Are you intrigued by the buzz around Decentralized Finance, commonly known as DeFi, but find yourself lost in the jargon? You’re not alone!

This comprehensive guide is your one-stop solution to understanding DeFi, its components, and its transformative potential.

From getting started to exploring the future landscape, we’ve got it all covered. So, buckle up as we dive deep into the world of DeFi and how it’s revolutionizing the financial industry.

Quick Takes

The following table summarizes the key points you’ll learn in each section of this blog post.

This will give you a quick overview and help you navigate the content more effectively.

| Section Title | Key Takeaways |

| What is Decentralized Finance (DeFi)? | Gain a foundational understanding of DeFi, its core principles, and its historical evolution. |

| Why DeFi Matters | Learn about the problems DeFi aims to solve and why it’s an improvement over traditional financial systems. |

| How DeFi Works | Understand the underlying technologies like blockchain and smart contracts that make DeFi possible. |

| Key Components of DeFi | Discover the essential elements of DeFi, including lending, borrowing, decentralized exchanges, and more. |

| Risks and Challenges | Become aware of the risks and challenges in the DeFi sector, helping you make informed decisions. |

| Regulatory Landscape | Get an overview of the current regulations affecting DeFi and the role of government. |

| DeFi vs Traditional Finance | Compare DeFi with traditional finance, understanding the pros and cons of each. |

| How to Get Started with DeFi | A step-by-step guide to getting started, including the popular cryptocurrencies used in DeFi. |

| DeFi Wallets | Learn about the importance of crypto wallets in DeFi and get recommendations for reliable options. |

| Future of DeFi | Explore upcoming trends, future applications, and the long-term potential of DeFi. |

| Case Studies | Real-world examples that demonstrate the impact and practical applications of DeFi. |

Feel free to refer back to this table as you read through the blog post to ensure you’re capturing all the essential information.

What is Decentralized Finance (DeFi)?

Decentralized Finance, commonly known as DeFi, is a disruptive innovation that aims to democratize access to financial services.

Unlike traditional financial systems, which are centralized and regulated by institutions like banks and governments, DeFi operates on a decentralized network.

This section will delve into the core principles, technologies, and benefits of DeFi.

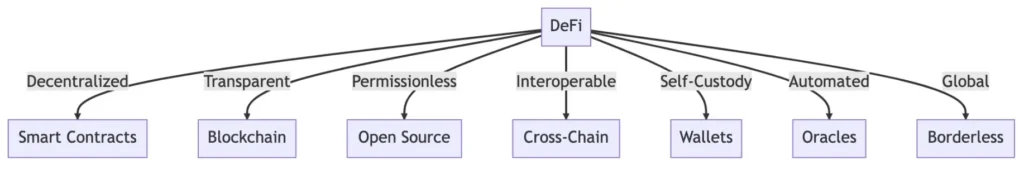

Core Principles of DeFi

DeFi is built on a set of core principles that differentiate it from traditional finance:

- Permissionless: Anyone can participate without the need for approval from a central authority.

- Transparency: All transactions are publicly recorded on the blockchain.

- Interoperability: DeFi applications can easily integrate with each other.

- Accessibility: Services are available to anyone with an internet connection, regardless of geographic location.

Vs

Underlying Technologies

DeFi wouldn’t be possible without the advent of blockchain technology and smart contracts.

Blockchain provides a transparent, secure, and immutable ledger, while smart contracts automate transactions without the need for intermediaries.

- Blockchain: A decentralized ledger that records all transactions across a network of computers.

- Smart Contracts: Self-executing contracts with the terms directly written into code.

Benefits of DeFi

DeFi offers several advantages over traditional financial systems:

- Financial Inclusion: Provides financial services to people who are unbanked or underbanked.

- Cost Efficiency: Lower fees due to the absence of middlemen.

- Speed and Availability: Services are available 24/7 and transactions can be completed more quickly.

- Ownership and Control: Users have full control over their assets and transactions.

Risks and Considerations

While DeFi is revolutionary, it’s not without risks such as smart contract vulnerabilities and regulatory uncertainties. It’s crucial to be aware of these risks, which we will cover in detail in the Risks and Challenges section.

| Benefits of DeFi | Risks of DeFi |

|---|---|

| High Yield | Smart Contract Risks |

| Transparency | Regulatory Uncertainty |

| Accessibility | High Volatility |

| Ownership | Technical Complexity |

By understanding what Decentralized Finance is and how it operates, you can better appreciate its potential to transform the financial landscape.

Whether you’re a seasoned investor or a newcomer, DeFi offers opportunities that are reshaping the way we think about money and financial services.

For a deeper dive into the technologies that make DeFi possible, check out our guide on Cryptocurrency Security.

Why DeFi Matters

Decentralized Finance (DeFi) is more than just a buzzword; it’s a movement that aims to create a more inclusive and efficient financial system.

This section will explore why DeFi is important, its impact on various sectors, and how it aligns with broader trends in finance and technology.

Democratizing Finance

One of the most compelling aspects of DeFi is its ability to democratize access to financial services.

Traditional financial systems often exclude a significant portion of the population due to stringent requirements and high fees. DeFi, being permissionless and open to all, breaks down these barriers.

Financial Innovation

DeFi is a hotbed for financial innovation. From yield farming to decentralized exchanges, new financial products and services are being developed at an unprecedented rate.

This innovation is not just disruptive but also adds value to the ecosystem.

- Yield Farming: Allows users to earn returns by providing liquidity.

- Decentralized Exchanges (DEXs): Enable peer-to-peer trading without a central authority.

Transparency and Security

Transparency is a cornerstone of DeFi. All transactions are publicly recorded on the blockchain, providing an unparalleled level of transparency and security. This is crucial for building trust in a financial system, especially when compared to the opaque nature of traditional finance.

Economic Efficiency

DeFi platforms operate without the overhead of traditional financial institutions, resulting in lower costs for end-users.

This efficiency is not just beneficial for individual users but also has macroeconomic implications.

Alignment with Broader Trends

DeFi aligns well with broader trends in finance and technology, such as financial inclusion, digitization, and the move toward a more open and interconnected financial ecosystem.

It’s not just a trend but a significant part of the future of finance.

By understanding why DeFi matters, you can better position yourself to take advantage of the opportunities it offers.

Whether you’re interested in investment or looking for ways to diversify your financial portfolio, DeFi has something to offer.

For more insights into the evolving world of finance, consider reading our article on Cryptocurrency Trading.

How DeFi Works

Understanding how Decentralized Finance (DeFi) works is crucial for anyone looking to delve into this revolutionary financial landscape.

This section will break down the key components that make DeFi function, from smart contracts to decentralized applications (dApps).

Smart Contracts: The Building Blocks

At the core of every DeFi application are smart contracts.

These are self-executing contracts with the terms of the agreement directly written into code. They automate and streamline various financial operations without the need for intermediaries.

Decentralized Applications (dApps)

DeFi services are often delivered through decentralized applications, commonly known as dApps.

These applications run on a blockchain and are designed to perform specific financial functions like lending, borrowing, or asset trading.

- Lending dApps: Platforms like Aave and Compound allow users to lend and borrow assets.

- Trading dApps: Uniswap and Sushiswap are examples of decentralized exchanges where users can trade assets directly.

Liquidity Pools

Liquidity pools are collections of funds deposited by users into a smart contract.

These pools facilitate trading, lending, and other financial activities within the DeFi space.

Users who provide liquidity are often rewarded with fees or governance tokens.

Governance and Tokenomics

Many DeFi platforms have governance tokens that allow holders to vote on changes to the platform.

This fosters a community-driven approach to development and decision-making.

Interoperability

One of the standout features of DeFi is its interoperability.

Assets and data can easily be moved between different DeFi platforms, thanks to the open-source nature and standardization of smart contracts.

Risk Management

While DeFi offers numerous advantages, it’s essential to understand the risks involved, such as smart contract vulnerabilities and market volatility. Always do your due diligence before interacting with a DeFi platform.

By grasping how DeFi works, you’ll be better equipped to navigate this dynamic and promising financial landscape.

Whether you’re a trader, investor, or just a tech enthusiast, understanding the mechanics of DeFi is the first step in leveraging its potential.

Key Components of DeFi

Decentralized Finance (DeFi) is a complex ecosystem with multiple components that work in tandem to provide financial services without the need for traditional intermediaries.

This section aims to demystify the key components that make up the DeFi landscape.

Smart Contracts

Smart contracts are the backbone of the DeFi ecosystem.

They are self-executing contracts with the terms directly written into lines of code. These contracts automate various financial transactions and services.

Decentralized Exchanges (DEXs)

Unlike traditional exchanges, Decentralized Exchanges (DEXs) allow users to trade assets directly with one another.

This eliminates the need for a central authority to facilitate trades, thereby enhancing security and reducing fees.

Stablecoins

Stablecoins are digital assets that are pegged to real-world assets like the U.S. dollar.

They provide a stable medium of exchange within the volatile crypto markets, making them crucial for lending, borrowing, and trading in DeFi.

Yield Farming and Liquidity Mining

Yield farming and liquidity mining are innovative ways to earn rewards by providing liquidity or participating in a DeFi protocol.

Users can earn interest or governance tokens as rewards.

Oracles

Oracles are third-party services that provide smart contracts with external information.

They play a crucial role in price feeds, settlement of smart contracts, and other functions that require external data.

Governance Tokens

Governance tokens give holders the right to vote on protocol changes and updates.

This fosters a decentralized and democratic decision-making process within the DeFi ecosystem.

For more on governance in the crypto world, check out our comprehensive guide on Crypto Regulations.

Layer 2 Solutions

With the increasing demand for DeFi services, scalability has become a concern. Layer 2 solutions like rollups and sidechains are designed to handle more transactions per second (TPS) without clogging the main blockchain.

By understanding these key components, you’ll gain a comprehensive view of what makes DeFi a groundbreaking innovation in the financial sector.

Whether you’re an investor, a developer, or simply curious, these components are the building blocks of any DeFi venture.

Risks and Challenges

While Decentralized Finance (DeFi) offers a plethora of opportunities, it’s essential to be aware of the risks and challenges that come with it.

This section aims to provide a balanced view of the potential pitfalls and hurdles in the DeFi landscape.

Smart Contract Vulnerabilities

Smart contracts are automated, but they are not immune to bugs or vulnerabilities. A single flaw can lead to significant financial losses.

Regulatory Uncertainty

The regulatory landscape for DeFi is still evolving. A lack of clear regulations can lead to unexpected legal challenges for DeFi platforms and their users.

Liquidity Risks

In DeFi, liquidity is often pooled from various users. However, there’s a risk of “impermanent loss,” where providing liquidity in volatile assets can lead to financial losses.

Price Volatility

The value of cryptocurrencies can be highly volatile, affecting the stability of the entire DeFi ecosystem. Stablecoins aim to mitigate this but are not entirely risk-free.

Security Risks

From phishing attacks to wallet compromises, the DeFi space is rife with security risks that can result in the loss of assets.

Interoperability Challenges

Many DeFi platforms operate on different blockchains, making interoperability a significant challenge. This limits the seamless exchange of assets and data between platforms.

Network Congestion

As DeFi gains popularity, network congestion can lead to slower transactions and higher fees, affecting the user experience.

By being aware of these risks and challenges, you can make more informed decisions in the DeFi space. Always conduct your own research and consider your risk tolerance before diving into any DeFi project.

Regulatory Landscape

Navigating the regulatory landscape is a crucial aspect of participating in the Decentralized Finance (DeFi) ecosystem.

This section aims to shed light on the current regulatory frameworks, their implications, and what the future might hold.

Global Regulatory Overview

Different countries have varying stances on DeFi and cryptocurrencies. While some nations are open to digital assets, others have stringent regulations or outright bans.

U.S. Regulations

In the United States, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are among the key regulatory bodies overseeing DeFi activities.

European Union Regulations

The European Union is working on a comprehensive framework known as the Markets in Crypto-Assets (MiCA), aiming to regulate DeFi platforms and assets.

Asian Regulations

Countries like Singapore and Japan have been more open to DeFi, while others like China have imposed strict regulations.

Compliance and KYC/AML

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are becoming increasingly important in the DeFi space to combat illegal activities.

The Future of DeFi Regulations

Regulatory frameworks are continuously evolving. It’s essential to stay updated with the latest legal developments to navigate the DeFi space effectively.

By understanding the regulatory landscape, you can better assess the risks and make informed decisions when participating in DeFi projects. Always consult legal experts for personalized advice.

DeFi vs Traditional Finance

The rise of Decentralized Finance (DeFi) has led to inevitable comparisons with traditional finance.

This section aims to dissect the key differences and similarities between the two, helping you make informed decisions in your financial journey.

Accessibility and Inclusion

Traditional finance often requires a bank account, credit history, and other formalities, making it less accessible to a large population. DeFi, on the other hand, is open to anyone with an internet connection.

Speed and Efficiency

Traditional financial systems can be slow due to multiple intermediaries, while DeFi offers near-instant transactions.

Cost-Effectiveness

DeFi generally offers lower fees than traditional finance, although this can vary based on network congestion and other factors.

Security and Control

Traditional finance institutions act as custodians of your assets, whereas in DeFi, you have full control over your assets. However, this comes with its own set of responsibilities and risks.

Flexibility and Innovation

DeFi platforms offer a wide range of financial products and services, many of which are not available in the traditional sector. From yield farming to flash loans, the innovation in DeFi is noteworthy.

For a deeper dive into DeFi products, check out our guide on Popular Cryptocurrencies.

Regulatory Oversight

Traditional finance is heavily regulated, providing a certain level of consumer protection. DeFi is still navigating its regulatory landscape, which can be both an advantage and a disadvantage.

By understanding these key differences and similarities, you can better navigate the evolving landscape of finance, be it traditional or decentralized. Always do your own research and consult financial advisors for personalized advice.

How to Get Started with DeFi

Embarking on your DeFi journey doesn’t have to be complicated. This section will guide you through the essential steps to get started with Decentralized Finance.

Choose a Cryptocurrency Wallet

The first step in entering the DeFi space is choosing a secure and user-friendly cryptocurrency wallet. This is where you’ll store and manage your digital assets.

For more information on selecting the right wallet, read our comprehensive guide on Crypto Wallets.

Acquire Cryptocurrency

You’ll need some cryptocurrency to interact with DeFi platforms.

This can be done through various methods such as buying from an exchange, mining, or staking.

| Method of Acquiring Cryptocurrency | Pros | Cons |

|---|---|---|

| Mining | – Low initial cost (depending on the cryptocurrency) – Potential for high returns | – High energy consumption – Requires specialized hardware |

| Buying on Exchanges | – Quick and easy – Wide variety of cryptocurrencies available | – Fees can be high – Risk of exchange hacks |

| Peer-to-Peer (P2P) Trading | – No fees – Direct transactions | – Risk of fraud – Limited availability of cryptocurrencies |

| Staking | – Passive income – Low risk | – Funds are locked for a period – Limited to specific cryptocurrencies |

| Airdrops | – Free tokens – No investment required | – Tokens may have little to no value – Tax implications |

| Forks | – Free tokens if you hold the original cryptocurrency | – New cryptocurrency may have little value – Requires action to claim tokens |

| Earning through Work | – Get paid for services or products – No need to buy or invest | – Limited opportunities – Risk of non-payment |

Connect to a DeFi Platform

Once you have some cryptocurrency in your wallet, the next step is to connect your wallet to a DeFi platform. This is usually done through a simple authorization process.

Explore Financial Products

DeFi platforms offer a myriad of financial products like lending, borrowing, yield farming, and more. Take some time to explore and understand these offerings.

Monitor and Manage Your Investments

Once you’ve invested in DeFi products, it’s crucial to monitor their performance and manage risks. Many platforms offer dashboards and analytics tools for this purpose.

Stay Updated and Secure

The DeFi space is rapidly evolving. Stay updated with the latest trends and always prioritize the security of your assets.

By following these steps, you’ll be well on your way to becoming a savvy DeFi investor. Always remember to do your own research and consult with financial advisors to make informed decisions.

DeFi Wallets

DeFi wallets are the cornerstone of your decentralized finance experience. They serve as the gateway to various DeFi platforms and financial products. In this section, we’ll delve into what makes a DeFi wallet unique and how to choose the right one for you.

Types of DeFi Wallets

There are several types of DeFi wallets, each with its own set of features and security measures. The most common types are:

- Software Wallets: Stored on your computer or mobile device.

- Hardware Wallets: Physical devices that store your private keys offline.

- Web Wallets: Accessed through a web browser.

- Mobile Wallets: Specifically designed for mobile devices.

| Type of DeFi Wallet | Features | Pros | Cons |

|---|---|---|---|

| Hardware Wallet | – Cold storage – Physical device – Multi-currency support | – Highly secure – Not connected to the internet – Long-term storage | – Initial cost – Not convenient for daily transactions |

| Software Wallet | – Mobile or desktop app – Multi-currency support – User-friendly interface | – Convenient for daily use – Free to use – Quick setup | – Less secure than hardware wallets – Risk of malware |

| Web Wallet | – Accessible via web browser – Multi-currency support – Integrated with exchanges | – Easy to use – Quick access – No installation required | – Vulnerable to phishing attacks – Not recommended for large amounts |

| Paper Wallet | – Physical paper with QR codes – Cold storage | – Highly secure – No risk of online hacking | – Can be lost or damaged – Inconvenient for regular use |

| Multi-Signature Wallet | – Requires multiple private keys – Enhanced security features | – Increased security – Good for shared accounts | – Complex setup – Not suitable for individual users |

| Mobile-Only Wallet | – Smartphone app – Simplified interface – Quick transactions | – Convenient for on-the-go use – User-friendly | – Less secure than other options – Limited features |

Key Features to Look For

When choosing a DeFi wallet, consider the following features:

- User Interface: Should be intuitive and easy to navigate.

- Security: Look for features like two-factor authentication (2FA) and cold storage.

- Compatibility: Ensure it supports the cryptocurrencies and DeFi platforms you intend to use.

- Backup and Recovery: Make sure there are robust backup and recovery options.

Security Measures

Security is paramount when it comes to DeFi wallets. Always opt for wallets that offer multiple layers of security such as PIN codes, biometric authentication, and encrypted private keys.

Popular DeFi Wallets

Here are some popular DeFi wallets that are widely used in the industry:

For an in-depth guide on how to choose the best wallet for your needs, check out our article on Crypto Wallets.

How to Set Up a DeFi Wallet

Setting up a DeFi wallet is generally straightforward. Here are the basic steps:

- Download or purchase the wallet.

- Create an account.

- Secure your account with the recommended security features.

- Transfer funds to your wallet.

- Connect to a DeFi platform.

By understanding the different types of DeFi wallets and their features, you can make an informed decision that aligns with your investment goals. Always prioritize security and functionality when choosing a wallet.

Future of DeFi

The future of decentralized finance (DeFi) is a topic of immense interest and speculation within the financial and tech communities.

As DeFi continues to disrupt traditional financial systems, it’s crucial to understand the trends and factors that will shape its future.

Emerging Trends

Several emerging trends are poised to influence the future of DeFi:

- Interoperability: Seamless interaction between different blockchains.

- Layer 2 Solutions: Technologies that improve scalability and transaction speed.

- Regulatory Clarity: Governments are working on regulations to ensure a safer DeFi environment.

- NFTs and DeFi: The integration of Non-Fungible Tokens (NFTs) in DeFi platforms.

Challenges and Risks

Despite its promise, DeFi is not without challenges:

- Security Risks: Smart contract vulnerabilities and hacks.

- Regulatory Hurdles: Unclear regulations can impede growth.

- Usability: Many DeFi platforms are not user-friendly, hindering mass adoption.

Innovations on the Horizon

Innovations like DAOs (Decentralized Autonomous Organizations), yield farming, and flash loans are just the tip of the iceberg. The DeFi space is ripe for innovations that could redefine financial transactions.

Investment in DeFi

Venture capital investment in DeFi projects is on the rise, indicating strong belief in its future potential. Major financial institutions are also showing interest in DeFi, further legitimizing the space.

Regulatory Landscape

Regulatory clarity will play a significant role in the future of DeFi. As governments around the world start to recognize the potential and risks associated with DeFi, we can expect more comprehensive crypto regulations to come into play.

Final Thoughts

The future of DeFi is promising but uncertain, shaped by innovations, regulatory changes, and adoption rates. As the sector matures, it will be interesting to see how DeFi integrates with traditional finance and what new opportunities arise.

Case Studies

Case studies offer a valuable perspective on the real-world applications and impact of decentralized finance (DeFi). In this section, we will delve into some compelling case studies that demonstrate the transformative power of DeFi platforms.

Uniswap: Revolutionizing Liquidity

Uniswap is a decentralized exchange that has revolutionized the concept of liquidity in the crypto space. It allows users to trade directly from their wallets without the need for an intermediary.

- Problem: Traditional exchanges often suffer from low liquidity and high fees.

- Solution: Uniswap uses an automated market maker model to provide constant liquidity.

- Impact: Lower fees and higher speed for end-users.

MakerDAO: Stability in a Volatile Market

MakerDAO offers a stablecoin, DAI, which is pegged to the U.S. dollar. This provides a stable asset in the otherwise volatile crypto market.

- Problem: Volatility in cryptocurrency prices.

- Solution: DAI offers a stable value pegged to a traditional currency.

- Impact: Enables more practical everyday uses for cryptocurrency.

Aave: Flash Loans and Financial Innovation

Aave has introduced the concept of flash loans, allowing users to borrow assets without collateral, provided the loan is returned within a single transaction.

- Problem: The need for collateral limits financial innovation.

- Solution: Flash loans remove the need for collateral.

- Impact: Opens up new possibilities in financial engineering.

| Aspect | Traditional Loans | Flash Loans |

|---|---|---|

| Speed | Days to weeks for approval and disbursement | Instantaneous, within one blockchain transaction |

| Collateral | Required (e.g., property, assets) | No collateral required |

| Use-Cases | – Home purchase – Car loans – Personal loans – Business loans | – Arbitrage – Collateral swapping – Liquidations – Protocol refinancing |

Yearn Finance: Automated Yield Farming

Yearn Finance automates the yield farming process, maximizing returns for investors.

- Problem: Yield farming is complex and time-consuming.

- Solution: Yearn Finance automates the process.

- Impact: Increased ROI for investors.

Compound: Earning Interest on Idle Assets

Compound allows users to earn interest on their idle crypto assets by lending them out.

- Problem: Idle assets don’t generate returns.

- Solution: Compound allows for asset lending.

- Impact: Additional income stream for crypto holders.

Wrapping Up the DeFi Revolution

As we’ve explored throughout this article, decentralized finance (DeFi) is not just a buzzword; it’s a transformative force in the financial landscape. From providing liquidity solutions and stable assets to introducing innovative financial products like flash loans, DeFi platforms are redefining what’s possible in finance.

The case studies we’ve examined illustrate the real-world impact of these platforms. They solve tangible problems and open up new avenues for financial engineering, all while making the financial ecosystem more inclusive and efficient.

As DeFi continues to evolve, it’s crucial to stay updated on the latest trends and platforms. Whether you’re a seasoned investor or a newcomer to the crypto space, DeFi offers opportunities that are too significant to ignore.

For those who are keen to dive deeper into the world of cryptocurrencies and DeFi, our Unveiling the Crypto Mystery guide is an excellent starting point.

The future of DeFi is bright, and its impact on the financial world is just beginning to be felt. So, are you ready to be a part of this financial revolution?

Additional Resources to Fuel Your DeFi Journey

Navigating the complex world of decentralized finance can be overwhelming, especially for those who are new to the space. To help you get a better grasp of DeFi and its various facets, we’ve compiled a list of additional resources that can serve as your go-to guide.

Books and Whitepapers

- “The Basics of Bitcoins and Blockchains” by Antony Lewis – A comprehensive guide to understanding the technology behind cryptocurrencies and blockchain.

- Ethereum Whitepaper – The original document that introduced Ethereum, the platform that made smart contracts and DeFi possible.

Online Courses

- Coursera’s Blockchain Basics – A beginner-friendly course that covers the fundamentals of blockchain technology.

- Udemy’s DeFi Course – A more specialized course focusing on decentralized finance.

Blogs and Websites

- CryptoMindPro – For a wide range of articles covering everything from crypto wallets to cryptocurrency trading.

- CoinDesk’s DeFi Section – For up-to-date news and analysis on the DeFi market.

Podcasts

- Unchained – Hosted by Laura Shin, this podcast features interviews with industry experts discussing the latest trends in blockchain and DeFi.

- The Daily Gwei – A podcast that focuses exclusively on Ethereum and its ecosystem, including DeFi.

Forums and Social Media

- r/defi on Reddit – A community where you can ask questions, share information, and discuss the latest developments in DeFi.

- DeFi Twitter Lists – Follow influencers and experts in the DeFi space to stay updated on real-time news and trends.

Frequently Asked Questions (FAQs) About DeFi

If you still have questions about decentralized finance, you’re not alone. Below is a table of frequently asked questions that aim to address common queries and concerns about DeFi.

| Question | Answer |

| What is DeFi? | Decentralized Finance (DeFi) is a financial system built on blockchain technology that operates without the need for traditional financial intermediaries like banks. |

| How is DeFi different from traditional finance? | DeFi is open-source, permissionless, and operates on a decentralized network, whereas traditional finance is centralized and regulated. Learn more. |

| Is DeFi safe? | While DeFi platforms are generally secure, they are not entirely risk-free. It’s essential to do your own research and understand the risks involved. |

| How do I get started with DeFi? | You can start by setting up a digital wallet, buying some cryptocurrency, and then interacting with DeFi platforms. |

| What are smart contracts? | Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They are a fundamental building block of DeFi. |

| What is yield farming? | Yield farming is a way to earn more cryptocurrency by lending or providing liquidity on a DeFi platform. |

| Can I earn interest with DeFi? | Yes, many DeFi platforms offer interest-earning opportunities through lending and staking. |

| What are the most popular DeFi platforms? | Some of the most popular platforms include Uniswap, Aave, and Compound. |

| Are there any fees involved? | Yes, most DeFi platforms charge fees for transactions, which are used to reward network participants. |

| Is DeFi regulated? | DeFi is largely unregulated, but it’s important to stay updated on crypto regulations as the landscape is constantly changing. |