What is Bitcoin? This simple question opens the door to an exciting and complex world of digital currency that’s reshaping how we think about money.

Imagine a system of money that’s not controlled by banks or governments but by the people who use it. That’s Bitcoin for you – a digital currency that’s as intriguing as it is revolutionary.

Key Takeaways

- Bitcoin Basics: Bitcoin is a digital currency, operating independently of central control, offering a new way of thinking about money.

- Ease of Access: Anyone with an internet connection can join the Bitcoin ecosystem, making it globally accessible.

- Innovative Technology: Bitcoin uses blockchain technology for secure, transparent transactions.

- Investment Potential: Recognized for its investment opportunities, Bitcoin appeals to those looking for alternative assets.

- User-Driven Control: Bitcoin’s decentralized nature means its users have more control over their transactions and funds.

In our journey through this article, we’ll uncover the layers of Bitcoin, helping you understand not just what it is, but why it’s become such a significant part of today’s digital landscape.

For those beginning their journey into cryptocurrency, this is your starting point to understanding Bitcoin and its impact on the financial world.

Read more about the evolving world of cryptocurrencies in our comprehensive guide on Popular Cryptocurrencies.

In the next section, we delve deeper into the mechanics of Bitcoin, laying out the fundamentals of this digital currency in terms anyone can grasp.

Stay tuned to uncover the mysteries of Bitcoin and why it’s more than just digital cash.

Understanding Bitcoin: The Basics

Bitcoin is more than just digital currency; it’s a revolutionary concept that combines technology, economics, and social dynamics. Let’s break it down into simpler terms, making it easy for anyone starting their cryptocurrency journey.

What is Bitcoin?

At its core, Bitcoin is a form of digital currency, distinct from the physical coins and bills in your wallet.

Unlike traditional currencies issued by governments (known as fiat currencies), Bitcoin operates without a central authority, like a bank or government. This independence from central control is what makes Bitcoin truly unique and appealing to many users globally.

How Bitcoin Functions

1. Decentralization:

- No central control: Bitcoin is managed by a network of computers worldwide.

- Peer-to-peer transactions: Transactions are made directly between users, bypassing traditional banking systems.

2. The Blockchain Technology:

- Public Ledger: All Bitcoin transactions are recorded in a public ledger known as the blockchain.

- Security and Transparency: The blockchain is a secure, transparent way to record transactions, ensuring the integrity and history of Bitcoin.

3. Mining and Transaction Verification:

- Process: Miners use powerful computers to solve complex mathematical problems, validating transactions and adding them to the blockchain.

- Reward: Miners are rewarded with new bitcoins, incentivizing them to maintain and secure the network.

Bitcoin’s Key Features

- Limited Supply: There will never be more than 21 million bitcoins, making it a deflationary currency unlike fiat money.

- Divisibility: Bitcoins can be divided into smaller units called satoshis, allowing for small transactions and greater accessibility.

- Global Accessibility: Anyone with an internet connection can use Bitcoin, making it accessible worldwide.

For a deeper dive into how Bitcoin is reshaping the financial world, explore our article on Unveiling the Crypto Mystery.

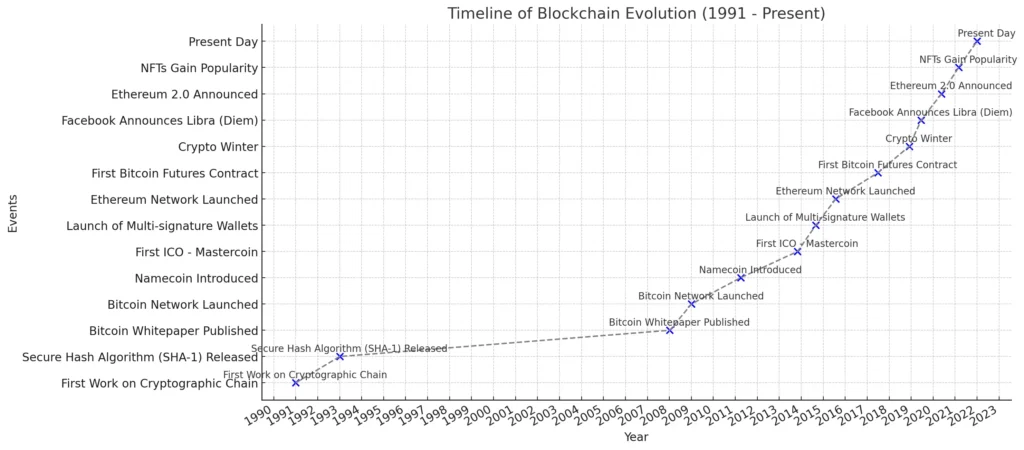

| Year | Date | Event |

| 2008 | October 31 | Satoshi Nakamoto publishes a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” |

| 2009 | January 3 | The first block on the Bitcoin blockchain is mined, marking the genesis of the Bitcoin network. |

| 2009 | July 15 | The first Bitcoin transaction takes place between Satoshi Nakamoto and Hal Finney. |

| 2010 | May 22 | The first Bitcoin exchange, Mt. Gox, is launched. |

| 2010 | July 17 | The first Bitcoin price is established at $0.00076 per coin. |

| 2011 | February 9 | The first Bitcoin-based marketplace, Silk Road, is launched. |

| 2011 | June 19 | The first major Bitcoin hack occurs when Mt. Gox is compromised, and 600,000 bitcoins are stolen. |

| 2012 | April 25 | The first Bitcoin ATM is installed in Vancouver, Canada. |

| 2013 | October 1 | The price of Bitcoin surpasses $100 for the first time. |

| 2014 | February 25 | The first Bitcoin futures contract is traded on the Chicago Mercantile Exchange (CME). |

| 2014 | March 25 | The IRS rules that Bitcoin is a taxable asset, subject to capital gains taxes. |

| 2015 | January 14 | The first Bitcoin block reward is halved, reducing the amount of new bitcoins created each year. |

| 2015 | September 22 | The Chinese government bans Bitcoin exchanges and financial institutions from handling Bitcoin transactions. |

| 2016 | March 24 | The first Bitcoin ETF, ProShares Bitcoin ETF, is filed with the Securities and Exchange Commission (SEC). |

| 2016 | July 16 | The SEC denies the ProShares Bitcoin ETF application. |

| 2017 | January 1 | The price of Bitcoin surpasses $1,000 for the first time. |

| 2017 | December 17 | The price of Bitcoin reaches an all-time high of $19,783.06. |

| 2018 | February 6 | The price of Bitcoin falls below $6,000 for the first time since November 2017. |

| 2019 | April 1 | The price of Bitcoin surpasses $5,000 for the first time since November 2018. |

| 2019 | October 21 | The SEC approves the first Bitcoin futures ETF, the Bakkt Bitcoin Futures ETF. |

| 2020 | March 12 | The price of Bitcoin crashes below $5,000 due to the COVID-19 pandemic. |

| 2020 | November 25 | The price of Bitcoin surpasses $25,000 for the first time. |

| 2021 | January 8 | The price of Bitcoin surpasses $40,000 for the first time. |

| 2021 | April 14 | Tesla announces that it has purchased $1.5 billion worth of Bitcoin and will begin accepting Bitcoin as payment for its electric vehicles. |

| 2021 | November 10 | The price of Bitcoin reaches an all-time high of $68,789.63. |

| 2022 | January 22 | The price of Bitcoin falls below $30,000 for the first time since July 2021. |

| 2022 | September 27 | The price of Bitcoin surpasses $25,000 for the first time since June 2022. |

In summary, Bitcoin is a groundbreaking digital currency that offers a decentralized, secure, and transparent way of conducting transactions.

It’s not just a form of money; it’s a whole new approach to the concept of currency, free from central control, and open to everyone, everywhere.

Stay tuned for our next section, where we’ll explore the unique features of Bitcoin and how they contribute to its growing popularity and potential as a future currency.

The Unique Features of Bitcoin

Bitcoin is not just a digital currency; it’s a revolutionary idea that brings a new perspective to financial transactions.

In this section, we’ll explore the distinctive features of Bitcoin that make it stand out in the world of finance and technology.

Decentralization: The Heart of Bitcoin

1. No Central Authority:

- Unlike traditional currencies, Bitcoin operates without a central bank or government control.

- This decentralization means that the system is managed collectively by the network, making it resistant to censorship and central failures.

2. Peer-to-Peer Network:

- Transactions occur directly between users without intermediaries, offering greater control and lower costs.

Transparency and Security: The Blockchain

1. A Public Ledger:

- Every Bitcoin transaction is recorded on the blockchain, a public ledger visible to all users.

- This transparency ensures accountability and traceability in financial transactions.

2. Enhanced Security:

- The blockchain’s design makes tampering with transaction history nearly impossible, ensuring the integrity of the financial records.

Bitcoin’s Economic Model

1. Limited Supply:

- Bitcoin has a capped supply of 21 million coins, a feature that helps to prevent inflation.

- This scarcity is similar to precious metals like gold, contributing to its value.

2. Divisibility:

- Bitcoin can be divided into smaller units known as satoshis, making it usable for microtransactions and increasing accessibility.

Global Accessibility and Inclusion

- Worldwide Use: Bitcoin can be accessed and used globally by anyone with an internet connection, making it a truly international currency.

- Financial Inclusion: It offers financial services to those without access to traditional banking, bridging the gap in financial inclusion.

For more insights into how blockchain technology is transforming various sectors, delve into our detailed exploration at Blockchain in Human Resources.

To sum up, Bitcoin’s unique features of decentralization, transparency, limited supply, divisibility, and global accessibility make it a unique player in the financial world.

It’s not just a currency but a new way of thinking about and handling money, breaking free from traditional financial constraints and offering a window into the future of finance.

Next, we’ll take a closer look at how to use Bitcoin, its practical applications, and how it fits into the broader landscape of digital currencies. Stay tuned for an insightful journey into the practical world of Bitcoin.

Practical Applications of Bitcoin

Bitcoin’s unique characteristics not only make it a fascinating subject but also give it practical applications in the real world. In this section, we will explore how Bitcoin is used in everyday life and its potential as a future currency.

Using Bitcoin for Transactions

1. Digital Purchases:

- Online Shopping: Many online retailers and services accept Bitcoin, allowing users to purchase goods and services.

- Digital Content: Bitcoin is often used to buy digital content like apps, games, and online subscriptions.

2. In-Person Transactions:

- Retail Stores: A growing number of physical stores accept Bitcoin, making it a viable option for in-person shopping.

- QR Code Payments: Users can make payments by scanning a QR code with their smartphone, simplifying the transaction process.

Investment and Trading

- Asset Investment: Many people buy Bitcoin as a long-term investment, similar to stocks or gold.

- Trading: Bitcoin’s price volatility makes it popular among traders looking to profit from market fluctuations.

- For insights on cryptocurrency investment strategies, check out our guide on Crypto Roth IRA.

Remittances and International Transfers

- Lower Transaction Fees: Bitcoin enables cheaper and faster international money transfers compared to traditional banking systems.

- Borderless Transactions: It’s an ideal solution for sending remittances to countries with limited banking infrastructure.

Philanthropy and Donations

- Non-Profit Donations: Bitcoin is increasingly used for charitable donations, offering transparency and ease of transfer.

- Supporting Causes: Many non-profit organizations accept Bitcoin, enabling global support for various causes.

Challenges and Considerations

- Price Volatility: The fluctuating value of Bitcoin can be a risk for users and merchants.

- Regulatory Landscape: The legal status of Bitcoin varies by country, affecting its use and acceptance.

The Future of Bitcoin

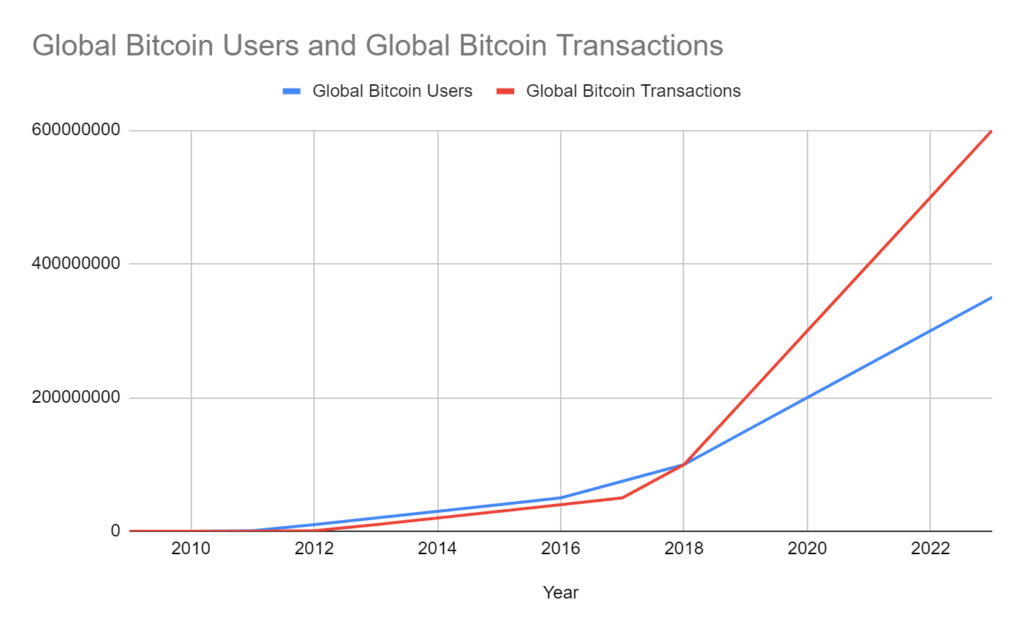

- Potential for Widespread Adoption: With its growing popularity, Bitcoin has the potential to become a more commonly accepted form of currency worldwide.

- Technological Innovations: Continuous improvements in blockchain technology and security measures could enhance Bitcoin’s usability and acceptance.

To explore how Bitcoin and similar technologies are influencing the fitness industry, dive into our article on Crypto Fitness Apps.

Navigating the Risks and Rewards of Bitcoin

Bitcoin, as a pioneering digital currency, presents a blend of opportunities and challenges. For those embarking on their journey into the world of cryptocurrency, it’s crucial to understand both the potential rewards and inherent risks of Bitcoin.

Embracing Bitcoin’s Potential

1. Investment Opportunities:

- Long-term Growth: Many view Bitcoin as a valuable long-term investment due to its limited supply and growing demand.

- Diversification: Bitcoin offers a way to diversify investment portfolios, potentially reducing risk.

2. Technological Innovation:

- Blockchain Advancements: The technology behind Bitcoin, blockchain, is continually evolving, potentially leading to more secure and efficient transactions.

- New Applications: Bitcoin’s underlying technology is being explored for use in various sectors, from finance to healthcare.

Understanding the Risks

1. Market Volatility:

- Bitcoin’s price is known for its high volatility, which can lead to significant price fluctuations.

- Investors and users should be prepared for the possibility of sudden increases or decreases in value.

2. Security Concerns:

- Cybersecurity Threats: Bitcoin wallets and exchanges can be targets for hacking and theft.

- Personal Responsibility: Users must safeguard their private keys and practice secure online behavior.

3. Regulatory Uncertainty:

- Bitcoin’s legal status varies globally, with some countries embracing it and others imposing restrictions or outright bans.

- Changes in regulations can impact Bitcoin’s usability and value.

Bitcoin’s Role in the Digital Age

- Pioneering Digital Currency: Bitcoin is often seen as the leader in the digital currency space, paving the way for other cryptocurrencies.

- A Symbol of Financial Autonomy: For many, Bitcoin represents a shift towards a more decentralized and user-empowered financial system.

Bitcoin offers a unique blend of risks and rewards. While it presents exciting opportunities for investment and innovation, it also requires an understanding and management of its risks. As the digital currency landscape continues to evolve, Bitcoin remains at the forefront, challenging traditional financial systems and offering a glimpse into the future of money.

To further explore the implications of Bitcoin in the modern economy, check out our article on How Bitcoin is Changing the Financial Landscape. Stay tuned for more insights into the exciting world of Bitcoin and cryptocurrencies.

The Future of Bitcoin: Trends and Predictions

As Bitcoin continues to captivate the world, it’s essential to look ahead and consider what the future might hold for this groundbreaking digital currency. Understanding the potential trends and developments can help beginners and enthusiasts alike navigate the ever-evolving landscape of cryptocurrency.

Emerging Trends in Bitcoin Usage

1. Increased Mainstream Adoption:

- Growing Acceptance: More businesses, both online and offline, are beginning to accept Bitcoin as a payment method.

- Public Awareness: As understanding and acceptance of Bitcoin grow, it’s likely to become more integrated into everyday financial activities.

2. Technological Enhancements:

- Improved Scalability: Ongoing developments, such as the Lightning Network, aim to enhance Bitcoin’s transaction speed and efficiency.

- Enhanced Security Measures: Continuous advancements in blockchain technology are expected to make Bitcoin transactions even more secure.

Predictions for Bitcoin’s Future

1. Market Evolution:

- Price Stability: Over time, some analysts predict that Bitcoin’s price volatility may decrease as the market matures.

- Regulatory Clarity: Clearer regulations could lead to greater stability and trust in Bitcoin as a digital asset.

2. Broader Financial Integration:

- Digital Asset Portfolios: Bitcoin is likely to become a more standard component of diversified investment portfolios.

- Innovative Financial Products: The emergence of Bitcoin-related financial products, like ETFs and derivatives, is anticipated.

Potential Challenges

- Regulatory Hurdles: The evolving regulatory landscape could pose challenges and impact Bitcoin’s growth and adoption.

- Technological Limitations: Addressing issues like scalability and energy consumption remains critical for Bitcoin’s long-term success.

For a deeper understanding of Bitcoin’s impact on various industries, explore our article on Blockchain’s Role in Transforming Industries.

Stay tuned for more updates and insights into the dynamic world of Bitcoin and cryptocurrencies.

Bitcoin in Everyday Life: Understanding its Practical Use

As Bitcoin continues to grow in popularity, it’s becoming more relevant in our daily lives.

This section aims to demystify how Bitcoin can be practically used, making it more approachable for those beginning their journey in the world of cryptocurrency.

Everyday Transactions with Bitcoin

1. Shopping with Bitcoin:

- Online Purchases: A rising number of online retailers now accept Bitcoin for various products and services.

- In-Store Payments: Physical stores are increasingly adopting Bitcoin payment options, facilitated by QR code scanning for easy transactions.

2. Bitcoin for Personal Finance:

- Remittances: Bitcoin provides a cost-effective and efficient way for international money transfers, especially valuable for sending remittances.

- Savings: Some people use Bitcoin as a digital savings account, given its potential for long-term value appreciation.

Bitcoin’s Role in the Digital Economy

- Digital Asset Trading: Bitcoin is a popular choice for digital asset trading, offering opportunities for both short-term traders and long-term investors.

- Crowdfunding and Donations: Bitcoin is used in crowdfunding initiatives and charitable donations, thanks to its global reach and ease of transfer.

The Societal Impact of Bitcoin

1. Financial Inclusion:

- Access to Banking Services: Bitcoin offers banking solutions to the unbanked or underbanked populations, enabling them to participate in the global economy.

- Empowerment: It provides financial autonomy to individuals, especially in regions with unstable currencies or restrictive financial systems.

2. Education and Awareness:

- Growing Knowledge Base: The rise of Bitcoin has led to increased educational resources and awareness about digital currencies and financial literacy.

- Community Engagement: Bitcoin has fostered a global community of enthusiasts, developers, and advocates who continuously drive innovation and adoption.

For more insights into how Bitcoin is shaping the future of digital finance, explore our in-depth analysis at Crypto and the Future of Banking.

Stay tuned for more updates and explorations into the fascinating world of Bitcoin and cryptocurrencies.

Embark on Your Bitcoin Journey: The Road Ahead

As we reach the conclusion of our exploration into Bitcoin, it’s clear that this digital currency is not just a fleeting trend but a significant innovation with the potential to reshape the financial landscape. For those just beginning their journey in the world of cryptocurrency, the road ahead is filled with exciting possibilities and learning opportunities.

The Transformative Power of Bitcoin

Bitcoin has demonstrated its ability to challenge traditional financial systems and offer an alternative that is decentralized, transparent, and accessible. Its impact extends beyond just financial transactions, influencing areas such as technological innovation, social empowerment, and global economic participation.

Your Role in the Bitcoin Ecosystem

As a new or prospective Bitcoin user, your journey is just beginning. Embracing Bitcoin means more than just understanding its technical aspects; it’s about recognizing its potential to drive change and being part of a community that values innovation and financial autonomy.

Next Steps in Your Bitcoin Adventure

- Educate Yourself: Continue learning about Bitcoin and blockchain technology. Knowledge is power, especially in the rapidly evolving world of cryptocurrency.

- Get Involved: Engage with online communities, attend workshops, or participate in forums to connect with like-minded individuals and experts.

- Experiment Safely: Start small with your Bitcoin investments or transactions. Familiarize yourself with digital wallets, exchanges, and secure transaction practices.

- Stay Informed: Keep up-to-date with the latest developments and trends in Bitcoin and the broader cryptocurrency market.

Join the Bitcoin Revolution

We invite you to be part of the Bitcoin revolution. Whether you’re interested in using Bitcoin for transactions, investing in it, or simply learning more about this ground-breaking technology, there’s a place for you in the Bitcoin community.

Explore more on our website, where we delve deeper into various aspects of cryptocurrencies and blockchain technology.

Bitcoin is more than just a currency; it’s a movement. By joining this movement, you’re not just witnessing history – you’re helping to shape the future of finance. So, take that first step on your Bitcoin journey today and discover the endless possibilities that await.

Are you ready to be part of the Bitcoin revolution? Let your journey begin!

Frequently Asked Questions

| Frequently Asked Questions | Answers |

|---|---|

| What is Bitcoin? | Bitcoin is a digital currency, known as a cryptocurrency, that operates without central authority or banks. It’s based on a decentralized network of computers and uses blockchain technology for secure transactions. |

| How does Bitcoin work? | Bitcoin transactions are verified by a network of nodes through cryptography and recorded in a public ledger called a blockchain. Users can send and receive bitcoins on this network using digital wallets. |

| Can Bitcoin be converted to cash? | Yes, Bitcoin can be exchanged for traditional currency through online exchanges, Bitcoin ATMs, or peer-to-peer transactions. However, the conversion rate can vary depending on the market value of Bitcoin at the time of the exchange. |

| Is Bitcoin legal? | The legality of Bitcoin varies by country. While it is legal in many countries, some have banned or restricted its use. Always check the legal status of Bitcoin in your specific location before using it. |

| How can I buy Bitcoin? | Bitcoin can be purchased on cryptocurrency exchanges, peer-to-peer platforms, Bitcoin ATMs, or from other individuals. You’ll need a Bitcoin wallet to store your bitcoins once you’ve purchased them. |

| Is Bitcoin safe to use? | While Bitcoin’s network is generally secure, risks exist, such as market volatility and potential hacking of wallets or exchanges. It’s important to practice safe storage and be aware of the risks before investing or transacting in Bitcoin. |

| Can Bitcoin be used for purchases? | Yes, an increasing number of online and physical stores accept Bitcoin as payment. However, its acceptance varies by merchant and region. |

| What are the fees for using Bitcoin? | Transaction fees for Bitcoin vary and depend on factors like the network’s current transaction volume and the size of the transaction. These fees go to miners who validate and secure blockchain transactions. |

| How is Bitcoin different from traditional currencies? | Unlike traditional currencies, Bitcoin is digital and decentralized. It’s not controlled by any government or financial institution and operates on a peer-to-peer network. Its supply is also limited, capped at 21 million bitcoins, unlike fiat currencies that can be printed by governments. |

| What are the risks of investing in Bitcoin? | Key risks include high market volatility, potential regulatory changes, and cybersecurity threats to wallets and exchanges. It’s advised to research thoroughly and consider your risk tolerance before investing in Bitcoin. |

Further Reading

To enhance your understanding of Bitcoin and related topics, we have curated a list of additional resources from our website.

These articles provide deeper insights into various aspects of cryptocurrencies, blockchain technology, and their applications. Click on “Read More” to explore each topic further.