In the fast-paced realm of digital finance, the term “best DeFi portfolio tracker” isn’t just a buzzword—it’s a ticket to streamlined management of burgeoning crypto assets. As decentralized finance (DeFi) continues to be the talk of the tech town, it’s weaving a complex yet fascinating web of financial opportunities. But, with great opportunity comes the need for meticulous management. That’s where DeFi portfolio trackers come into play, acting as your personal finance compass in the sprawling DeFi landscape.

Now, let’s get a taste of what makes a DeFi portfolio tracker the go-to tool for modern-day digital investors. Imagine a dashboard where all your DeFi investments, from yield farming earnings to staked assets, are displayed in real-time. A place where you can not only see the current value of your assets but also analyze past performance, all in a few clicks. This isn’t a figment of imagination but a reality made possible by DeFi portfolio trackers.

Whether you are a seasoned crypto enthusiast or someone who’s just got their feet wet in the DeFi ocean, having a reliable DeFi portfolio tracker is like having a financial lighthouse amid a storm of market volatility.

Key Takeaways

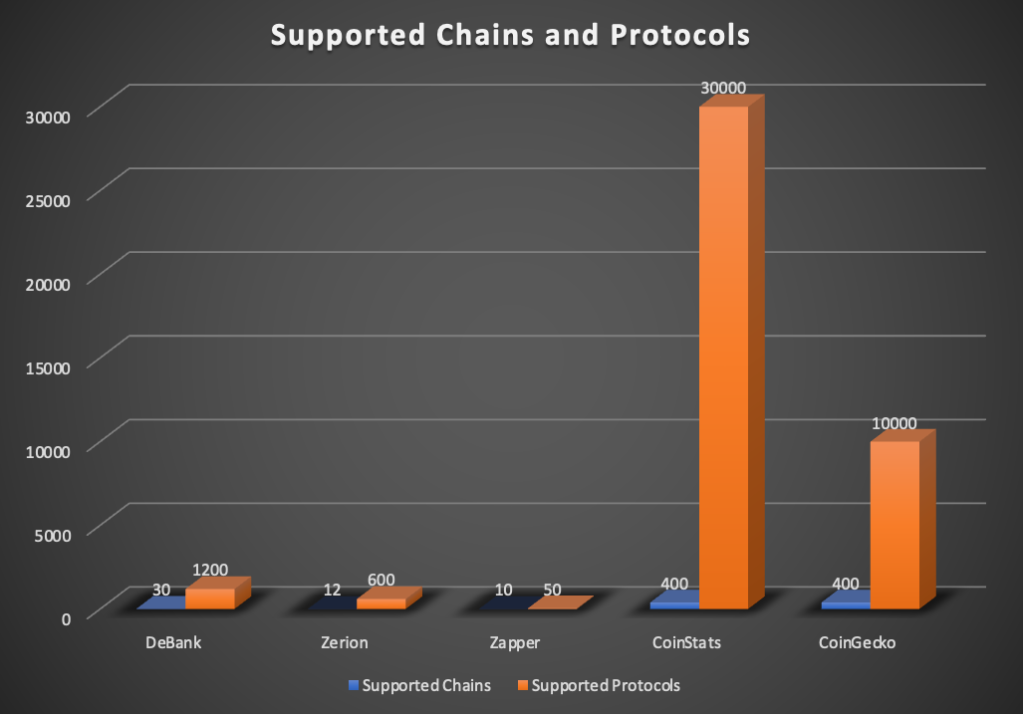

Feature DeBank Zerion Zapper CoinStats CoinGecko Supported Protocols 1200+ 600+ 50+ – – Supported Chains 30+ 12+ 10+ 10 – Real-time Tracking Yes Yes Yes Yes Yes Yield Farming Yes Yes Yes Yes Yes NFT Tracking Yes Yes No No No

The table above encapsulates a snapshot of the capabilities of some of the prominent DeFi portfolio trackers in the market. Each tracker has its own set of strengths, catering to different chains, protocols, and user preferences. As we delve deeper into this article, we’ll unearth the unique features, user interfaces, and the overall effectiveness of these trackers in managing and optimizing your DeFi portfolio.

Stay with us, as we navigate through the nuances of DeFi portfolio trackers, helping you pinpoint the one that resonates with your financial ethos, and propels you towards informed and insightful DeFi asset management.

Deep Dive into DeFi Portfolio Trackers

The core essence of DeFi portfolio trackers lies in their ability to provide a coherent and consolidated view of your DeFi investments. As DeFi platforms mushroom across the blockchain ecosystem, the ability to have a centralized overview becomes indispensable. Here’s a closer look at the core features that define these trackers:

Understanding the Core Features

- Real-time Portfolio Tracking:

- Stay updated with the current value of your assets.

- Track the performance of your investments over time.

- Yield Farming Analytics:

- Analyze the returns from different yield farming pools.

- Compare the performance of various liquidity providing opportunities.

- NFT Tracking:

- Monitor the value of your NFT holdings.

- Stay informed about market trends and opportunities in the NFT space.

- Cross-chain Support:

- Manage assets across different blockchain networks.

- Seamless integration with various DeFi protocols.

- Customization and User Interface:

- Personalize your dashboard to meet your preferences.

- User-friendly interfaces that simplify complex financial data.

These features are crucial in ensuring that investors have a clear understanding and control over their decentralized assets. Moreover, the ability to analyze historical data, compare different investment opportunities, and make informed decisions is what sets these trackers apart in the ever-evolving DeFi domain.

The Importance of Cross-chain Support

In a decentralized ecosystem, where interoperability is celebrated, having cross-chain support in a DeFi portfolio tracker is a massive boon. It’s not just about having a window to view your assets; it’s about having a doorway to interact with a multitude of blockchain networks. This feature allows for a more integrated and holistic approach to DeFi asset management.

Customization and User Interface

The essence of DeFi is to democratize finance, making it accessible to everyone. A good DeFi portfolio tracker embodies this spirit by offering a user-friendly interface alongside customization options. Whether you are a DeFi novice or a seasoned investor, being able to tailor the dashboard to your liking enhances the user experience manifold.

Explore the transformative world of Decentralized Finance (DeFi) with our comprehensive guide to further grasp the components and advantages of DeFi, which forms the backbone of these portfolio trackers.

In the subsequent sections, we will delve into the specifics of each DeFi portfolio tracker, unraveling their unique offerings, and how they stand out in catering to the diverse needs of the DeFi community.

Exploring DeBank: A Comprehensive Platform

DeBank has made a name for itself in the DeFi space by offering a robust platform that supports a vast range of protocols and chains. With its expansive coverage and feature-rich interface, it’s a go-to choice for many DeFi enthusiasts.

Overview of DeBank

DeBank prides itself on being a comprehensive platform with a wide protocol and chain support. Here are the key takeaways from DeBank’s offerings:

- Supported Protocols: Over 1200 protocols.

- Supported Chains: More than 30 chains.

- Real-time Portfolio Tracking: Yes.

- Yield Farming Analytics: Yes.

- NFT Tracking: Yes.

The expansive protocol and chain support highlights DeBank’s commitment to providing a comprehensive platform for DeFi asset management.

DeBank’s Evolution and Unique Features

DeBank didn’t just stop at being a DeFi portfolio tracker; it evolved over time to include unique features that set it apart in the crowded DeFi space:

- Social Feed: A feature that brings a social dimension to DeFi portfolio management.

- DeFi Analytics: Provides insights into the DeFi market, helping investors make informed decisions.

These features provide an added layer of engagement and insight, making DeBank not just a tool, but a community for DeFi enthusiasts.

Case Study: Efficient DeFi Portfolio Management with DeBank

Imagine a DeFi investor, Alice, who has diversified her investments across multiple protocols and chains. Managing her assets becomes a chore until she discovers DeBank. Now, she enjoys a centralized view of all her investments, real-time tracking, and insightful analytics that help her make informed decisions.

Moreover, the social feed feature allows her to interact with a community of like-minded investors, broadening her horizon in the DeFi ecosystem.

Unlock your passive income potential with our ultimate guide to cryptocurrency lending to understand how DeBank can also aid in tracking your lending and borrowing activities in the DeFi space.

DeBank’s comprehensive features, coupled with its wide support for various DeFi protocols and chains, make it a reliable companion for anyone looking to simplify their DeFi asset management. In the upcoming sections, we’ll explore other DeFi portfolio trackers and how they compare with DeBank in meeting the diverse needs of the DeFi community.

Zerion: Bridging DeFi and NFTs

In the realm of DeFi portfolio trackers, Zerion stands out by bridging the gap between DeFi and Non-Fungible Tokens (NFTs). Its emphasis on creating a seamless interface for both financial realms makes it a unique and valuable platform for crypto enthusiasts.

Overview of Zerion

Zerion’s approach towards creating a unified platform for DeFi and NFT tracking is noteworthy. Here are the key aspects of Zerion:

- Supported Protocols: Over 600 protocols.

- Supported Chains: More than 12 chains.

- Real-time Portfolio Tracking: Yes.

- Yield Farming Analytics: Yes.

- NFT Tracking: Yes.

The integration of NFT tracking alongside DeFi assets underlines Zerion’s innovative approach towards crypto asset management.

Early Inception and its Impact

Being one of the earliest DeFi portfolio trackers, Zerion has a deep-rooted understanding of the decentralized finance ecosystem:

- Multi-chain Support: Supports multiple chains including Ethereum, Polygon, and Binance Smart Chain, facilitating diversified asset management.

- Non-custodial Wallet: Ensures users have full control over their assets while enjoying a seamless asset management experience.

Navigating the NFT Wave with Zerion

NFTs have taken the crypto world by storm, and Zerion’s NFT portfolio tracker allows users to ride this wave with confidence. By providing a centralized platform to track and manage both DeFi and NFT assets, Zerion addresses the growing demand for a unified asset management platform in the crypto space.

Master the world of cryptocurrency security to understand how platforms like Zerion can be a part of your broader digital asset security strategy.

Zerion’s unique positioning at the intersection of DeFi and NFTs opens up a realm of possibilities for crypto investors. Its user-friendly interface and comprehensive features provide a solid foundation for managing a diversified crypto portfolio. As we proceed, we’ll explore how other DeFi portfolio trackers align with the evolving needs of the DeFi community.

Zapper: Your Yield Farming Companion

In the bustling field of DeFi, yield farming is a prevalent strategy for earning returns on investments. Zapper emerges as a dedicated companion for yield farmers by offering a streamlined platform to manage and optimize yield farming activities.

Overview of Zapper

Zapper’s focus is clear – to make yield farming management as seamless as possible. Here’s a brief overview of what Zapper offers:

- Supported Protocols: Over 50 protocols.

- Supported Chains: More than 10 chains.

- Real-time Portfolio Tracking: Yes.

- Yield Farming Analytics: Yes.

- NFT Tracking: No.

Zapper’s emphasis on yield farming makes it a distinct platform in the realm of DeFi portfolio trackers.

Yield Farming Optimization

Yield farming can be a complex endeavor. Zapper simplifies this process by providing:

- Auto-compounding: Maximizes returns by automatically compounding earnings.

- Pool Exploration: Discover new pools and investment opportunities.

- Investment Analysis: Compare different yield farming strategies to find the most profitable approach.

Through these features, Zapper acts as a catalyst in optimizing the yield farming process.

Multi-Blockchain Support

In the fragmented blockchain landscape, Zapper’s multi-blockchain support is a breath of fresh air:

- Cross-chain Interaction: Manage assets across Ethereum, Binance Smart Chain, Polygon, and other supported chains.

- Unified Dashboard: A single dashboard to view and manage assets across different chains.

Yield farming is not limited to a single blockchain, and neither is Zapper. This cross-chain support amplifies the ease of managing yield farming activities across various DeFi platforms.

Embark on a thrilling journey into the world of cryptocurrency trading to explore how Zapper can aid in managing your yield farming strategies alongside other trading activities.

Zapper’s dedication to simplifying and optimizing yield farming reflects a thoughtful approach to addressing a specific, yet significant, niche within the DeFi ecosystem. As we transition to other DeFi portfolio trackers, we’ll see how each platform caters to diverse needs within the decentralized finance community.

CoinStats: Beyond DeFi

While being deeply rooted in the broader cryptocurrency realm, CoinStats also extends its arms into the DeFi space, providing a comprehensive platform to track and manage a wide range of crypto assets.

Overview of CoinStats

CoinStats isn’t just about DeFi; it’s about providing a holistic view of your entire crypto portfolio. Here’s a snapshot of what CoinStats brings to the table:

- Supported Cryptocurrencies: Over 30,000 cryptocurrencies.

- Supported Exchanges: More than 400 exchanges.

- Real-time Portfolio Tracking: Yes.

- Yield Farming Analytics: Yes.

- NFT Tracking: No.

The extensive support for cryptocurrencies and exchanges amplifies CoinStats’ appeal to a broader audience of crypto enthusiasts.

Comprehensive Crypto and DeFi Portfolio Tracking

CoinStats stands out by blending traditional crypto tracking with DeFi analytics, providing a unified platform for managing diverse crypto assets:

- Multi-chain Support: Manage assets across a variety of blockchain networks.

- Exchange Integration: Sync your portfolio with supported exchanges for real-time tracking.

This blend of traditional and decentralized finance tracking makes CoinStats a versatile platform for both seasoned and new crypto investors.

Tax Reporting Feature

In the complex world of crypto taxation, CoinStats offers a sigh of relief with its tax reporting feature:

- Tax Calculation: Calculate your crypto taxes based on your trading history.

- Tax Report Generation: Generate detailed tax reports to stay compliant with regulatory requirements.

Navigating the tax landscape is a crucial aspect of crypto asset management. Delve into our comprehensive guide on popular cryptocurrencies to further understand the financial landscape you’re stepping into with platforms like CoinStats.

CoinStats’ ability to traverse both traditional crypto and DeFi landscapes makes it a valuable asset for a wide spectrum of crypto investors. Its inclusive approach brings a lot to the table, especially for those looking to have an overarching view of their entire crypto portfolio alongside their DeFi assets. As we move onto our final DeFi portfolio tracker, CoinGecko, we’ll explore how it compares to the comprehensive nature of CoinStats.

CoinGecko: A Trusted Crypto Aggregator

CoinGecko has carved a niche for itself as a comprehensive crypto aggregator, providing a plethora of information ranging from market data to DeFi statistics. Its foray into DeFi portfolio tracking aligns with its mission to provide a 360-degree view of the crypto market.

Overview of CoinGecko

Here’s a glimpse into what CoinGecko offers in terms of DeFi portfolio tracking:

- Supported Cryptocurrencies: Over 10,000 cryptocurrencies.

- Supported Exchanges: More than 400 exchanges.

- Real-time Portfolio Tracking: Yes.

- Yield Farming Analytics: Yes.

- NFT Tracking: No.

The vast number of supported cryptocurrencies and exchanges makes CoinGecko a versatile platform for both market analysis and portfolio management.

High-Security Features

In a domain where security is paramount, CoinGecko steps up with robust security features:

- Two-Factor Authentication (2FA): Enhances account security by adding an extra layer of protection.

- Cold Storage: Encourages users to keep a majority of their funds in cold storage for added security.

These security measures resonate with the importance of safeguarding digital assets while managing them efficiently.

Market News and Analysis

Staying updated with market trends is crucial for making informed investment decisions. CoinGecko provides:

- Latest Market News: Stay abreast of the latest happenings in the crypto and DeFi space.

- Comprehensive Analysis: Delve into detailed market analysis to better understand market dynamics.

Discover the rising world of Decentralized Finance (DeFi) and its impact to further enrich your understanding of the market trends that platforms like CoinGecko help you navigate.

CoinGecko’s holistic approach towards crypto market analysis, coupled with its DeFi portfolio tracking features, presents a well-rounded platform for crypto enthusiasts. As we venture further into the comparative analysis of these DeFi portfolio trackers, the diverse features and unique selling propositions of each platform will help you gauge the one that resonates with your DeFi portfolio management needs.

Comparative Analysis: Choosing Your DeFi Portfolio Tracker

Each DeFi portfolio tracker we explored comes with its own set of features, strengths, and focus areas. Your choice depends on your specific needs, investment strategy, and the level of diversity in your crypto portfolio. Here, we’ll compare these platforms side by side to help you make an informed decision.

Core Features Comparison

Let’s first look at how these platforms stack up in terms of core features:

| Feature | DeBank | Zerion | Zapper | CoinStats | CoinGecko |

| Real-time Tracking | Yes | Yes | Yes | Yes | Yes |

| Yield Farming Analytics | Yes | Yes | Yes | Yes | Yes |

| NFT Tracking | Yes | Yes | No | No | No |

| Supported Chains | 30+ | 12+ | 10+ | Various | Various |

| Security Features | – | – | – | – | 2FA, Cold Storage |

Each platform caters to different aspects of DeFi and crypto asset management, ensuring a range of options for different types of investors.

User Interface and Experience

A user-friendly interface and a pleasant user experience are crucial for effective portfolio management:

- DeBank and Zerion offer clean interfaces with a focus on ease of navigation.

- Zapper provides a streamlined interface specifically tailored for yield farming enthusiasts.

- CoinStats and CoinGecko offer comprehensive dashboards that cater to a broader cryptocurrency audience alongside DeFi investors.

Ease of use is a significant factor, especially for newcomers in the DeFi space.

Community and Support

Having a strong community and robust support are essential aspects of any platform:

- DeBank has a growing community with active discussions on various DeFi topics.

- Zerion and Zapper have communities that are focused on sharing knowledge and experiences.

- CoinStats and CoinGecko have extensive user bases due to their broader crypto market appeal.

Making the right choice in a DeFi portfolio tracker can significantly impact your ability to manage and grow your digital assets effectively. Reflect on your investment strategy, the assets you hold, and the level of community and support you desire to make an informed decision. In the next section, we’ll delve into how these platforms are contributing to the broader DeFi ecosystem, paving the way for a more open and accessible financial future.

Impact on the DeFi Ecosystem

The emergence of DeFi portfolio trackers is not just a boon for individual investors, but a significant stride toward maturing the DeFi ecosystem. These platforms play a pivotal role in increasing accessibility, fostering community engagement, and providing a foundation for informed investment strategies.

Enhancing Accessibility

DeFi portfolio trackers lower the entry barrier for newcomers and provide seasoned investors with invaluable tools for managing and optimizing their portfolios:

- User-Friendly Interfaces: Simplify the otherwise complex DeFi landscape.

- Real-Time Tracking: Provides instant insights, fostering a sense of control and understanding.

- Educational Resources: Many of these platforms offer guides and tutorials to help users navigate the DeFi space.

Immerse yourself in our guide on the impact of blockchain technology to understand the foundational changes that DeFi, supported by these trackers, is bringing to the financial landscape.

Fostering Community Engagement

Community is the backbone of the DeFi movement. The social features and community forums on these platforms create a space for discussion, knowledge sharing, and collective problem-solving:

- Social Feeds and Forums: Platforms like DeBank offer social feeds, fostering a community-centric environment.

- Support Channels: Providing avenues for users to seek help and share their insights.

Empowering Informed Investment Strategies

Informed decision-making is crucial for success in any investment venture:

- Market Analysis: Platforms like CoinGecko provide comprehensive market analysis, aiding in informed decision-making.

- Yield Farming Analytics: Tools offered by Zapper and others help in optimizing yield farming strategies.

- Tax Reporting: CoinStats provides tax reporting features, helping users stay compliant.

The advent of DeFi portfolio trackers is a testament to the evolving DeFi ecosystem. They are not just tools for individual asset management but catalysts propelling the DeFi movement towards a more accessible and community-driven future. As you venture into managing your DeFi assets, choosing a platform aligned with your needs and the broader ethos of decentralized finance will not only benefit you but contribute to the maturation of the entire DeFi ecosystem.

Conclusion: Navigating Your DeFi Journey

The advent of DeFi portfolio trackers has undeniably added a layer of simplicity and efficiency to managing decentralized assets. As the DeFi realm continues to expand, having a reliable and feature-rich platform to track your investments is indispensable. Each tracker we delved into offers a unique set of features catering to different facets of the DeFi ecosystem.

Reflecting on Your Needs

Your choice of a DeFi portfolio tracker should resonate with your investment goals and the level of engagement you wish to have in the DeFi community:

- Diverse Asset Management: If you hold a variety of assets across different chains, a platform like DeBank or Zerion could be more suited.

- Yield Farming Focus: For yield farming enthusiasts, Zapper offers dedicated tools to optimize your strategies.

- Broader Crypto Portfolio: If your portfolio extends beyond DeFi, CoinStats or CoinGecko provide a holistic view of all your crypto assets.

Reflecting on your needs and aligning them with the features of these platforms will ensure a smoother journey in the DeFi landscape.

Embracing the Learning Curve

The DeFi space is vibrant but comes with a learning curve. Leveraging the educational resources, community forums, and support channels provided by these platforms can significantly enhance your DeFi experience:

- Educational Resources: Dive into guides, tutorials, and market analysis to build a solid understanding.

- Community Engagement: Join discussions, share insights, and learn from the experiences of other community members.

Explore the dynamics of DeFi lending and borrowing to further enhance your understanding and make informed decisions in your DeFi ventures.

Your journey in the decentralized finance domain is bound to be exciting and insightful. With the right DeFi portfolio tracker by your side, managing your assets, engaging with the community, and making informed decisions becomes a less daunting endeavor. As you venture forth, the knowledge, insights, and community support garnered from these platforms will be your companions in navigating the vibrant and ever-evolving world of DeFi.

Frequently Asked Questions

| Question | Answer |

| What is a DeFi portfolio tracker? | A DeFi portfolio tracker is a platform that allows users to manage and monitor their decentralized finance (DeFi) assets. It provides real-time tracking, analytics, and other features to help users optimize their DeFi investments. |

| Why do I need a DeFi portfolio tracker? | A DeFi portfolio tracker simplifies the management of your DeFi assets, provides valuable insights through analytics, and often comes with community support for better decision-making and problem-solving. |

| Can I track NFTs on DeFi portfolio trackers? | Yes, some DeFi portfolio trackers like DeBank and Zerion provide NFT tracking features, allowing users to manage both DeFi and NFT assets from a single platform. |

| Are DeFi portfolio trackers safe? | While these platforms strive to maintain high security standards, the level of safety can vary. It’s essential to use security features provided, like Two-Factor Authentication (2FA), and follow best practices to safeguard your assets. |

| Can I manage assets on multiple blockchains? | Yes, many DeFi portfolio trackers offer multi-chain support allowing you to manage assets across different blockchains from a unified interface. |

| How do DeFi portfolio trackers help with yield farming? | They provide yield farming analytics, auto-compounding features, and tools to explore new pools and optimize strategies, making yield farming management more efficient and profitable. |

| Do DeFi portfolio trackers provide tax reporting features? | Some platforms like CoinStats provide tax reporting features to help users calculate and report their crypto taxes efficiently. |

| Can I access market news and analysis on these platforms? | Yes, platforms like CoinGecko provide market news and analysis, aiding users in staying updated with market trends and making informed investment decisions. |

| Where can I learn more about DeFi? | Many DeFi portfolio trackers offer educational resources, and you can also explore comprehensive guides on Crypto Mind Pro to deepen your understanding of DeFi. |