“Are you ready to dive into the exhilarating world of popular cryptocurrencies but don’t know where to start? Look no further!”

Welcome to your one-stop guide that demystifies the complex labyrinth of popular cryptocurrencies. From Bitcoin to blockchain, from DeFi to NFTs, we’ve got it all covered. Whether you’re a newbie looking to dip your toes or a seasoned trader searching for advanced strategies, this guide is your treasure map to navigate the cryptoverse.

Buckle up as we take you on a rollercoaster ride through the highs and lows, the risks and rewards, and the dos and don’ts of this digital frontier. Ready to embark on this crypto journey? 🚀

Key Takeaways

| Section | Key Takeaways |

| What Makes a Cryptocurrency Popular? | Understand the key factors that contribute to the popularity of cryptocurrencies. |

| Bitcoin: The Pioneer | Learn why Bitcoin remains the most popular cryptocurrency and its impact on the financial world. |

| Ethereum: More Than Just a Cryptocurrency | Discover Ethereum’s versatility beyond being just a cryptocurrency. |

| Binance Coin: The Exchange Giant | Explore how Binance Coin became popular by solving real-world problems. |

| Cardano: Banking the Unbanked Through Blockchain | Uncover Cardano’s mission to provide financial services to the unbanked. |

| Solana: The Speedster | Learn about Solana’s high throughput and low latency. |

| Ripple (XRP): The Banker’s Coin | Understand Ripple’s role in facilitating real-time, cross-border payments. |

| Polkadot: The Interoperability King | Discover how Polkadot enables different blockchains to transfer messages and value. |

| Chainlink: The Connector | Learn how Chainlink connects smart contracts with real-world data. |

| NFTs and Cryptocurrencies | Understand the role of NFTs in the world of popular cryptocurrencies. |

| DeFi and Cryptocurrencies | Explore how decentralized finance is changing the landscape of popular cryptocurrencies. |

| How to Evaluate Popular Cryptocurrencies | Gain insights into the metrics for evaluating the potential and popularity of a cryptocurrency. |

| FAQ | Get answers to commonly asked questions about popular cryptocurrencies. |

What Makes a Cryptocurrency Popular?

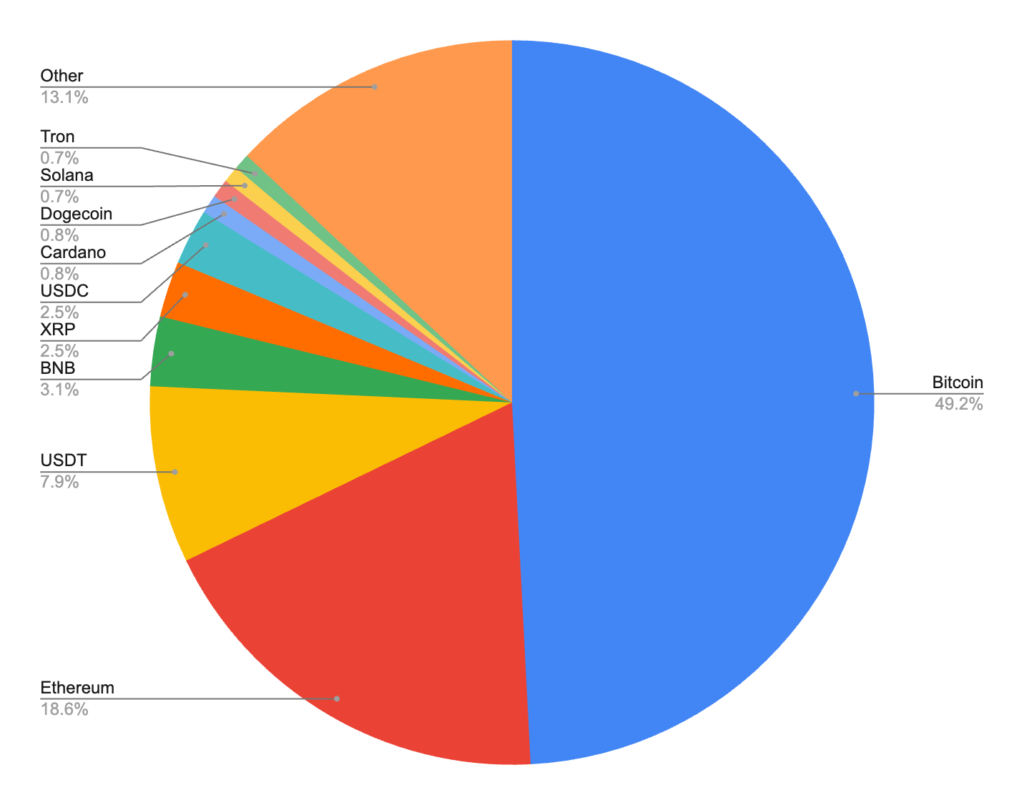

The term “Popular Cryptocurrencies” often floats around in discussions, but what really makes a cryptocurrency popular? Is it just the market capitalization, or are there other factors at play?

In this section, we’ll delve into the key elements that contribute to the popularity of a cryptocurrency.

Market Capitalization

Market capitalization is the total value of a cryptocurrency in circulation. It’s calculated by multiplying the current price by the total number of coins in circulation.

A high market cap often indicates a strong community and investor trust.

Utility and Use-Case

A cryptocurrency needs to solve a real-world problem or have a specific use case to gain popularity.

For instance, Bitcoin was the first to introduce decentralized digital cash, while Ethereum brought in smart contracts.

Community Support

A strong community can propel a cryptocurrency to new heights. Community support often manifests in the form of development contributions, online discussions, and even memes that create buzz.

Liquidity

Liquidity refers to how easily a cryptocurrency can be bought or sold without affecting its market price. High liquidity often correlates with popularity, as it attracts both retail and institutional investors.

Regulatory Compliance

Cryptocurrencies that comply with regulations are more likely to gain mainstream acceptance.

This is especially important for cryptocurrencies like Ripple (XRP), which aim to work with traditional financial institutions and is currently in litigation against the Securities and Exchange Commission (SEC) in the US.

Media Coverage

Positive media coverage can significantly boost the popularity of a cryptocurrency. It’s not just about news articles; social media platforms also play a crucial role in shaping public opinion.

Technological Innovation

Last but not least, technological innovation is a key driver. Features like scalability, speed, and security can set a cryptocurrency apart from its competitors.

Bitcoin: The Pioneer

Bitcoin, often referred to as the “digital gold,” was the first cryptocurrency to gain widespread recognition and remains the most popular to this day. But what makes Bitcoin a pioneer in the world of cryptocurrencies? Let’s explore.

The Genesis: Satoshi Nakamoto

In 2008, an unknown person or group of people under the pseudonym Satoshi Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This was the birth of Bitcoin, and it revolutionized the way we think about money.

Decentralization: The Core Principle

One of the most groundbreaking aspects of Bitcoin is its decentralized nature. Unlike traditional currencies, which are controlled by central banks, Bitcoin operates on a peer-to-peer network.

Blockchain: The Underlying Technology

Bitcoin transactions are recorded on a public ledger known as the blockchain. This technology ensures transparency and security, making it nearly impossible to counterfeit Bitcoin.

Mining and Rewards

Bitcoin mining involves solving complex mathematical problems, known as “proof-of-work,” to validate transactions and secure the network. Miners are rewarded with newly minted Bitcoin, making it a self-sustaining system.

Adoption and Acceptance

Bitcoin has come a long way since its inception. Today, it’s accepted by various merchants worldwide and has even caught the attention of institutional investors. Its role as a store of value has been compared to that of gold.

Challenges and Criticisms

Despite its pioneering status, Bitcoin is not without challenges. Issues like scalability, energy consumption, and regulatory hurdles have often been points of criticism.

By understanding the pioneering aspects of Bitcoin, you can better appreciate its role in shaping the world of cryptocurrencies. Its influence extends beyond just being a digital currency; it has set the standard for what cryptocurrencies can achieve.

Ethereum: More Than Just a Cryptocurrency

Ethereum, often dubbed the “world computer,” has redefined what blockchain technology can do. While Bitcoin pioneered decentralized money, Ethereum took it a step further by enabling decentralized applications (dApps).

The Visionary: Vitalik Buterin

In late 2013, a young programmer named Vitalik Buterin proposed the idea of Ethereum. Unlike Bitcoin, which is primarily a digital currency, Ethereum aims to be a platform for decentralized applications.

Smart Contracts: The Building Blocks

One of the most innovative features of Ethereum is the concept of “smart contracts.” These are self-executing contracts with the terms directly written into code, eliminating the need for intermediaries.

dApps: A New Frontier

Decentralized applications, or dApps, are built on the Ethereum blockchain. They operate without a central authority, offering a new level of freedom and transparency.

Ether: The Fuel

Ether (ETH) is the native cryptocurrency of the Ethereum network. It’s used to facilitate transactions and is also necessary for deploying smart contracts.

Challenges and Roadmap

Ethereum faces challenges like scalability and high gas fees. However, with the transition to Ethereum 2.0, these issues are being actively addressed.

By understanding the multifaceted nature of Ethereum, you can see that it’s not just another cryptocurrency. Its capabilities extend to enabling a decentralized internet, making it a game-changer in the blockchain space.

Binance Coin: The Exchange Giant

Binance Coin (BNB) is not just another cryptocurrency; it’s the backbone of the Binance Exchange, one of the world’s largest cryptocurrency trading platforms. Initially launched as an ERC-20 token on the Ethereum blockchain, BNB has evolved to become a cornerstone in the crypto world.

The Genesis: Binance ICO

In 2017, Binance raised $15 million through an Initial Coin Offering (ICO) for its Binance Coin. The ICO was a massive success, setting the stage for BNB’s future growth.

Utility: More Than Just Trading Fees

BNB offers a multitude of uses within the Binance ecosystem. It can be used to pay for trading fees at a discounted rate, participate in token sales, and even book travel arrangements.

Binance Smart Chain: A Parallel Universe

The Binance Smart Chain (BSC) is a parallel blockchain to the Binance Chain, enabling the creation of smart contracts and a new staking mechanism for BNB. It has become a hub for decentralized finance (DeFi) projects.

Tokenomics: Supply and Burn

Binance Coin has a unique tokenomic model that involves periodic “burns” to reduce the total supply, thereby increasing scarcity and potentially driving up value.

The Road Ahead

With plans for more utility and integration into the Binance ecosystem, BNB is poised for continued growth. It’s not just a utility token; it’s a key player in the broader Binance ecosystem.

Cardano: Banking the Unbanked Through Blockchain

Cardano is not just another blockchain; it’s a platform with a mission. Founded by Ethereum co-founder Charles Hoskinson, Cardano aims to bring financial services to the unbanked—those without access to traditional banking systems.

The Academic Approach

Unlike many other blockchain projects, Cardano takes an academic and research-driven approach to its development. This ensures a robust and secure platform capable of scaling and adapting to real-world needs.

Financial Inclusion: The Core Mission

Cardano’s primary goal is to provide financial services to the 1.7 billion unbanked people worldwide. Through its blockchain, Cardano enables secure and transparent transactions, even in regions where traditional banking is not available.

Smart Contracts and Decentralized Applications

Cardano’s blockchain supports smart contracts and decentralized applications (DApps), which can be tailored to create financial products for the unbanked. This opens up a world of possibilities, from microloans to insurance products.

ADA: The Fuel of Cardano

ADA, Cardano’s native cryptocurrency, plays a crucial role in the ecosystem. It is used for transactions, smart contracts, and as a staking token to secure the network.

Partnerships and Future Plans

Cardano has formed partnerships with governments and NGOs to further its mission. With a roadmap filled with upgrades and new features, Cardano is well on its way to becoming a key player in the quest for global financial inclusion.

Solana: The Speedster

In the world of blockchain, speed is often the name of the game, and Solana is a frontrunner in this race. Known for its blazing-fast transaction speeds and low fees, Solana is quickly becoming a go-to platform for decentralized applications (DApps).

The Need for Speed

In an industry where every second counts, Solana’s high throughput and low latency make it a standout choice for developers and traders alike. With a block time of just 400 milliseconds, Solana can handle up to 65,000 transactions per second (TPS).

Proof of History: The Secret Sauce

Solana’s unique consensus algorithm, known as Proof of History (PoH), is the key to its speed. Unlike traditional blockchain systems, PoH allows for greater scalability without compromising security.

SOL: The Powerhouse Token

Solana’s native cryptocurrency, SOL, serves multiple purposes within the ecosystem. It’s used for transaction fees, staking, and even participating in on-chain governance.

Ecosystem and Community

Solana’s ecosystem is rich and diverse, hosting a wide range of DApps, from DeFi to NFTs. Its strong community support and developer-friendly tools make it a hotbed for innovation.

Interoperability and Future Prospects

Solana is not an island; it’s built for interoperability. With bridges to other blockchains like Ethereum and Binance Smart Chain, Solana is positioning itself as a universal layer for decentralized applications.

Ripple (XRP): The Banker’s Coin

Ripple, often associated with its native cryptocurrency XRP, has carved a unique niche for itself as the “Banker’s Coin.” Unlike many cryptocurrencies that aim to bypass traditional banking systems, Ripple seeks to work alongside them.

The Ripple Protocol: Bridging the Gap

Ripple’s underlying technology, the Ripple Protocol Consensus Algorithm (RPCA), enables quick and secure cross-border transactions. It’s a favorite among financial institutions for its efficiency and low transaction costs.

XRP: More Than Just a Coin

XRP serves as both a digital asset and a bridge currency in the Ripple network. It facilitates the transfer of value within the Ripple ecosystem and can be used for a variety of applications beyond simple transactions.

The Banking Connection

Ripple has partnered with over 300 financial institutions, including big names like American Express and Santander. These partnerships aim to modernize the outdated infrastructure of global finance.

The SEC Case: A Cloud Over Ripple

In December 2020, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, alleging that it conducted an unregistered securities offering. The case is ongoing and has brought both scrutiny and volatility to XRP’s market performance.

Future Prospects

Despite the ongoing SEC case, Ripple continues to expand its network and forge new partnerships. Its focus on regulatory compliance and institutional adoption sets it apart in a crowded crypto landscape.

Polkadot: The Interoperability King

In the realm of blockchain technology, Polkadot stands out as a beacon of interoperability. It aims to enable different blockchains to transfer messages and value in a trust-free fashion, seeking to make a web of blockchains that can efficiently interoperate with one another.

The Architecture: A Symphony of Chains

Polkadot’s architecture is a complex but harmonious assembly of various types of chains, primarily the Relay Chain, Parachains, and Bridges. This design allows for seamless communication between different blockchains.

The DOT Token: Fueling the Network

Polkadot’s native token, DOT, serves multiple purposes within the network, including governance, staking, and bonding. It’s an essential part of the ecosystem that keeps the network secure and operational.

Ecosystem: A Growing Family

Polkadot’s ecosystem is rapidly expanding, with numerous projects building on its interoperable framework. From DeFi to NFTs, the range of applications is vast and continues to grow.

Interoperability: The Ultimate Goal

Polkadot aims to solve one of the most pressing challenges in the blockchain space: interoperability. By allowing diverse blockchains to interact without the need for intermediaries, Polkadot is paving the way for a decentralized internet of blockchains.

For a deeper understanding of blockchain interoperability, check out our article on Unveiling the Crypto Mystery.

Chainlink: The Connector

Chainlink has carved a unique niche in the blockchain world as a decentralized oracle network. It acts as a bridge between smart contracts on the blockchain and real-world data, enabling them to interact in a secure and reliable manner.

Decentralized Oracles: The Heart of Chainlink

Chainlink’s decentralized oracles are the linchpin that connects smart contracts to external data sources. These oracles are designed to be tamper-proof and provide data that is both accurate and reliable.

LINK Token: More Than Just a Currency

The LINK token is Chainlink’s native cryptocurrency and serves multiple functions within the network, including incentivizing node operators and securing data integrity.

Smart Contracts: The Ultimate Beneficiary

Chainlink enhances the utility of smart contracts by enabling them to securely interact with real-world data, thereby expanding their potential applications far beyond token transactions.

Chainlink’s Ecosystem: A Web of Possibilities

Chainlink has fostered a robust ecosystem comprising various DeFi projects, data providers, and enterprise solutions, all leveraging its decentralized oracle network.

NFTs and Cryptocurrencies

In the ever-evolving landscape of digital assets, NFTs and cryptocurrencies stand as two pillars with distinct characteristics and functionalities. While cryptocurrencies like Bitcoin and Ethereum are fungible, NFTs are unique digital assets that cannot be replaced.

What Makes NFTs Unique?

Unlike cryptocurrencies, which are interchangeable and identical, NFTs are unique and indivisible. They often represent ownership of a specific item or piece of content, such as digital art, collectibles, or even tweets.

The Utility of NFTs

NFTs have found applications beyond just digital art. They are used in gaming, real estate, and even in tokenizing physical assets. The utility of NFTs is expanding as blockchain technology evolves.

How Do NFTs and Cryptocurrencies Interact?

NFTs are generally built on the same blockchain networks that support cryptocurrencies. For example, most NFTs are built on the Ethereum blockchain and can be bought using Ether.

The Market Dynamics

The market for NFTs and cryptocurrencies is highly volatile but also offers high rewards. While cryptocurrencies are more liquid, NFTs can sometimes fetch astronomical prices due to their uniqueness.

To get a foundational understanding of cryptocurrencies, you can refer to our beginner’s guide on Unveiling the Crypto Mystery.

DeFi and Cryptocurrencies

Decentralized Finance, commonly known as DeFi, is a revolutionary concept that aims to democratize finance by removing intermediaries.

It’s a world where cryptocurrencies aren’t just digital assets but also financial tools in lending, borrowing, or asset trading.

What is DeFi?

DeFi stands for “Decentralized Finance,” an umbrella term for a variety of financial applications in cryptocurrency or blockchain geared toward disrupting financial intermediaries.

How Does DeFi Work?

DeFi operates on smart contracts, which are self-executing contracts with the terms directly written into code. These smart contracts run on blockchain platforms like Ethereum, making them transparent and immutable.

DeFi and Cryptocurrencies: A Perfect Match

Cryptocurrencies serve as the backbone of the DeFi system. They are used as collateral for loans, as assets for trading, and as a means for transferring value in a wide range of financial applications.

Risks and Rewards

While DeFi offers a new world of opportunities, it’s not without risks such as smart contract failures, regulatory uncertainty, and high volatility. However, the rewards can be substantial, offering higher interest rates and lower transaction fees compared to traditional finance.

How to Evaluate Popular Cryptocurrencies

Investing in cryptocurrencies can be a rewarding but risky endeavor, as the market is known for its high volatility. To mitigate risks and make informed decisions, it’s crucial to know how to evaluate a cryptocurrency.

Market Capitalization

One of the first metrics to consider is the market capitalization of the cryptocurrency. It gives you an idea of the coin’s stability and how significant it is in the market.

Technology and Use-Case

Understanding the technology behind a cryptocurrency and its use case is vital. Is it a blockchain-based token, or does it use another form of distributed ledger technology? What problem does it aim to solve?

Community and Developer Activity

A strong community and active developers can be a good indicator of the cryptocurrency’s credibility and potential for growth. Check forums, social media, and GitHub repositories for activity.

Regulatory Compliance

Cryptocurrencies that comply with regulations are generally considered safer investments. However, the regulatory landscape is still evolving, so this can be a grey area.

Price History and Liquidity

Understanding past price trends can help predict future behavior. However, remember that past performance is not an indicator of future results. Liquidity is also crucial; it should be easy to buy and sell the cryptocurrency.

Risk Factors

Every investment comes with risks. Be aware of factors like market volatility, technological vulnerabilities, and competitive landscape.

Wrapping Up: Your Roadmap to Crypto Mastery

Congratulations, you’ve just taken a deep dive into the world of cryptocurrencies! From understanding the basics to exploring the various types of cryptocurrencies like Bitcoin, Ethereum, and altcoins, you’re now equipped with the knowledge to navigate this exciting yet complex landscape.

We’ve also touched upon the revolutionary technologies that power these digital assets, such as blockchain and smart contracts. These innovations are not just disrupting the financial sector but are also making waves in various other industries.

Remember, the key to successful investment in cryptocurrencies lies in thorough research and evaluation. Always stay updated with market trends, technological advancements, and regulatory changes.

So, what’s next on your crypto journey? Whether it’s diving into the world of NFTs, exploring DeFi platforms, or perhaps even minting your own cryptocurrency, the possibilities are endless.

Frequently Asked Questions: Your Crypto Queries Answered

| Questions | Answers |

| What is cryptocurrency? | Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies, it operates on decentralized networks based on blockchain technology. |

| How do I buy cryptocurrency? | You can buy cryptocurrencies through various online platforms known as cryptocurrency exchanges. Some popular exchanges include Coinbase, Binance, and Kraken. |

| What is blockchain? | Blockchain is a distributed ledger technology that records transactions across multiple computers in a secure, transparent, and immutable manner. |

| How do I store my cryptocurrencies? | Cryptocurrencies can be stored in digital wallets. These wallets can be hardware-based or software-based. 🔗 Learn more about crypto wallets |

| What are altcoins? | Altcoins are any cryptocurrencies other than Bitcoin. Examples include Ethereum, Litecoin, and Ripple. |

| What is DeFi? | DeFi stands for Decentralized Finance. It refers to financial services, like lending or asset trading, that are built on blockchain technologies. |

| What are NFTs? | NFTs, or Non-Fungible Tokens, are unique digital assets verified using blockchain technology. They are often used to represent ownership of unique items like art or collectibles. |

| How do I evaluate a cryptocurrency? | Evaluating a cryptocurrency involves looking at various factors such as market cap, liquidity, technological innovation, team, and regulatory environment. |

| Is cryptocurrency legal? | The legality of cryptocurrency varies by country. While some countries have embraced it, others have imposed restrictions or outright bans. |

| What are the risks involved? | Investing in cryptocurrencies carries risks like market volatility, cybersecurity threats, regulatory changes, and technological vulnerabilities. |