Are you intrigued by the idea of earning passive income through crypto staking? You’ve landed in the right place!

This comprehensive guide will demystify the world of staking in cryptocurrency, offering you actionable insights and expert tips.

From understanding the basics to diving into tax implications and security best practices, we’ve got you covered. Read on to become a staking pro and make your crypto work for you!

Quick Takes

Here’s a quick summary of what you’ll learn in each section of this comprehensive guide on staking cryptocurrencies.

| Section Title | Key Takeaways |

| What is Staking? | Gain a clear definition of what staking is and how it differs from other investment methods. |

| The Mechanics of Staking | Learn the technical aspects of staking, including terms like validators, nodes, and rewards. |

| Benefits of Staking Cryptocurrencies | Discover the advantages of staking, such as earning passive income and contributing to network security. |

| Risks and Drawbacks | Understand the risks involved in staking and how to mitigate them. |

| Popular Cryptocurrencies for Staking | Get to know some of the most popular cryptocurrencies that offer staking options. |

| How to Choose a Cryptocurrency for Staking | Learn the factors to consider when choosing which cryptocurrency to stake. |

| Types of Staking: Delegated vs. Non-Delegated | Understand the different types of staking and their respective pros and cons. |

| Setting Up a Crypto Wallet for Staking | Follow a step-by-step guide to setting up a crypto wallet for staking. |

| Staking Pools: What You Need to Know | Learn about staking pools and how they can amplify your staking rewards. |

| Tax Implications of Staking | Understand the tax considerations and obligations when staking cryptocurrencies. |

| Regulatory Landscape | Get a brief overview of the regulatory environment surrounding staking. |

| Best Practices for Secure Staking | Acquire tips and best practices for ensuring that your staking activities are secure. |

| Future Trends in Crypto Staking | Gain insights into upcoming trends and the future of staking in the cryptocurrency world. |

By the end of this blog post, you’ll have a comprehensive understanding of staking cryptocurrencies, from the basics to advanced topics, including its benefits, risks, and future trends.

What is Staking?

Staking is a popular investment strategy in the world of cryptocurrencies that allows you to earn additional coins by holding and “staking” your existing cryptocurrencies in a digital wallet.

Unlike traditional investment methods, staking crypto involves participating in the transaction validation process on a proof-of-stake (PoS) blockchain.

In simpler terms, you’re putting your crypto assets to work, helping to maintain the network while earning rewards.

Staking offers a dual benefit. Firstly, it provides a way to earn passive income. The more you stake, the more you earn.

Additionally, staking helps in maintaining the blockchain network’s security and efficiency.

It’s a win-win for both individual investors and the broader crypto ecosystem.

Risks Involved

While staking can be lucrative, it’s not without risks.

The value of your staked cryptocurrencies can fluctuate, and there’s also the risk of network attacks.

However, these risks are often outweighed by the potential rewards, especially if you’re well-informed and cautious.

For a deeper understanding of the risks and how to mitigate them, read our section on Risks and Drawbacks.

By understanding what staking is and how it works, you’re well on your way to making an informed decision about whether this investment strategy is right for you.

Whether you’re a seasoned investor or a newbie, staking cryptocurrencies offers a way to earn additional income while contributing to network security.

The Mechanics of Staking

Understanding the mechanics of staking is crucial for anyone looking to earn passive income through this investment strategy.

In this section, we’ll delve into the technical aspects of how staking works, from choosing a staking pool to understanding staking algorithms.

Choosing a Staking Pool

A staking pool is a group of coin holders who combine their resources to increase their chances of validating blocks and receiving rewards.

By joining a pool, you can earn a portion of the pool’s total rewards, proportional to your contribution.

- Research: Look for reputable staking pools with a track record of consistent rewards.

- Join: Once you’ve chosen a pool, you’ll need to lock a certain amount of your cryptocurrency into the pool’s wallet.

- Earn: You’ll earn rewards based on the pool’s success in validating transactions and creating new blocks.

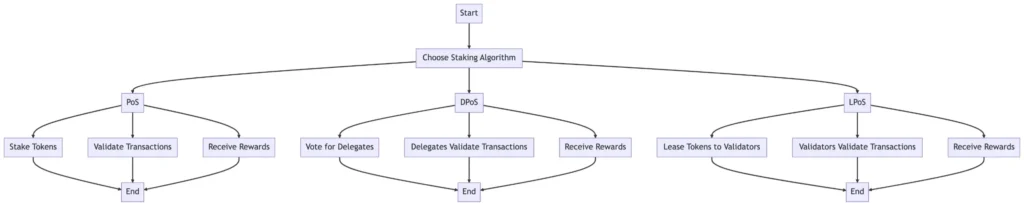

Staking Algorithms

Different cryptocurrencies use different staking algorithms. The most common are:

- Proof of Stake (PoS): The original staking algorithm, where validators are chosen based on the number of coins they hold.

- Delegated Proof of Stake (DPoS): A more democratic version where coin holders vote for a small number of delegates to validate transactions.

- Leased Proof of Stake (LPoS): Allows you to lease your coins to a full node, which then validates transactions on your behalf.

Reward Distribution

The rewards you earn from staking can come in various forms, including:

- Block Rewards: Additional coins for creating a new block.

- Transaction Fees: A portion of the fees paid by users for transactions in the block you validated.

- Bonus Rewards: Some networks offer extra incentives or bonuses for staking.

Factors Affecting Staking Rewards

Your staking rewards can be influenced by several factors, such as:

- Amount Staked: Generally, the more you stake, the higher your rewards.

- Network Participation: The total amount of coins staked in the network can affect individual rewards.

- Uptime: The amount of time your wallet or node is active and participating in validation.

By grasping the mechanics of staking, you’ll be better equipped to choose the right staking pool, understand the algorithms involved, and maximize your rewards.

This knowledge is essential for anyone serious about staking cryptocurrencies as a long-term investment strategy.

Benefits of Staking Cryptocurrencies

Staking cryptocurrencies offers a plethora of benefits, making it an attractive investment option for both novice and seasoned investors.

From generating passive income to enhancing network security, let’s explore the various advantages of staking.

Passive Income Generation

One of the most appealing aspects of staking is the ability to generate passive income. By simply holding and staking your coins, you can earn additional tokens over time.

- Consistent Earnings: Unlike trading, where profits can be volatile, staking provides a more consistent income stream.

- Low Entry Barrier: You don’t need extensive knowledge of trading or market analysis to start staking.

Enhanced Network Security

Staking contributes to the overall security and stability of the blockchain network.

- Validator Incentives: Validators are incentivized to act honestly, as malicious actions could lead to a loss of staked coins.

- Reduced Risk of Attacks: The more coins that are staked, the more secure the network becomes, making it difficult for attackers to gain control.

Community Participation

Staking often comes with voting rights, allowing you to participate in the governance of the blockchain network.

- Decision-making: Influence updates, changes, or improvements to the network.

- Community Engagement: Be an active member of the community, contributing to its growth and success.

Liquidity Provision

Some staking models, especially in DeFi projects, allow you to provide liquidity to the network, earning additional rewards.

- Increased Earnings: Liquidity providers often earn higher rewards compared to regular staking.

- Market Stability: Providing liquidity helps maintain a stable market, benefiting all network participants.

Environmental Sustainability

Staking is generally more energy-efficient compared to Proof of Work (PoW) models, making it a more sustainable option.

- Lower Energy Consumption: Staking requires less computational power, reducing its carbon footprint.

- Sustainable Growth: As the world moves towards sustainability, staking could become the standard for future blockchain networks.

Staking cryptocurrencies offers a balanced mix of financial gains, network security, and community engagement, making it a compelling investment strategy for anyone interested in the crypto space.

Risks and Drawbacks

While staking cryptocurrencies offers numerous benefits, it’s crucial to be aware of the associated risks and drawbacks.

From potential financial losses to network vulnerabilities, let’s delve into the challenges you might face when staking.

Financial Risks

Staking is not without its financial pitfalls, and it’s essential to understand these before diving in.

- Impermanent Loss: In liquidity pools, the value of your staked tokens can decrease due to price volatility.

- Slashing: In some staking models, validators who act maliciously or fail to validate correctly can lose a portion of their staked tokens.

Technical Complexities

Staking often involves a steep learning curve, especially for those new to the crypto world.

- Technical Knowledge: Understanding the staking process, smart contracts, and network rules can be challenging.

- Operational Errors: Mistakes in setting up your staking can lead to financial losses.

Network Vulnerabilities

While staking contributes to network security, it’s not entirely foolproof.

- Sybil Attacks: An attacker could create multiple fake validators to compromise the network.

- Long-range Attacks: An attacker could fork the blockchain from a point far behind the current state.

For a deeper understanding of network vulnerabilities, check out our article on Cryptocurrency Security.

Regulatory Uncertainties

The regulatory landscape for staking is still evolving, which adds an element of risk.

- Legal Risks: Depending on your jurisdiction, staking income may be subject to various tax implications.

- Regulatory Changes: Sudden changes in crypto regulations can impact your staking operations.

Stay updated on the latest regulatory changes by visiting our Crypto Regulations page.

Lock-up Periods

Many staking models require tokens to be locked up for a certain period, affecting liquidity.

- Limited Access: You can’t sell or move your staked tokens during the lock-up period.

- Opportunity Cost: You might miss out on other investment opportunities due to the lock-up.

Understanding the risks and drawbacks of staking is essential for making informed decisions. While the rewards can be lucrative, it’s crucial to weigh these against the potential challenges you may encounter.

Popular Cryptocurrencies for Staking

Staking has become a popular way to earn passive income in the crypto space. However, not all cryptocurrencies are suitable for staking. In this section, we’ll explore some of the most popular cryptocurrencies that offer staking opportunities.

Ethereum 2.0

Ethereum is transitioning from a Proof-of-Work to a Proof-of-Stake model, known as Ethereum 2.0.

- Annual Yield: 5-12%

- Minimum Stake: 32 ETH

- Lock-up Period: As of Shanghai/Capella network upgrade occurred in April 2023, the withdrawal is available.

Suggested Image: A graphical representation of Ethereum 2.0 staking model.

Cardano (ADA)

Cardano offers a unique Ouroboros PoS algorithm that is more energy-efficient.

- Annual Yield: 4-6%

- Minimum Stake: No minimum

- Lock-up Period: None

Polkadot (DOT)

Polkadot allows staking through its Nominated Proof-of-Stake (NPoS) model.

- Annual Yield: 8-12%

- Minimum Stake: 1 DOT

- Lock-up Period: 7-28 days

Tezos (XTZ)

Tezos uses a Liquid Proof-of-Stake model, allowing token holders to stake without running a full node.

- Annual Yield: 5-7%

- Minimum Stake: 1 XTZ

- Lock-up Period: None

Cosmos (ATOM)

Cosmos offers a unique Tendermint PoS model and focuses on interoperability between blockchains.

- Annual Yield: 9-11%

- Minimum Stake: 1 ATOM

- Lock-up Period: 21 days

Binance Coin (BNB)

Binance Coin offers staking through the Binance platform, making it convenient for users.

- Annual Yield: 6-9%

- Minimum Stake: 1 BNB

- Lock-up Period: 15-60 days

For more information on popular cryptocurrencies, check out our article on Popular Cryptocurrencies.

Choosing the right cryptocurrency for staking depends on various factors such as yield, lock-up period, and minimum stake.

Make sure to do your due diligence before diving into the world of staking.

How to Choose a Cryptocurrency for Staking

Selecting the right cryptocurrency for staking is crucial for maximizing your returns while minimizing risks. In this section, we’ll delve into the key factors you should consider when making your choice.

Research the Project

Before you stake your hard-earned money, it’s essential to understand the project behind the cryptocurrency.

- Whitepaper: Read the project’s whitepaper to understand its goals and roadmap.

- Team: Research the team’s background and expertise.

- Community: A strong community often indicates a well-supported project.

Evaluate the Staking Model

Different cryptocurrencies use various staking models, each with its pros and cons.

- Proof-of-Stake (PoS)

- Delegated Proof-of-Stake (DPoS)

- Liquid Proof-of-Stake (LPoS)

Assess the Financial Aspects

Financial considerations are crucial when choosing a cryptocurrency for staking.

- Annual Yield: Higher yields are generally more attractive but may come with higher risks.

- Minimum Stake: Ensure you can meet the minimum staking requirements.

- Lock-up Period: Consider how long your assets will be locked up.

Consider the Security Measures

Security is paramount when it comes to staking. Make sure the project has robust security protocols and a good track record.

- Smart Contract Audits: Check if the staking contracts have been audited.

- Insurance: Some projects offer insurance on staked assets.

User Experience and Support

A user-friendly interface and strong customer support can make your staking experience much more enjoyable.

- User Interface: Choose platforms with intuitive and easy-to-use interfaces.

- Customer Support: Ensure the project offers robust customer support.

Choosing a cryptocurrency for staking is not a decision to be taken lightly. By considering the project’s credibility, staking model, financial aspects, security measures, and user experience, you can make a well-informed choice.

Types of Staking: Delegated vs. Non-Delegated

Staking in the cryptocurrency world comes in various forms, but the two primary types are Delegated and Non-Delegated staking. Understanding the differences between these two can help you make an informed decision on how to stake your assets.

Delegated Staking

In Delegated Staking, you entrust your coins to a validator, who then stakes them on your behalf.

Advantages

- Less Technical Knowledge Required: You don’t need to run a node yourself.

- Lower Risk: Validators are usually well-versed in staking and can minimize risks.

Disadvantages

- Commission Fees: Validators take a cut from your staking rewards.

- Less Control: You have less control over your staked assets.

Non-Delegated Staking

Non-Delegated Staking allows you to stake your coins directly, without the need for a validator.

Advantages

- Full Control: You have complete control over your staked assets.

- No Commission Fees: All staking rewards go directly to you.

Disadvantages

- Technical Expertise Required: You need to run and maintain your own node.

- Higher Risk: You are responsible for all security measures.

| Feature | Delegated Staking | Non-Delegated Staking |

|---|---|---|

| Pros | ||

| Lower Entry Barriers | Yes, easier to start with smaller amounts. | No, often requires a significant amount of tokens. |

| Reduced Complexity | Yes, the staking pool handles most tasks. | No, you’re responsible for all tasks. |

| Higher Liquidity | Yes, easier to unstake and sell tokens. | No, tokens are usually locked for a period. |

| Cons | ||

| Centralization Risks | Yes, risk of centralization through large staking pools. | No, more decentralized as individuals control their own nodes. |

| Lower Returns | Yes, staking pools take a fee. | No, all rewards go to you. |

| Third-Party Risks | Yes, risk of the staking pool getting hacked or being fraudulent. | No, you control your own security. |

Which One is Right for You?

The choice between Delegated and Non-Delegated staking depends on various factors like your technical expertise, risk tolerance, and financial goals.

For more information on how to assess these factors, refer to our guide on How to Choose a Cryptocurrency for Staking.

By understanding the nuances between Delegated and Non-Delegated staking, you can choose the method that aligns best with your investment strategy and risk profile.

Setting Up a Crypto Wallet for Staking

Setting up a crypto wallet for staking is a crucial step in the staking process. A secure and compatible wallet not only ensures the safety of your assets but also enables you to participate in staking without any hitches.

Types of Wallets Suitable for Staking

There are various types of wallets you can use for staking, each with its own set of features and security measures.

Hardware Wallets

- Highly Secure: Almost immune to online hacking attempts.

- Less Convenient: Requires physical access to the device for transactions.

Software Wallets

- Convenient: Easily accessible from your computer or mobile device.

- Less Secure: Vulnerable to malware and phishing attacks.

Web Wallets

- User-Friendly: Easy to set up and use.

- Least Secure: Susceptible to online hacks.

Learn more about the types of cryptocurrency wallets in our article: Unlock the Vault: Your Ultimate Guide to Crypto Wallet.

Steps to Set Up a Wallet for Staking

- Choose the Right Wallet: Make sure the wallet supports the cryptocurrency you wish to stake.

- Download and Install: Follow the installation guide specific to your chosen wallet.

- Secure Your Wallet: Set up strong passwords and enable two-factor authentication.

- Transfer Funds: Move the cryptocurrency you wish to stake into your new wallet.

- Start Staking: Follow the staking instructions specific to your cryptocurrency.

Security Measures

- Backup: Always keep a backup of your wallet’s key phrases.

- Software Update: Keep your wallet software up-to-date to benefit from the latest security enhancements.

By carefully selecting and setting up your crypto wallet, you can stake your assets with peace of mind, knowing that they are secure and that you are ready to earn staking rewards.

Staking Pools: What You Need to Know

Staking pools offer a convenient way for individuals to participate in cryptocurrency staking without the need for significant investment or technical expertise. In this section, we’ll delve into what staking pools are, their advantages and disadvantages, and how to choose the right one for you.

What Are Staking Pools?

Staking pools are platforms where multiple participants combine their staking resources to increase their chances of validating blocks and earning rewards. By joining a pool, you can earn a portion of the rewards based on your contribution to the pool’s total staking balance.

Advantages of Staking Pools

Lower Entry Barriers

- Cost-Effective: Allows you to stake with a smaller amount of cryptocurrency.

- Simplified Process: No need for specialized hardware or software.

Higher Reward Potential

- Increased Chances: More resources mean a higher likelihood of validating blocks.

- Consistent Earnings: Rewards are distributed regularly, even if they are smaller per individual.

Disadvantages of Staking Pools

Reduced Control

- Dependence on Pool Operators: The pool’s performance relies on the competency of the operators.

- Fee Deductions: Most pools charge a fee, reducing your overall earnings.

Steps to Choose the Right Staking Pool and Join

- Research: Look for pools that support the cryptocurrency you wish to stake.

- Check Reputation: Read reviews and ask for recommendations.

- Understand Fees: Make sure you are comfortable with the fee structure.

- Security: Ensure the pool follows best practices for security.

- Join the Pool: Follow the specific instructions to join and start staking.

For more information on how to secure your investments, read our article on Cryptocurrency Security.

By understanding the ins and outs of staking pools, you can make an informed decision that aligns with your investment goals and risk tolerance.

Tax Implications of Staking

Understanding the tax implications of staking is crucial for anyone involved in this investment strategy. In this section, we’ll explore how staking rewards are taxed, the types of tax events you should be aware of, and how to report your earnings to the tax authorities.

How Are Staking Rewards Taxed?

Staking rewards are generally considered taxable income by most jurisdictions. The moment you receive staking rewards, they are subject to income tax based on their fair market value at the time of receipt.

Types of Tax Events

Income Tax

- Immediate Taxation: Staking rewards are taxed as income upon receipt.

Capital Gains Tax

- Short-Term: If you sell the staked coins within a year, any profit is considered short-term capital gains.

- Long-Term: Holding the staked coins for more than a year may qualify them for long-term capital gains tax, which is usually lower.

Reporting Staking Rewards

- Record Keeping: Maintain detailed records of your staking activities, including dates, amounts, and the value of the cryptocurrency at the time of staking.

- Tax Forms: Use the appropriate tax forms for reporting cryptocurrency income. In the U.S., this is typically IRS Form 1040.

- Consult a Tax Advisor: Due to the complex nature of cryptocurrency taxation, it’s advisable to consult a tax advisor familiar with cryptocurrency.

Tax Minimization Strategies

- Hold for the Long-Term: Consider holding your staked coins for more than a year to benefit from lower long-term capital gains tax rates.

- Tax-Loss Harvesting: Sell underperforming assets to offset gains and reduce your overall tax liability.

For more details on cryptocurrency taxation, check out our comprehensive guide on Crypto Tax.

Understanding the tax implications of staking can save you from unexpected liabilities and help you make more informed investment decisions.

Always consult a tax advisor to ensure you are complying with your local tax laws.

Regulatory Landscape

Navigating the regulatory landscape of cryptocurrency staking is a critical aspect for both individual investors and businesses. This section will delve into the current regulations affecting staking, the role of regulatory bodies, and what the future may hold for staking regulations.

Current Regulations on Staking

As of now, there is no universal regulatory framework governing cryptocurrency staking. However, some countries have started to classify staking rewards as taxable income, similar to mining rewards.

Country-Specific Guidelines

- United States: The SEC has not yet provided clear guidelines on staking, but staking rewards are generally considered taxable.

- European Union: The EU is still in the process of formulating a unified stance on staking.

- Asia: Countries like Japan and South Korea are more progressive in their approach but lack specific staking regulations.

Role of Regulatory Bodies

Various regulatory bodies like the SEC in the United States, FCA in the UK, and ESMA in the European Union are responsible for overseeing cryptocurrency activities, including staking.

Key Regulatory Bodies

- SEC (U.S.): Primarily concerned with securities and investor protection.

- FCA (UK): Focuses on market integrity and consumer protection.

- ESMA (EU): Aims to establish a uniform regulatory framework across EU member states.

Future of Staking Regulations

The regulatory landscape is ever-evolving, with ongoing discussions and proposals aimed at creating a more secure and transparent environment for staking.

- Global Standards: Efforts are being made to establish global standards for staking.

- Consumer Protection: Regulatory bodies are increasingly focusing on safeguarding consumer interests.

For an in-depth look at the broader regulatory environment of cryptocurrencies, visit our guide on Crypto Regulations.

Understanding the regulatory landscape is crucial for making informed decisions in the staking ecosystem. Always stay updated on the latest regulations and consider consulting legal experts in the field.

Best Practices for Secure Staking

Security is paramount when it comes to staking cryptocurrencies. This section will guide you through the best practices to ensure that your staking activities are as secure as possible. From choosing the right staking platform to understanding the importance of private keys, we’ve got you covered.

Choosing a Reputable Staking Platform

The first step in secure staking is selecting a trustworthy platform. Look for platforms that are transparent, have a strong track record, and are widely recognized in the community.

Factors to Consider

- Security Measures: Does the platform offer two-factor authentication (2FA)?

- Transparency: Are the staking processes and fee structures clearly outlined?

- Community Trust: What does the community say about the platform?

Importance of Private Keys

Your private keys are the gateway to your staked assets. Losing them could result in the loss of your investment.

How to Secure Your Private Keys

- Cold Storage: Store your keys offline, away from internet access.

- Encrypted USB Drives: Use hardware encrypted drives for added security.

Regular Monitoring and Updates

Staying updated with the latest security patches and monitoring your staking activities can go a long way in ensuring security.

Update Schedule

- Weekly: Check for software updates.

- Monthly: Review your staking rewards and performance.

Diversification Strategy

Putting all your eggs in one basket is never a good idea. Diversifying your staking portfolio can mitigate risks.

For more on diversification strategies in the crypto world, check out our guide on Cryptocurrency Trading.

Types of Diversification

- Asset Diversification: Stake in multiple cryptocurrencies.

- Platform Diversification: Use more than one staking platform.

By adhering to these best practices, you can significantly reduce the risks associated with staking. Always remember, that the key to secure staking is continuous learning and vigilance.

Future Trends in Crypto Staking

As the cryptocurrency landscape continues to evolve, staking is emerging as a significant trend with far-reaching implications. This section delves into the future trends that are set to shape the world of crypto staking, from the rise of DeFi staking to environmental considerations.

The Rise of DeFi Staking

Decentralized Finance (DeFi) is revolutionizing how we think about staking. DeFi staking allows for more flexible and lucrative opportunities compared to traditional staking methods.

Key Features of DeFi Staking

- Non-custodial: You control your own funds.

- High APY: Often offers higher returns than traditional staking.

Environmental Considerations

As the world becomes more eco-conscious, the environmental impact of crypto activities is under scrutiny. Proof-of-Stake (PoS) and its variants are seen as more energy-efficient alternatives to Proof-of-Work (PoW).

Sustainable Staking

- Low Energy Consumption: PoS consumes less energy than PoW.

- Carbon Offsetting: Some platforms offer carbon offset options.

Regulatory Changes

With increased adoption comes increased regulation. Future trends indicate a more regulated staking environment, which could impact how and where you can stake your crypto.

For more information on crypto regulations, visit our Crypto Regulations guide.

Potential Regulatory Impacts

- Taxation: Increased scrutiny on staking rewards.

- Compliance: Requirement for staking platforms to adhere to local laws.

Technological Advancements

Blockchain technology is ever-evolving, and this will undoubtedly affect staking mechanisms. Future trends may include more secure and efficient staking protocols.

Upcoming Technologies

- Layer 2 Solutions: For faster and cheaper transactions.

- Smart Contracts: For automated and trustless staking.

By staying ahead of these trends, you can make more informed decisions about your staking activities. The future of crypto staking is promising, but it’s essential to keep an eye on these evolving trends to maximize your returns.

Wrapping Up: Your Roadmap to Mastering Crypto Staking

As we navigate the ever-changing landscape of cryptocurrency, staking stands out as a compelling way to grow your digital assets. From understanding the basics to diving deep into future trends, this comprehensive guide aims to equip you with the knowledge you need to make informed staking decisions.

Whether you’re a beginner looking to dip your toes into the staking pool or an experienced crypto enthusiast aiming for higher returns, there’s something in this guide for everyone.

Remember, the key to successful staking lies in understanding the risks, keeping up with regulations, and adopting best practices for secure staking.

Thank you for joining us on this journey through the world of crypto staking. As the sector continues to evolve, staying updated will be your best strategy. Happy staking!

Frequently Asked Questions: Your Quick Guide to Crypto Staking

| Question | Answer |

| What is crypto staking? | Staking is the process of actively participating in transaction validation on a proof-of-stake (PoS) blockchain. By holding and “staking” your cryptocurrency, you can earn additional coins as rewards. |

| How do I start staking? | To start staking, you’ll need a crypto wallet that supports staking and a minimum amount of the cryptocurrency you wish to stake. |

| What are the risks involved in staking? | Risks include, but are not limited to, loss of staked coins due to network attacks, changes in network rules, or wallet security breaches. |

| What is delegated staking? | Delegated staking allows you to participate in staking by delegating your coins to a validator, who will stake on your behalf. |

| How are staking rewards calculated? | Staking rewards are usually calculated based on the number of coins you stake, the staking period, and the annual staking yield. |

| Are staking rewards taxable? | Yes, staking rewards are generally considered taxable income. It’s crucial to consult a tax advisor for crypto tax implications in your jurisdiction. |

| What are staking pools? | Staking pools allow multiple participants to combine their staking resources and share the rewards. |

| How do I choose a staking pool? | Look for a staking pool with a good reputation, low fees, and a high uptime. |

| Is staking regulated? | The regulatory landscape for staking varies by country. Always check local laws before participating. |

| What are the best practices for secure staking? | Use a hardware wallet, keep software up-to-date, and only stake with reputable services. |

Feel free to refer back to this FAQ section whenever you have quick questions about crypto staking. For more in-depth information, you can always revisit the sections of this guide.

Additional Resources

Navigating the world of crypto staking can be complex, but you don’t have to go it alone. Below are some invaluable resources that can help you deepen your understanding and make more informed decisions.

Books and E-books

- “Mastering Blockchain” – A comprehensive guide that covers the fundamentals of blockchain technology, including staking mechanisms.

- “Cryptoassets: The Innovative Investor’s Guide” – This book provides insights into various crypto assets, including staking tokens.

Websites and Blogs

- Unveiling the Crypto Mystery – Our very own pillar page that serves as a beginner’s guide to the world of cryptocurrency.

- Staking Rewards – A website dedicated to tracking staking opportunities and their respective ROI.