Cold storage is often recommended for holding large amounts of cryptocurrency for an extended period.

Advantages of Cold Storage

The primary advantage of cold storage is its enhanced security. Because these wallets are offline, they are immune to online hacking attempts, phishing scams, and malware. This makes them ideal for storing substantial amounts of cryptocurrency.

Wallet safety is essential, as cryptocurrencies are high-value targets for hackers. Some safeguards include encrypting the wallet with a strong password and storing any large amounts you have offline.

Disadvantages of Cold Storage

While cold storage offers robust security, it lacks the convenience of hot storage wallets. Transactions are not as quick and may require multiple steps, including connecting your cold storage device to a computer to authorize transactions.

Real-Life Examples

- Ledger Nano S: A hardware wallet known for its top-notch security features.

- Trezor: Another hardware wallet, praised for its user-friendly interface.

- Paper Wallet: Though now considered obsolete, paper wallets were once a popular form of cold storage.

The global crypto wallet market size was valued at USD 8.42 billion in 2022, and cold storage solutions like Ledger and Trezor make up a significant portion of this market.

Hot vs Cold Storage: A Comparison

When it comes to storing your cryptocurrencies, the choice between hot and cold storage often boils down to a trade-off between convenience and security. Both have their merits and drawbacks, and the best choice depends on your individual needs and how you intend to use your cryptocurrencies.

| Features | Hot Wallet | Cold Wallet |

|---|---|---|

| Convenience | High | Low |

| Security | Moderate | High |

| Accessibility | Easy | Limited |

| Transaction Speed | Fast | Slow |

| Cost | Low | High |

| Internet Connection | Required | Not Required |

| Risk of Hacking | Higher | Lower |

Convenience vs Security

Hot storage is all about convenience. It’s quick, easy to use, and ideal for daily transactions. Cold storage, on the other hand, is the epitome of security but lacks the ease of use that hot storage offers.

Accessibility vs Long-Term Storage

Hot storage wallets are easily accessible and are often integrated with online platforms and exchanges. Cold storage is less accessible but is perfect for long-term storage of significant cryptocurrency amounts.

Risk Factors

Hot storage is susceptible to online hacking attempts, phishing scams, and malware. Cold storage is virtually immune to these risks but can be lost or damaged physically.

The number of crypto wallets worldwide has grown at a rate of 1,271.97% since 2016. This rapid growth underscores the importance of understanding the risks associated with different storage methods.

Which One is Right for You?

The choice between hot and cold storage depends on your individual needs. If you’re a day trader or frequently use cryptocurrencies for online purchases, hot storage may be more suitable. If you’re an investor holding large amounts of cryptocurrencies, cold storage is the safer bet.

How to Choose Between Hot and Cold Storage

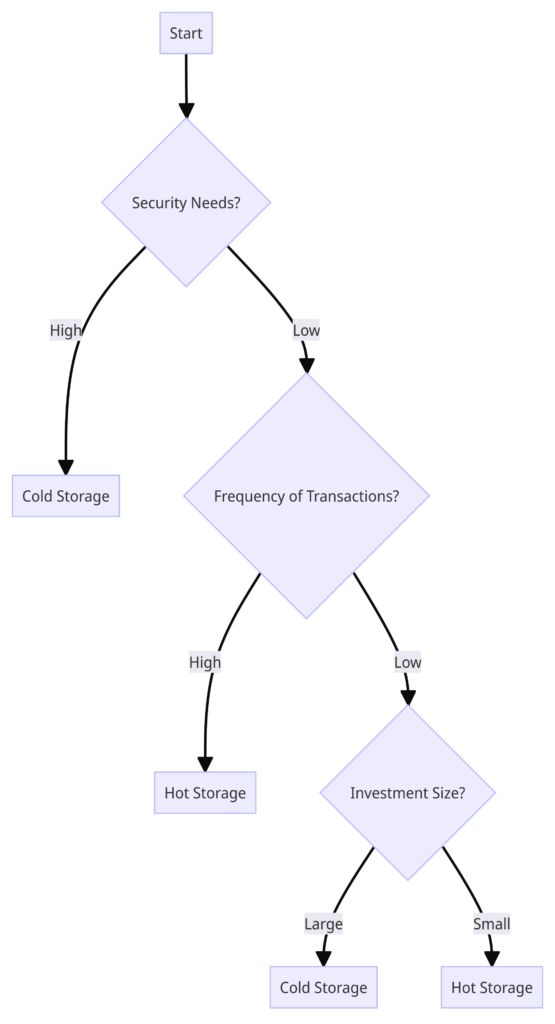

Choosing between hot and cold storage is a critical decision that can significantly impact the safety and accessibility of your cryptocurrencies. This section aims to guide you through the factors you should consider when making this choice.

Assess Your Needs

The first step in choosing the right storage option is to assess your needs. Are you a frequent trader who needs quick access to your assets, or are you a long-term investor looking for maximum security? Your usage pattern will largely dictate the type of storage that’s best for you.

Consider the Amount

The amount of cryptocurrency you own is another crucial factor. For smaller amounts that you plan to use regularly, hot storage is more convenient. For larger sums that you intend to hold long-term, cold storage offers better security.

Evaluate Security Risks

Understanding the security risks associated with each type of storage is vital. Hot storage is vulnerable to online threats, while cold storage is susceptible to physical loss or damage. Weigh these risks carefully before making a decision.

Frequency of Transactions

If you’re someone who frequently trades or uses cryptocurrencies for online purchases, the convenience of hot storage may outweigh the security benefits of cold storage.

Consult Community Recommendations

Often, the best advice comes from those who have been in the crypto space for a while. Online forums, reviews, and expert opinions can provide valuable insights into the most reliable hot and cold storage options.

The ongoing global crypto ownership average is 15% according to research by Finder.com. As ownership grows, community wisdom becomes an invaluable resource for making informed decisions.

Security Measures for Both Types

Regardless of whether you opt for hot or cold storage, implementing robust security measures is crucial. In this section, we’ll delve into the best practices for securing both types of crypto wallets.

Security Measures for Hot Storage

- Two-Factor Authentication (2FA): Always enable 2FA to add an extra layer of security.

- Strong Passwords: Use complex passwords and change them regularly.

- Software Updates: Keep your wallet software up-to-date to protect against vulnerabilities.

Wallet safety is essential, as cryptocurrencies are high-value targets for hackers. Some safeguards include encrypting the wallet with a strong password and using two-factor authentication for exchanges.

Security Measures for Cold Storage

- Physical Security: Store your cold storage device in a secure location like a safe.

- Encryption: Encrypt the device with a strong password.

- Backup: Always keep a backup of your cold storage wallet in another secure location.

Common Measures for Both

- Regular Audits: Periodically review your security settings.

- Multi-Signature: Use multi-signature options if available.

- Be Cautious of Phishing Scams: Always double-check URLs and email addresses to ensure you’re not falling for a phishing attempt.

Popular Wallets for Hot and Cold Storage

Choosing the right wallet can be a daunting task given the plethora of options available. In this section, we’ll highlight some of the most popular wallets for both hot and cold storage, helping you make an informed decision.

Popular Hot Storage Wallets

- Coinbase Wallet: Known for its user-friendly interface and seamless integration with the Coinbase exchange.

- MetaMask: A go-to wallet for interacting with Ethereum-based decentralized applications (dApps).

- Trust Wallet: Offers multi-currency support and a built-in decentralized exchange.

Popular Cold Storage Wallets

- Ledger Nano S: Offers top-notch security features and supports multiple cryptocurrencies.

- Trezor: Known for its user-friendly interface and robust security measures.

- Coldcard: A Bitcoin-only wallet that offers extreme security features for the privacy-conscious.

Wallets with Both Options

Some wallets offer both hot and cold storage options, providing the best of both worlds. Examples include:

- Exodus: Offers a desktop version for cold storage and a mobile version for hot storage.

- Atomic Wallet: Provides a balance between security and convenience, offering both hot and cold storage options.

The global crypto wallet market size was valued at USD 8.42 billion in 2022, and is expected to expand at a compound annual growth rate (CAGR) of 24.8% from 2023. This growth indicates a rising demand for versatile wallets that offer both hot and cold storage options.

FAQs

Frequently asked questions (FAQs) can serve as a quick guide to resolving common queries about hot and cold storage. Here, we address some of the most commonly asked questions to help you make an informed decision.

What is Hot Storage?

Hot storage refers to crypto wallets that are connected to the internet. They are convenient for quick transactions but are more susceptible to online threats.

What is Cold Storage?

Cold storage refers to crypto wallets that are not connected to the internet. These wallets offer enhanced security but are less convenient for frequent transactions.

What are the Risks Associated with Hot Storage?

The primary risks with hot storage are online hacking attempts, phishing scams, and malware. Always implement robust security measures to mitigate these risks.

What are the Risks Associated with Cold Storage?

Cold storage is generally secure from online threats but can be susceptible to physical damage or loss. It’s crucial to keep backups and store the wallet in a secure location.

Stat: Wallet safety is essential, as cryptocurrencies are high-value targets for hackers. Some safeguards include encrypting the wallet with a strong password and storing any large amounts you have offline.

Can I Use Both Hot and Cold Storage?

Yes, many users opt for a combination of hot and cold storage. Hot storage is used for daily transactions, while cold storage is used for holding larger amounts long-term.

How Do I Choose Between Hot and Cold Storage?

The choice between hot and cold storage depends on various factors like your security needs, the amount of cryptocurrency you own, and how frequently you transact. Assess these factors carefully before making a decision.

Additional Resources

Navigating the world of crypto wallets can be overwhelming, especially for newcomers. To help you deepen your understanding and make informed decisions, here are some additional resources on hot and cold storage.

Books and Ebooks

- “Mastering Bitcoin” by Andreas M. Antonopoulos: A comprehensive guide to Bitcoin and cryptocurrency technologies.

- “Cryptoassets” by Chris Burniske and Jack Tatar: Focuses on the investment aspect of cryptocurrencies and how to store them securely.

Online Courses

- Coursera’s “Bitcoin and Cryptocurrency Technologies”: Offers a deep dive into how cryptocurrencies work, including wallet security.

- Udemy’s “Cryptocurrency Wallets Course”: A beginner-friendly course that covers both hot and cold storage options.

Websites and Blogs

- Unveiling the Crypto Mystery: What is Cryptocurrency and Why Should You Care?: An article outlining the crypto fundamentals and basics.

- CoinDesk’s Learning Center: Provides a range of articles and guides on cryptocurrency storage options.

Securing Your Crypto Future: Final Thoughts

Choosing the right cryptocurrency wallet is a pivotal moment in your journey through the crypto universe. Whether you’re leaning towards the convenience of hot storage or the fortress-like security of cold storage, understanding the intricacies of each is non-negotiable. From wallet basics and types to essential security protocols and popular choices, this guide has aimed to equip you with the knowledge you need to make an informed decision.

The crypto landscape is ever-changing, and staying ahead of the curve is vital for both the safety and growth of your digital assets. Don’t hesitate to dive into the additional resources listed above to further deepen your understanding.

The number of crypto wallet users surged to 84.02 million worldwide as of August 2022, up from 76.32 million in August 2021. This burgeoning user base underscores the critical importance of informed decision-making in wallet selection.

Thank you for reading, and here’s to a secure and prosperous journey in the world of cryptocurrency!