What Are Altcoins?

Entering the world of cryptocurrency can be exciting and a bit overwhelming. But, don’t worry!

We’re starting with the basics. Altcoins, short for “alternative coins,” are a fascinating part of the crypto universe. They are all the cryptocurrencies that were launched after the success of Bitcoin, aiming to offer alternative solutions in the digital asset world.

Key Takeaways

- Altcoins: Cryptocurrencies other than Bitcoin.

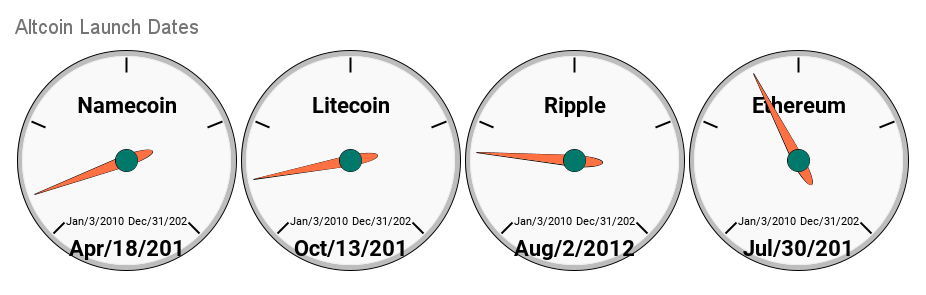

- First Altcoin: Namecoin, launched in 2011.

- Popular Examples: Ethereum, Ripple, Litecoin.

- Main Appeal: Offering different functionalities and solving limitations of Bitcoin.

While Bitcoin, the first and most famous cryptocurrency (What is Bitcoin?), has its unique place, altcoins bring diversity to the crypto space. They range from coins like Ethereum (Ethereum Explained), which introduced smart contracts, to Litecoin, known for faster transactions.

Altcoins represent the innovative spirit of the crypto world, each with its unique features and uses.

The altcoin market is vast and varied. As of now, there are thousands of altcoins, each striving to offer something different.

Whether it’s a more efficient transaction process, lower fees, or specific applications like smart contracts or decentralized finance (DeFi), altcoins are expanding the boundaries of what cryptocurrencies can do.

For those just stepping into the world of crypto, understanding altcoins is a crucial part of the journey. They represent not just investment opportunities but also the continuous evolution of blockchain technology and its applications.

To get a deeper understanding of the origin and purpose of these digital assets, let’s dive into the detailed world of altcoins.

From their history to how they compare with Bitcoin, we’ll explore the essentials of altcoins. Stay tuned to uncover the diverse and dynamic world of these alternative cryptocurrencies!

The History of Altcoins

The journey of altcoins began as a ripple in the vast ocean of cryptocurrency, quickly turning into a significant wave. Let’s take a step back to 2011, a milestone year in the crypto world, marking the birth of altcoins.

The First Altcoin: Namecoin

- Year Launched: 2011

- Purpose: To decentralize domain name registration

- Unique Feature: Used for registering domains with .bit extension

Namecoin, the pioneer altcoin, was not just another digital currency; it was a revolutionary idea aimed at decentralizing the internet’s domain name registration system.

This ambition set the stage for the diverse purposes altcoins would serve in the future.

The Growth of Altcoins

- 2011: The emergence of Litecoin, offering faster transactions and larger supply compared to Bitcoin.

- 2013: Ripple joins the scene, focusing on partnering with financial institutions for quicker international payments.

- 2015: A landmark year with the birth of Ethereum, introducing smart contracts and decentralized applications (DApps).

Each of these altcoins brought something unique to the table, whether it was Litecoin’s speed and efficiency or Ethereum’s groundbreaking platform for DApps. They represented not just alternatives to Bitcoin but also new possibilities within the blockchain technology.

The history of altcoins is a testament to the evolving nature of cryptocurrencies, continually pushing the boundaries and offering new solutions.

Their development reflects the dynamic and innovative spirit of the crypto community, always looking for ways to improve and expand the possibilities of blockchain technology.

Understanding this history is crucial for anyone venturing into cryptocurrencies, as it gives insight into the diverse applications and potential of these digital assets. As we move forward, the evolution of altcoins continues to shape the future of finance and technology.

Altcoins vs. Bitcoin: Understanding the Differences

When we talk about cryptocurrencies, Bitcoin often comes to mind first. But what sets Bitcoin apart from altcoins?

It’s important to understand these differences, especially for those new to the world of cryptocurrency.

Bitcoin: The Pioneer

- Launched: 2009

- Key Features:

- Peer-to-peer electronic cash system.

- Decentralized, no central authority.

- Limited supply of 21 million coins.

- Main Limitations:

- Limited use-cases beyond investment and transactions.

- Energy-intensive mining process.

- Scalability issues, handling only about seven transactions per second.

Bitcoin (What is Bitcoin?) set the stage for cryptocurrencies, but its limitations paved the way for the development of altcoins.

Altcoins: The Evolution

- Purpose: To address the limitations of Bitcoin and introduce new functionalities.

- Diversity: Thousands of altcoins with various features.

- Innovations:

- Smart contracts (Ethereum).

- Faster transaction speeds (Litecoin).

- Specialized use-cases like decentralized finance (DeFi).

Altcoins are not just alternatives to Bitcoin; they represent the continuous innovation in the crypto space, offering solutions to Bitcoin’s limitations and expanding the use-cases of cryptocurrencies.

| Feature | Bitcoin | Altcoins |

| Symbol | ₿ | Diverse symbols |

| Decentralization: | High decentralization with no central authority, relying on a distributed network of computers. | Varies, some with high decentralization similar to Bitcoin, while others may have centralized aspects. |

| Transaction Speed: | Approximately 7 transactions per second. | Varies widely, some with faster transaction speeds than Bitcoin (e.g., Litecoin), while others may be slower. |

| Smart Contracts: | Limited smart contract functionality. | Diverse range of smart contract capabilities, enabling various applications like decentralized applications (DApps), non-fungible tokens (NFTs), and decentralized finance (DeFi). |

| Use Cases: | Primarily used as a digital currency and store of value. | Wider range of use cases, including payments, remittances, investments, decentralized applications, and various financial services. |

| Market Dominance: | Holds the largest market capitalization among cryptocurrencies. | Collectively represent a significant portion of the cryptocurrency market, with individual altcoins holding varying market shares. |

| Adoption: | Widely adopted by merchants and institutions. | Adoption rates vary among altcoins, with some gaining traction while others remain less prominent. |

| Community: | Large and active community of developers, users, and enthusiasts. | Communities for individual altcoins can vary in size and activity levels. |

| Innovation: | Driven by ongoing development and improvements in the Bitcoin protocol. | Altcoins often represent innovative approaches to blockchain technology and experimentation with new features and applications. |

| Risks: | Subject to price volatility and regulatory uncertainties. | Altcoins may face additional risks due to their diversity and varying levels of adoption and maturity. |

Altcoins have introduced a level of diversity that Bitcoin alone couldn’t offer.

They are instrumental in pushing the boundaries of what digital currencies can achieve, leading to a more inclusive and functional cryptocurrency ecosystem.

Altcoins to Empower Crypto with More Use-Cases

The world of altcoins is not just about creating alternatives to Bitcoin; it’s about revolutionizing the cryptocurrency space with diverse and innovative use-cases.

Broadening the Horizon

- Smart Contracts: Pioneered by Ethereum, smart contracts automate agreements and transactions without the need for intermediaries.

- Decentralized Finance (DeFi): Platforms like Ethereum have made DeFi possible, offering decentralized alternatives for financial services like lending, borrowing, and insurance.

- Improved Transaction Capabilities: Altcoins like Litecoin offer faster and more efficient transactions compared to Bitcoin.

Altcoins have significantly expanded the functionalities of the original cryptocurrency concept, introducing new technologies and possibilities.

The Impact of Altcoins

- Innovation: Each altcoin comes with its unique proposition, be it in terms of technology, use-case, or efficiency.

- Accessibility: Altcoins have made the cryptocurrency market more accessible, offering different entry points and opportunities for users and investors.

Altcoins are more than just digital currencies; they are catalysts for innovation in the financial and technological sectors. They have opened the door to a world where blockchain technology is not just about transactions but about creating a decentralized and efficient digital ecosystem.

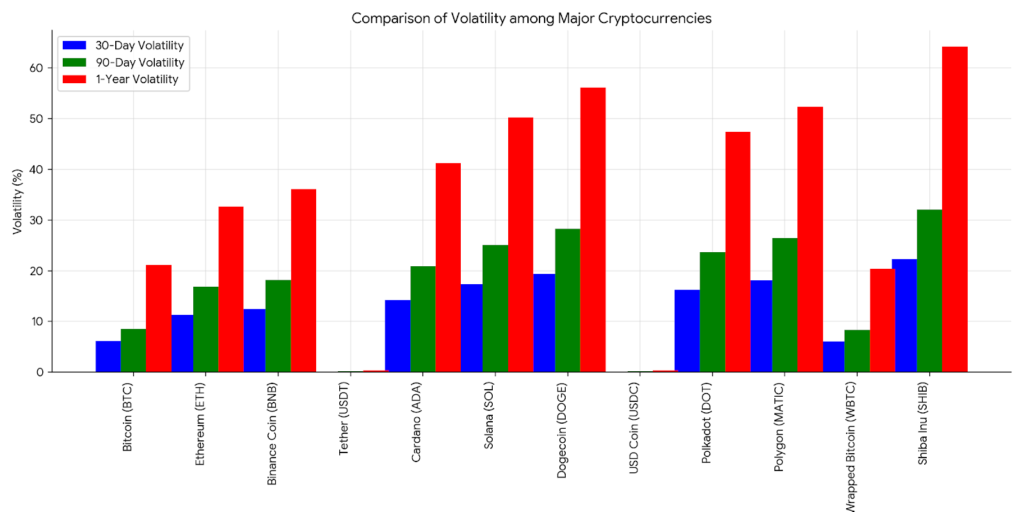

Higher Risks but Increased Profitability in Altcoins

Investing in altcoins can be like riding a rollercoaster – thrilling, but with its ups and downs. It’s essential for beginners to understand the risks and potential rewards involved.

Weighing the Risks

- Volatility: Altcoins can experience rapid price changes, both up and down.

- Market Manipulation: Smaller altcoins may be susceptible to price manipulation schemes.

- Liquidity: Some altcoins may have lower trading volumes, making them harder to buy or sell quickly.

Potential for Greater Rewards

- Growth Potential: Many altcoins have room for significant growth.

- Innovation: Investing in a groundbreaking altcoin project can be rewarding if the technology succeeds.

Investing in altcoins requires careful research and consideration. While the potential for high returns exists, so does the risk of significant losses. It’s crucial to approach altcoin investment with a balanced perspective, understanding both the opportunities and the challenges involved.

What Is Altcoin Mining and How Does It Differ From Bitcoin Mining?

Altcoin mining is a fascinating aspect of the cryptocurrency world, offering a different approach compared to Bitcoin mining.

The Bitcoin Mining Model

- Consensus Algorithm: Proof of Work (PoW).

- Mining Process: Requires powerful hardware like ASIC miners.

- Energy Consumption: Notably high, raising environmental concerns.

Bitcoin’s mining process (What is Bitcoin?) involves solving complex mathematical puzzles, which requires substantial computational power and energy.

Diverse Mining Mechanisms in Altcoins

- Alternative Algorithms: Many altcoins use different algorithms, allowing mining with less specialized equipment like GPUs or CPUs.

- Proof of Stake (PoS): Some altcoins use PoS, where validators are chosen based on the number of coins they hold and are willing to ‘stake’.

- Energy Efficiency: PoS and other algorithms are typically more energy-efficient than Bitcoin’s PoW.

Altcoin mining offers a more varied and often more environmentally friendly approach compared to Bitcoin’s energy-intensive model.

This diversity not only makes the mining process more accessible but also reflects the innovative spirit of the altcoin market.

Pros and Cons of Altcoins

As we continue our exploration of altcoins, it’s important to understand their advantages and challenges.

Advantages of Altcoins

- Innovation: Altcoins bring new technologies and functionalities to the crypto space.

- Diversity: A wide range of options for different needs and preferences.

- Potential for High Returns: Some altcoins have shown significant growth potential.

Challenges Faced by Altcoins

- Volatility: Altcoins can experience rapid and unpredictable price changes.

- Risk of Scams: The altcoin market has seen its share of fraudulent projects.

- Market Manipulation: Smaller altcoins can be more susceptible to price manipulation.

Understanding these pros and cons is crucial for anyone interested in the altcoin market. It helps in making informed decisions and navigating the complexities of cryptocurrency investments.

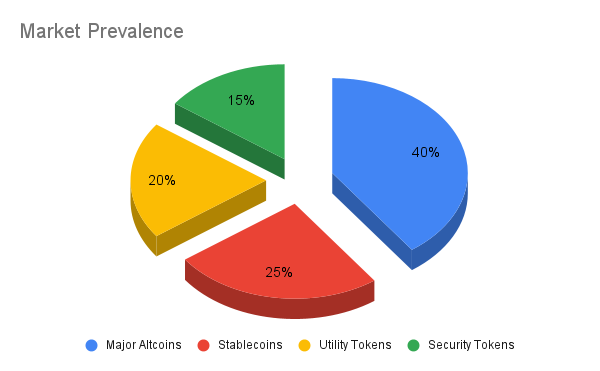

Different Types of Altcoins

The altcoin universe is diverse, with each type offering unique features and purposes. Let’s explore the various categories of altcoins that have emerged.

Major Altcoins

- Ethereum (ETH): Known for smart contracts and DApps.

- Ripple (XRP): Focuses on fast, cross-border payments.

- Litecoin (LTC): Offers quicker transactions and a larger supply compared to Bitcoin.

Stablecoins

- Examples: Tether (USDT), DAI

- Characteristics: Pegged to fiat currencies or other assets to maintain stability.

Utility Tokens and Coins

- Function: Provide access to a platform’s services or benefits.

- Issuance: Often via Initial Coin Offerings (ICOs).

Security Tokens

- Nature: Represent a stake in a project or company.

- Regulation: Generally subject to financial regulations.

Understanding these categories can help beginners navigate the altcoin market more effectively, choosing investments that align with their interests and risk tolerance.

Where Can You Buy Altcoins?

Purchasing altcoins is a key step in beginning your cryptocurrency journey. Here’s a simple guide to help you navigate this process.

Step 1: Choose a Crypto Exchange

- Fiat-to-Crypto Exchanges: For buying altcoins with fiat currencies (e.g., USD, EUR, AUD).

- Documentation: Prepare for Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

Step 2: Buy Crypto Using Fiat

- Payment Methods: Credit cards for speed, bank transfers for lower fees.

- Exchange Wallet: Your purchased crypto will be stored here.

Step 3: Transfer to an Altcoin Exchange

- For Less Common Altcoins: Transfer your major crypto (e.g., BTC, ETH) to an exchange that supports your desired altcoin.

Step 4: Trade for Altcoins

- Trading Pairs: Select the appropriate altcoin pair (e.g., ETH/XYZ coin).

- Transaction Execution: Buy your chosen altcoin.

Step 5: Secure Your Altcoins

- Storage: Transfer your altcoins from the exchange to a secure wallet.

This guide is designed to make your entry into the world of altcoins as smooth as possible. Remember, each step is crucial for a safe and successful purchase of altcoins.

Frequently Asked Questions About Altcoins

Here’s a table of common questions and answers to help clarify some aspects of altcoins:

| Question | Answer |

|---|---|

| What are altcoins? | Altcoins are cryptocurrencies other than Bitcoin, offering various functionalities and innovations in the crypto space. |

| Why were altcoins created? | Altcoins were created to address some of Bitcoin’s limitations and to introduce new features and use-cases in the cryptocurrency market. |

| Are altcoins a good investment? | Altcoins can be a good investment, but they come with higher risks due to their volatility and market uncertainties. It’s important to research and understand each altcoin before investing. |

| How do I buy altcoins? | Altcoins can be purchased on cryptocurrency exchanges using fiat currencies or by trading with other cryptocurrencies like Bitcoin or Ethereum. |

| What’s the difference between altcoins and Bitcoin? | Altcoins differ from Bitcoin in various ways, including their underlying technologies, use-cases, transaction speeds, and consensus mechanisms. |

Further Reading

Here’s a table of further reading options, featuring internal links from your site to enhance the SEO of the article: