Bitcoin, a digital revolution that reshaped the financial world, began as a simple idea but has grown into a global phenomenon. This journey of Bitcoin, from a concept in the digital ether to a mainstream financial asset, is not just about technology; it’s about the people, the ideas, and the movements that propelled it.

For those just starting their journey into cryptocurrency, understanding Bitcoin’s history is crucial. It’s a tale of innovation, challenges, and unexpected turns.

Key Takeaways

- Bitcoin’s Roots: Born from the fusion of cryptography and digital cash concepts.

- Satoshi Nakamoto: The enigmatic creator whose true identity remains a mystery.

- First Transactions: Marking the real-world value of Bitcoin with the famous “Pizza Day”.

- Global Impact: How Bitcoin challenged traditional finance and continues to shape the future.

Let’s embark on this exciting journey through the history of Bitcoin, tracing its steps from an obscure digital currency to a powerhouse in the financial sector. For a deeper understanding of what Bitcoin is, check out our comprehensive guide on What is Bitcoin.

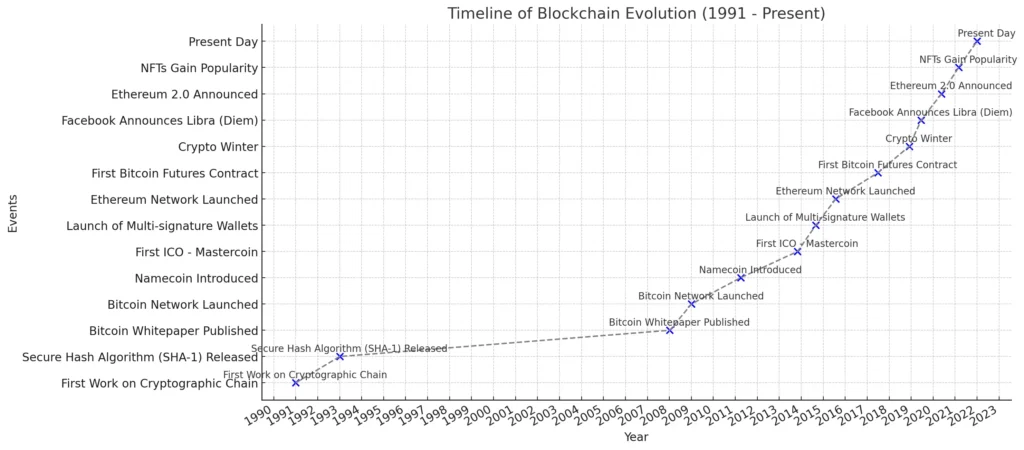

Early Concepts and Predecessors to Bitcoin

The foundation of Bitcoin didn’t emerge from a void. It was built upon a series of innovative ideas and developments in the realm of digital cash and cryptography.

This section explores the precursors to Bitcoin, shedding light on the evolutionary path that led to the creation of this ground-breaking cryptocurrency.

The Genesis of Digital Cash

- David Chaum’s Ecash: The early 90s saw David Chaum’s ecash, a pioneering concept in digital cash technologies.

- Proof-of-Work Concept: Adam Back’s Hashcash, introduced in 1997, laid the groundwork for what would become a core principle in Bitcoin’s design.

Pioneers of Cryptographic Ideas

- Wei Dai’s b-money: An early proposal for an anonymous, distributed electronic cash system.

- Nick Szabo’s Bit Gold: Szabo’s bit gold concept was a direct precursor to Bitcoin’s architecture.

Reusable Proof of Work

- Hal Finney’s RPOW: Hal Finney extended the idea of proof-of-work, creating the reusable proof of work (RPOW) system, which is a direct antecedent to Bitcoin’s mining process.

The Legacy of Early Innovations

These early developments created the fertile ground for Bitcoin’s emergence. By understanding these technological and conceptual forerunners, we can appreciate the depth and ingenuity behind Bitcoin’s creation.

For more insights into the technical aspects behind these innovations, delve into our detailed exploration of Blockchain Technology.

The Emergence of Bitcoin

The story of Bitcoin truly begins in 2008, a watershed year that marked the inception of a new era in digital currency.

This section unveils the pivotal moments that led to the birth of Bitcoin, setting the stage for a financial revolution.

The Birth of a New Currency

- Bitcoin.org Registration: On August 18, 2008, the domain bitcoin.org was registered, signaling the start of a new digital phenomenon.

- Satoshi Nakamoto’s Whitepaper: The release of the “Bitcoin: A Peer-to-Peer Electronic Cash System” whitepaper by the mysterious Satoshi Nakamoto laid the foundation for Bitcoin’s underlying principles.

- Genesis Block: On January 3, 2009, the Bitcoin network came into existence with Nakamoto mining the first block, known as the Genesis Block.

Satoshi Nakamoto: An Enigmatic Figure

- Who is Satoshi Nakamoto?: The true identity of Satoshi Nakamoto, the creator of Bitcoin, remains one of the greatest mysteries in the world of cryptocurrency.

- Nakamoto’s Departure: Around mid-2010, Nakamoto stepped away from the project, leaving a legacy that continues to intrigue and inspire.

A New Era in Finance

The creation of Bitcoin wasn’t just a technological breakthrough; it was the start of a new chapter in financial history. This innovative digital currency opened the doors to a world of possibilities, challenging traditional financial systems and introducing the concept of decentralized finance.

Bitcoin’s First Transactions and Early Adoption

As Bitcoin began its journey, the early stages were marked by significant milestones that demonstrated its practical use and potential.

This section highlights the first steps of Bitcoin in the real world, from its initial transactions to the growing interest of early adopters.

The First Bitcoin Transaction

- Hal Finney’s Involvement: Programmer Hal Finney was one of Bitcoin’s earliest supporters and the recipient of the first-ever Bitcoin transaction from Nakamoto on January 12, 2009.

- The Transaction: This historic transaction involved Nakamoto sending 10 bitcoins to Finney, marking a pivotal moment in Bitcoin’s history.

Bitcoin Pizza Day: A Milestone Transaction

- Date: On May 22, 2010, a landmark event in Bitcoin’s history occurred, now celebrated as Bitcoin Pizza Day.

- The Transaction: 10,000 BTC were exchanged for two pizzas, demonstrating the real-world value of Bitcoin for the first time.

Early Adopters and Community Growth

- Community Involvement: Early supporters like Wei Dai and Nick Szabo played crucial roles in nurturing the Bitcoin community.

- Growth of the Network: These initial transactions and community efforts were instrumental in demonstrating Bitcoin’s potential, leading to its gradual acceptance and growth.

Nakamoto’s Legacy

- Nakamoto’s Departure: Nakamoto’s withdrawal from Bitcoin development left a lasting impact, but the cryptocurrency continued to grow, driven by its community.

Growth and Challenges in the Early Years

Bitcoin’s journey after its initial adoption was marked by rapid growth, but not without its share of challenges.

This section delves into the pivotal events and obstacles Bitcoin faced in its early years, shaping its path towards mainstream acceptance.

The Rise of Bitcoin Exchanges

- Coinbase’s Milestone: In February 2013, Coinbase reported selling over $1 million worth of bitcoins, indicating growing market interest.

- Mt. Gox Saga: The rise and fall of Mt. Gox, one of the largest bitcoin exchanges, highlighted both the potential and the vulnerabilities of Bitcoin.

The Silk Road Controversy

- Impact on Bitcoin’s Reputation: The association with the Silk Road, an online black market, presented a significant challenge to Bitcoin’s public image.

- FBI Seizure: The FBI’s seizure of bitcoins from the Silk Road in 2013 was a major event that brought Bitcoin into the spotlight, albeit controversially.

Technological and Financial Challenges

- Processing Delays: Exchanges like BitInstant and Mt. Gox faced processing delays, leading to significant fluctuations in Bitcoin’s value.

- Public Perception: Skepticism from financial experts and the general public posed challenges to Bitcoin’s acceptance.

Bitcoin’s Resilience and Growth

Despite these challenges, Bitcoin demonstrated remarkable resilience. The number of merchants accepting Bitcoin continued to grow, signaling its increasing legitimacy and potential as a mainstream financial instrument.

Mainstream Acceptance and Regulatory Milestones

Bitcoin’s journey from a niche digital currency to a globally recognized financial asset is a story of overcoming skepticism and gaining legitimacy.

This section highlights the key developments that contributed to Bitcoin’s acceptance in the wider financial and legal world.

Legal Recognition and Adoption

- Japan’s Legalization: Japan set a precedent by passing a law to accept Bitcoin as a legal payment method, demonstrating a significant shift in regulatory attitudes towards cryptocurrencies.

- Russia’s Legalization Plans: Russia’s announcement to legalize the use of cryptocurrencies like Bitcoin further underscored its growing acceptance.

Increasing Merchant Adoption

- Expanding Acceptance: By 2015, over 100,000 merchants worldwide were accepting Bitcoin, reflecting its increasing utility in everyday transactions.

The Evolution of Bitcoin Technology

- Technological Developments: Continuous improvements in Bitcoin’s technology have played a crucial role in its mainstream adoption.

- Bitcoin Forks: The creation of Bitcoin Cash in 2017 was a significant event, representing a divergence in the Bitcoin community regarding its future direction.

Technological Evolution and Forks

As Bitcoin continued to grow, it also evolved technologically, leading to significant developments and forks in its network.

This section delves into these advancements, illustrating how they have shaped Bitcoin’s current state and its trajectory for the future.

Key Technological Developments

- Blockchain Improvements: Continuous enhancements to Bitcoin’s underlying blockchain technology have increased its efficiency and security.

- Adoption of SegWit: The implementation of Segregated Witness (SegWit) was a major step in improving Bitcoin’s scalability and transaction capacity.

The Era of Bitcoin Forks

- Bitcoin Cash Fork: On August 1, 2017, Bitcoin underwent a major fork, leading to the creation of Bitcoin Cash (BCH). This event marked a significant divergence in the Bitcoin community over its future direction.

- Other Forks: Following Bitcoin Cash, several other forks emerged, each proposing different improvements or changes to the Bitcoin protocol.

| Feature | Bitcoin (BTC) | Bitcoin Cash (BCH) | Bitcoin SV (BSV) |

| Block size | 1 MB | 8 MB | 2 GB |

| Transaction speed | 7 transactions per second | 130 transactions per second | 2,100 transactions per second |

| Focus | Store of value | Medium of exchange | Adhering to original Bitcoin protocol |

Impact of Forks on the Bitcoin Ecosystem

- Diversification: The forks led to the creation of new cryptocurrencies, each with its unique features and community.

- Community Debates: These forks sparked discussions and debates within the Bitcoin community, emphasizing the need for consensus in the decentralized world of cryptocurrencies.

Bitcoin’s Role in the Modern Financial System

Bitcoin’s ascent from a novel idea to a key player in the modern financial landscape is a testament to its enduring appeal and adaptability.

This section explores Bitcoin’s integration into mainstream finance and the current trends shaping its future.

Integration into Mainstream Finance

- Legal Acceptance: Countries like Japan and Russia legalizing Bitcoin mark its acceptance into the formal financial system.

- Institutional Investment: Major financial institutions and investors have begun embracing Bitcoin, acknowledging its potential as a store of value.

Trends Shaping Bitcoin’s Future

- Increasing Adoption: The growing number of businesses and platforms accepting Bitcoin signals its widening acceptance.

- Technological Innovations: Ongoing advancements in blockchain technology continue to enhance Bitcoin’s functionality and appeal.

Challenges and Opportunities

- Regulatory Environment: The evolving regulatory landscape presents both challenges and opportunities for Bitcoin’s future.

- Market Volatility: Bitcoin’s price volatility remains a concern, but also offers opportunities for investors.

Conclusion: Reflecting on Bitcoin’s Journey

As we wrap up our exploration of Bitcoin’s history, it’s evident that Bitcoin has been more than just a digital currency; it’s been a movement, a symbol of decentralization, and a challenge to the traditional financial system.

The Impact of Bitcoin

- Revolutionizing Finance: Bitcoin has fundamentally challenged how we perceive and use money.

- Empowering Individuals: By offering a decentralized alternative, Bitcoin has empowered individuals globally.

Looking Ahead: The Future of Bitcoin

- Potential Growth: Bitcoin’s future holds immense potential, with possibilities of further adoption and innovation.

- Ongoing Challenges: Regulatory hurdles and market volatility remain key challenges that Bitcoin will continue to face.

Bitcoin’s journey from an obscure digital currency to a significant player in global finance has been nothing short of remarkable. As we look to the future, Bitcoin’s story is far from over. It continues to evolve, adapt, and influence.

For a deeper understanding of Bitcoin and its place in the world of cryptocurrency, be sure to explore our comprehensive guide on What is Bitcoin.

FAQ: Understanding Bitcoin

Here’s a table of common questions and answers about Bitcoin to further enhance your understanding:

| Question | Answer |

|---|---|

| What is Bitcoin? | Bitcoin is a digital currency, or cryptocurrency, that operates on a decentralized network using blockchain technology. It allows for peer-to-peer transactions without the need for intermediaries like banks. |

| Who created Bitcoin? | Bitcoin was created by an individual or group under the pseudonym Satoshi Nakamoto. The true identity of Nakamoto remains unknown. |

| How does Bitcoin work? | Bitcoin transactions are verified by network nodes through cryptography and recorded on a public ledger called a blockchain. |

| Can Bitcoin be converted to cash? | Yes, Bitcoin can be converted to cash through various cryptocurrency exchanges or Bitcoin ATMs. |

| Is Bitcoin legal? | The legality of Bitcoin varies by country. In some countries, it is fully legal, while others have restricted or banned its use. |

| How can I buy Bitcoin? | Bitcoin can be bought on cryptocurrency exchanges, through peer-to-peer platforms, or at Bitcoin ATMs. |

| What are the risks of using Bitcoin? | Risks include market volatility, potential loss of investment due to price fluctuations, and security risks like hacking. |

| Can Bitcoin be used anonymously? | While Bitcoin transactions are recorded on a public ledger, they are pseudonymous, offering a degree of privacy. However, complete anonymity isn’t guaranteed. |

| How are new Bitcoins created? | New Bitcoins are created through a process called mining, where miners use computational power to solve complex mathematical problems and validate transactions. |

Further Reading

To enhance your understanding of Bitcoin and related topics, here is a table of recommended articles for further reading, featuring internal links from your site: