Ever wondered what makes blockchain technology the buzzword of the decade?

Welcome to your one-stop guide that unravels the labyrinth of blockchain, demystifying its applications, its revolutionary potential, and how it’s shaping multiple industries.

From finance and healthcare to education and beyond, this guide will provide you with a 360-degree view of the blockchain world. Buckle up as we dive deep into this transformative technology!

Key Takeaways

Section Title Key Takeaways What is Blockchain Technology? Understand the fundamentals, including its history and core components. Why is Blockchain Revolutionary? Learn why blockchain’s features like decentralization and transparency make it a game-changer. Types of Blockchain Distinguish between Public, Private, and Consortium blockchains. Key Technical Concepts Master the terminology such as nodes, consensus algorithms, and hash functions. Smart Contracts Discover what smart contracts are and their practical use-cases. Blockchain and Cryptocurrency Explore the relationship between blockchain and popular cryptocurrencies. Blockchain in Financial Services Understand how blockchain is revolutionizing cryptocurrency trading and other financial services. Blockchain in Supply Chain Learn how blockchain enhances tracking and quality control in supply chains. Blockchain in Governance Find out how blockchain can improve transparency and efficiency in elections and public records. Blockchain in Healthcare Discover the potential for blockchain to secure patient records and trace drugs. Blockchain and Internet of Things (IoT) Delve into how blockchain can improve device management and data integrity in IoT. Blockchain and Real Estate Learn how blockchain can simplify property titles and contracts. Blockchain and Media Discover how blockchain can impact royalty tracking and content distribution. Rise of DeFi Understand what DeFi is and how blockchain enables decentralized finance. Navigating NFT Learn about NFTs and where to find or trade them in NFT marketplaces. Tokenomics Understand the role of tokens and the difference between utility and security tokens. Blockchain Scalability Learn about the challenges and solutions to blockchain scalability. Blockchain Security Understand common security threats and how to ensure cryptocurrency security. Blockchain and Regulations Get an overview of the legal landscape surrounding blockchain and crypto regulations. Ethical Concerns Discuss ethical issues like energy consumption and data privacy in blockchain technology. Future of Blockchain Explore upcoming trends and the unveiling mysteries of crypto. Investing in Blockchain Gain insights into the risks and rewards of buying crypto. Blockchain Jobs and Careers Learn about the skillsets required for various blockchain-related job roles. Blockchain Communities Discover where to find like-minded individuals, be it forums or academic circles. Blockchain in Emerging Markets Understand the impact of blockchain in emerging economies. Blockchain Tools and Platforms Get acquainted with popular blockchain platforms and cryptocurrency exchanges. Blockchain and Taxes Learn about tax obligations related to blockchain and crypto tax. Blockchain and Lending Understand how blockchain is used in cryptocurrency lending. Blockchain and Education Discover courses, certifications, and paths to becoming a blockchain expert.

What is Blockchain Technology?

Blockchain technology is a groundbreaking innovation that has far-reaching implications beyond its most famous application, cryptocurrency.

It serves as a decentralized, distributed ledger that records all transactions across a network of computers. In this section, we will delve into the history, core components, and the inner workings of blockchain technology.

Brief History and Evolution

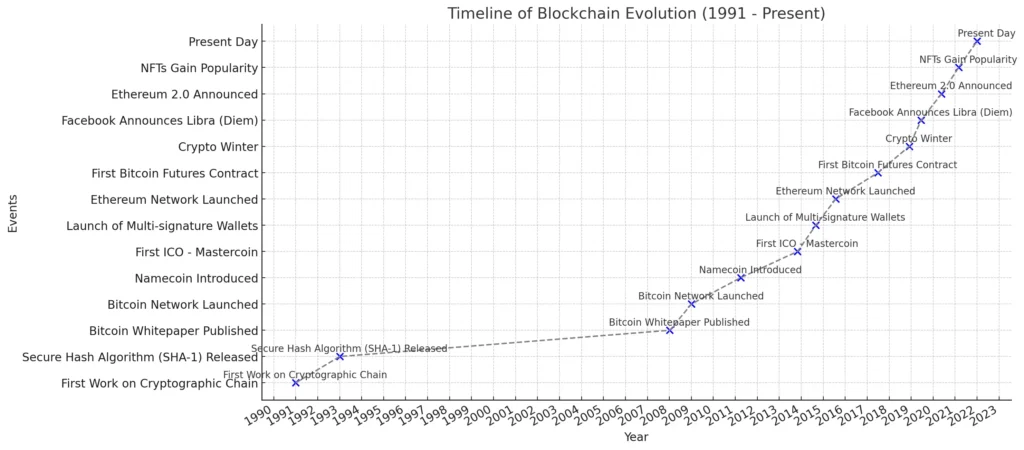

The concept of a blockchain was first outlined in 1991 by researchers Stuart Haber and W. Scott Stornetta. However, it gained significant attention with the release of Bitcoin in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto.

Over the years, blockchain technology has evolved from a basic public ledger for Bitcoin transactions to a multi-faceted technology with various applications.

Core Components and How It Works

The blockchain comprises three main components:

- Blocks: Each block contains a list of transactions. These transactions are encrypted for security.

- Chain: Blocks are linked together chronologically to form a chain.

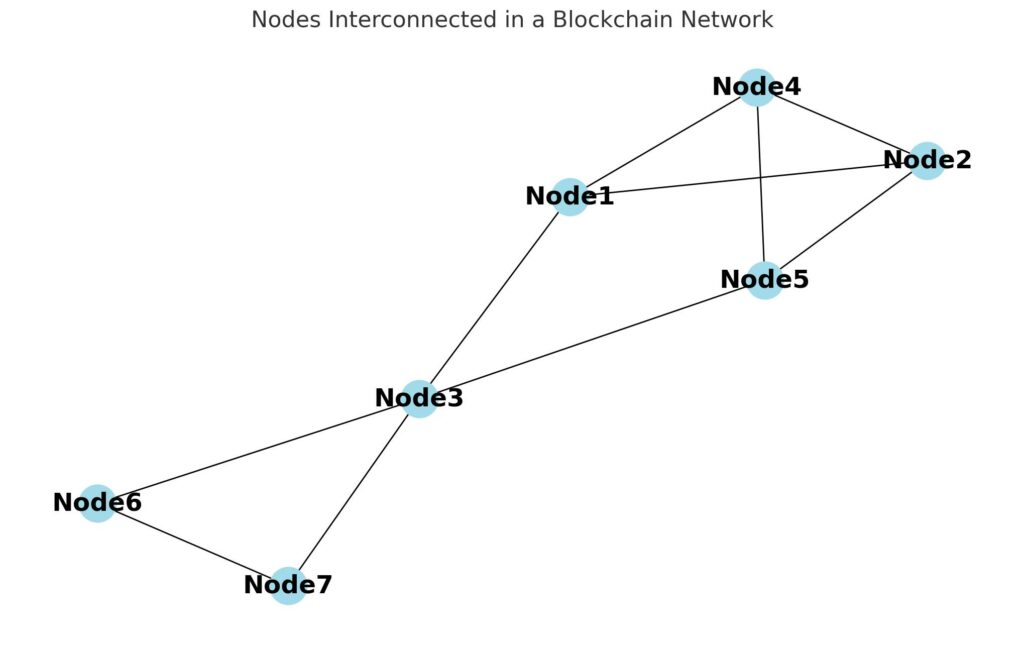

- Nodes: These are the computers that make up the network. They validate and store the transactions on the blockchain.

When a transaction occurs, it is grouped with other transactions into a block. Nodes validate these transactions through consensus algorithms.

Once validated, the block is added to the chain in a linear, chronological order. This mechanism ensures the integrity and chronological order of all transactions.

Decentralization and Security

One of the most appealing features of blockchain is decentralization.

Unlike centralized systems, where a single entity has control, blockchain distributes authority across a network of nodes.

This setup enhances security, as it would require a massive amount of computing power to alter the blockchain, making it practically immutable.

| Criteria | Centralized Systems | Decentralized Systems |

|---|---|---|

| Control | Controlled by a single entity or organization | Distributed control across multiple nodes |

| Security | Centralized security measures; single point of failure | Enhanced security due to distributed nature |

| Vulnerability | Vulnerable to attacks targeting the central authority | Less vulnerable; attacks must compromise multiple nodes |

Transparency and Immutability

Transparency is another cornerstone of blockchain technology. Every transaction is publicly recorded on the blockchain, making it transparent and easily auditable.

Coupled with its immutability—once data is added to the blockchain, it cannot be altered—this technology offers a high level of trust and security.

Why is Blockchain Revolutionary?

The revolutionary aspect of blockchain technology lies in its ability to disrupt traditional systems and bring about significant improvements in various domains. From enhancing trust and transparency to decentralization and beyond, blockchain is set to redefine how we think about and handle data. In this section, we’ll delve into the key features that make blockchain a groundbreaking innovation.

Decentralization and Trust

In traditional centralized systems, a single entity has control over all the data and transactions. This creates a single point of failure and vulnerability. Blockchain technology turns this model on its head by distributing control across a network of nodes.

Each node has a copy of the blockchain, ensuring no single point of control or failure. This decentralization fosters a new level of trust among participants in the network.

Transparency and Immutability

Transparency is another cornerstone of blockchain. Each transaction is recorded on a public ledger that can be viewed by anyone within the network. This level of transparency has never been seen before in traditional systems.

Moreover, once a transaction is added to the blockchain, it becomes immutable, meaning it cannot be altered or deleted. This ensures a high level of security and trustworthiness.

Interoperability and Open Source

One of the most promising features of blockchain is its ability to operate across different systems and platforms, also known as interoperability. This is primarily possible because most blockchain technologies are open source, allowing for greater collaboration and innovation.

| Aspect | Open-Source Software Advantages | Open-Source Software Disadvantages | Proprietary Software Advantages | Proprietary Software Disadvantages |

|---|---|---|---|---|

| Control | Users have full control over the software. | May lack professional support. | Professional support and training. | Users have limited control. |

| Cost | Generally free to use. | Potential for malicious code. | Code is closely guarded, potentially reducing security risks. | High costs for software and updates. |

| Security | Source code is publicly available, allowing for collective scrutiny. | Possible security vulnerabilities due to transparent code. | Likely to be stable and well-tested. | Security is a “black box” — users must trust the company. |

| Innovation | Allows for rapid innovation by a community. | Rapid changes may result in instability. | Development is controlled and organized. | Innovation is limited to the company’s own developers. |

| Community Support | Strong community support. | Dependence on community for updates. | Updates and features are regularly provided. | Limited community support. |

| Customization | Highly customizable. | May require technical expertise to modify. | Designed for out-of-the-box use. | Limited customization. |

| Legal Risks | Lower legal risks as software is publicly available. | Potential for code misuse. | Legal protection through licensing agreements. | Potential for vendor lock-in and legal issues. |

Scalability and Efficiency

Although blockchain faces challenges in scalability, solutions are continuously being developed to make it more efficient. Layer 2 solutions, sharding, and different consensus algorithms are among the technologies aiming to make blockchain faster and more scalable.

For an in-depth look at scalability challenges and solutions, refer to our section on Blockchain Scalability.

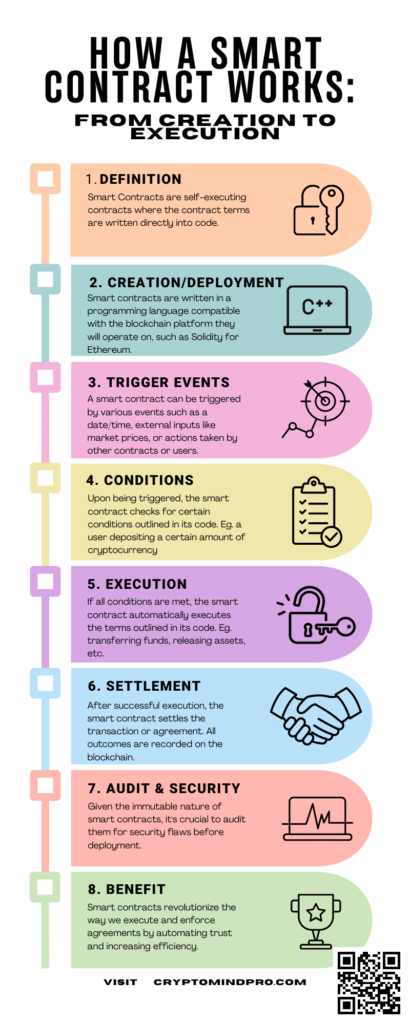

Smart Contracts and Automation

Smart contracts are self-executing contracts where the contract terms are written in code. These automate many processes in various industries, from real estate to supply chain management, and beyond.

By automating these processes, blockchain allows for a much more efficient and error-free system.

| Industry | Processes That Can Be Automated |

|---|---|

| Finance | Payment Processing, Loans, Asset Management |

| Healthcare | Patient Records, Drug Traceability, Billing |

| Real Estate | Property Transfers, Rental Agreements, Mortgages |

| Supply Chain | Inventory Management, Procurement, Quality Assurance |

| Legal | Contract Creation, Dispute Resolution, Compliance |

| Entertainment | Royalty Distribution, Licensing, Ticket Sales |

| Education | Credential Verification, Tuition Payments, Course Enrollment |

| Insurance | Policy Issuance, Claims Processing, Risk Assessment |

| Energy | Grid Management, Energy Trading, Renewable Energy Credits |

Types of Blockchain

Blockchain technology isn’t a one-size-fits-all solution. There are different types of blockchains, each designed to meet specific needs and use-cases. Understanding these variations is crucial for anyone interested in implementing or investing in blockchain technology.

In this section, we’ll explore the three primary types of blockchains: Public, Private, and Consortium.

Public Blockchains

Public blockchains are open to anyone who wants to participate. They are fully decentralized, meaning no single entity has control over the network.

Transactions are verified by network nodes through consensus algorithms.

Bitcoin and Ethereum are classic examples of public blockchains.

Private Blockchains

Unlike public blockchains, private blockchains are restricted to a specific group of participants, often within a single organization. They offer more control over who can make transactions and validate blocks, but at the cost of decentralization.

Private blockchains are often used for internal business processes.

| Aspect | Public Blockchain Pros | Public Blockchain Cons | Private Blockchain Pros | Private Blockchain Cons |

|---|---|---|---|---|

| Accessibility | Open to anyone, highly inclusive | Vulnerable to “51% attacks” | Restricted membership increases trust | Limited accessibility may reduce network robustness |

| Control | Decentralized, no single entity has control | No control over who joins | Controlled by a single entity or consortium | Centralized control may introduce vulnerabilities |

| Security | Highly secure due to decentralization | Lower transaction speed | Can be as secure as needed | Security is as good as the controlling entity |

| Speed and Efficiency | Can be more robust due to larger network | Less efficient due to redundancy | Faster transactions | May not be as robust due to smaller network size |

| Transparency | All transactions are public | Too transparent for some business needs | Transparency can be tailored | Transparency might be limited |

| Cost | Usually free to use | Higher operational costs | Cost-effective | Initial setup cost |

Consortium Blockchains

Consortium blockchains, also known as federated blockchains, are controlled by a group of organizations rather than a single entity. They offer a middle ground between the openness of public blockchains and the control of private blockchains.

Consortium blockchains are commonly used in sectors like finance for cross-border transactions.

Choosing the Right Type of Blockchain

The choice between public, private, and consortium blockchains depends on various factors like the level of control, transparency, and the specific use-case.

For example, if you’re interested in decentralized finance (DeFi), a public blockchain would be more appropriate. On the other hand, for internal supply chain management, a private or consortium blockchain might be more suitable.

Different Use-Cases and Suitable Types of Blockchain

| Use-Case | Most Suitable Type of Blockchain |

|---|---|

| Financial Transactions | Public |

| Supply Chain Management | Consortium |

| Voting Systems | Public or Consortium |

| Healthcare Records | Private |

| Real Estate Transactions | Public |

| Media and Content Distribution | Public |

| Corporate Governance | Consortium |

| Smart Contracts | Public |

| Cross-border Payments | Public |

| Identity Management | Consortium |

This table outlines various use-cases and the most suitable types of blockchain for each. The choice between public, private, and consortium blockchains depends on the specific requirements of each application, such as transparency, security, and speed.

Key Technical Concepts

Blockchain technology, while revolutionary, is built on a set of key technical concepts that govern its functionality and efficacy. Understanding these foundational elements will give you a more nuanced appreciation of what makes blockchain tick.

In this section, we’ll explore nodes, consensus algorithms, hash functions, and smart contracts.

Nodes

In blockchain terminology, a node refers to a computer connected to the blockchain network. Each node has its copy of the blockchain and participates in the validation of transactions.

There are different types of nodes, such as full nodes and light nodes, each serving a specific role in the network.

Consensus Algorithms

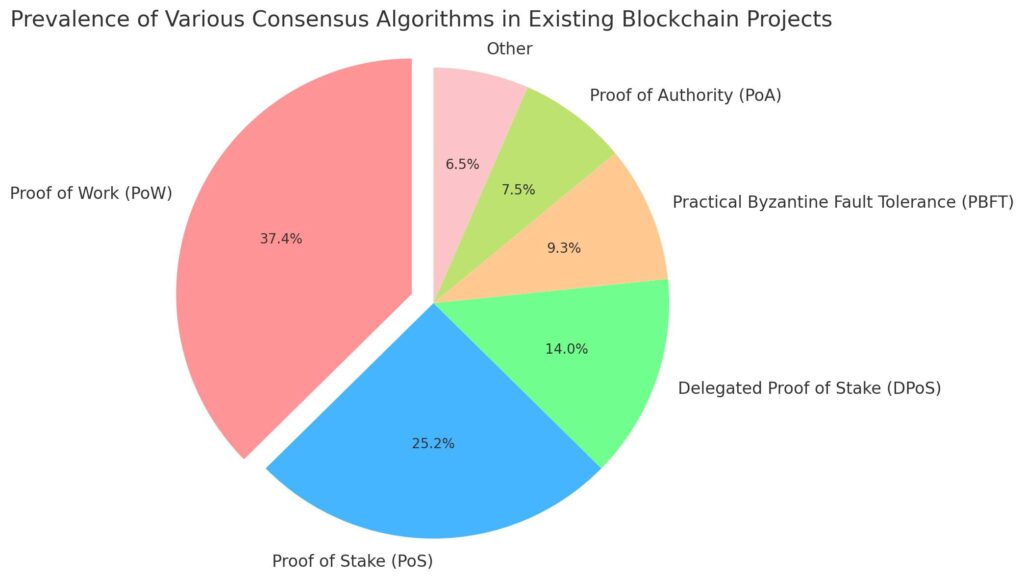

A consensus algorithm is a method used by blockchain networks to agree on the validity of transactions.

The most commonly known algorithms are Proof of Work (PoW) and Proof of Stake (PoS), but several others are also in use, including Delegated Proof of Stake (DPoS) and Practical Byzantine Fault Tolerance (PBFT).

Hash Functions

Hash functions play a crucial role in ensuring the integrity and security of transactions on a blockchain. They convert transaction data into a fixed-size string of characters, which is virtually impossible to turn back into the original data.

This ensures that once a transaction is added to a block, altering it would require changing all subsequent blocks, making the blockchain secure and immutable.

| Original Data | Hashed Data (SHA-256) |

|---|---|

| Blockchain | 625da44e4eaf58d61cf048d168aa6f5e492dea166d8bb54ec06c30de07db57e1 |

| Crypto | df12b8f89b61274c73291296ec828eab61202f5863680ec6003682821d77fd31 |

| SmartContract | d4e94fd579b1eec3abfe36ab306d02b361f399d528543a43874f0ee769bd2d01 |

| DeFi | 3871f97fc9a1fa1298ef55c7ec904392f630e41e2f7be2355bf92c400d4c3151 |

| NFT | 35987a0f9ae77012a5146a982966661b75cdeaa4161d1d62b1e18d39438e7396 |

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement written into code. They eliminate the need for intermediaries and automate various processes, from transferring funds to executing complex business agreements.

For a deeper dive into smart contracts, feel free to visit our section dedicated to Smart Contracts.

Cryptographic Signatures

In blockchain transactions, cryptographic signatures are used to verify the authenticity of the sender. These signatures are generated using the sender’s private key and can be verified by anyone in the network using the sender’s public key, adding an extra layer of security.

| Step | Action | Role of Private Key | Role of Public Key |

|---|---|---|---|

| 1. Message Creation | Create a digital message (often a transaction) that you want to secure. | Not involved | Not involved |

| 2. Hashing | Generate a hash of the message using a cryptographic hash function. | Not involved | Not involved |

| 3. Signing | Use your private key to sign the hash, creating a cryptographic signature. | Used to sign the hash | Not involved |

| 4. Verification | Others use your public key to verify the signature, ensuring the message hasn’t been tampered with. | Not involved | Used for signature verification |

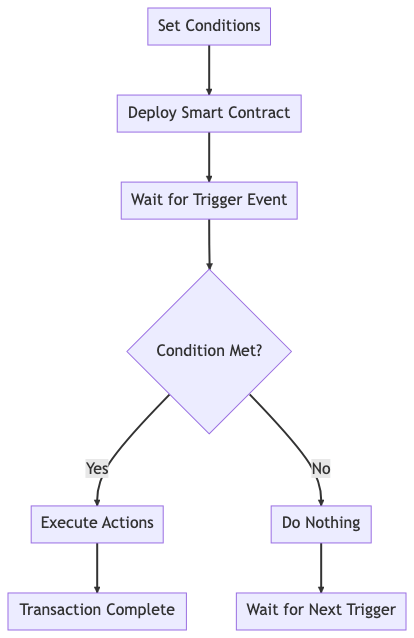

Smart Contracts

Smart contracts are one of the most transformative applications of blockchain technology. Acting as self-executing contracts with the terms directly written into code, they automate a wide range of processes and transactions.

In this section, we’ll explore what smart contracts are, how they work, their benefits, limitations, and real-world applications.

What Are Smart Contracts?

At its core, a smart contract is a piece of code deployed on a blockchain. It automatically executes actions when predetermined conditions are met, eliminating the need for intermediaries.

For example, in a real estate transaction, the transfer of property could be automatically triggered once payment is confirmed.

How Do Smart Contracts Work?

Smart contracts work on an “if-then” principle. When a certain condition is met (“if”), an action is automatically triggered (“then”).

For instance, if a customer pays for a digital product, then the smart contract will automatically release the download link to the customer.

Benefits of Smart Contracts

Smart contracts offer a plethora of benefits, some of which are:

- Trust: Parties can trust that the agreed terms will be executed.

- Transparency: All terms are visible on the blockchain.

- Security: Manipulating a smart contract would require altering the entire blockchain, which is practically impossible.

- Cost-Efficiency: By eliminating intermediaries, smart contracts reduce transaction costs.

Limitations and Challenges

While smart contracts are revolutionary, they aren’t without limitations:

- Complexity: Writing a smart contract requires specialized knowledge.

- Immutability: Once deployed, they can’t be easily altered.

- Legal Recognition: Smart contracts aren’t yet universally recognized by law.

For a more comprehensive understanding of these challenges, you may also read our section on Blockchain and Regulations.

Real-World Applications

Smart contracts are versatile and have applications across various industries:

- Real Estate: Automating property transfer upon payment.

- Supply Chain: Automating inventory tracking and management.

- Insurance: Instant payout upon verification of a claim.

- Entertainment: Automating royalty payments to artists.

Blockchain and Cryptocurrency

Blockchain technology and cryptocurrency are intrinsically linked, as the former serves as the foundational technology for the latter. However, the relationship between the two is often misunderstood.

In this section, we will clarify the connection, explore how cryptocurrencies leverage blockchain technology, and discuss some of the most prominent cryptocurrencies in the market today.

The Inseparable Connection

Cryptocurrencies like Bitcoin were the first applications to bring blockchain technology into the spotlight.

Essentially, cryptocurrencies are digital or virtual assets that use cryptography for security, and they operate on a blockchain to ensure decentralization and transparency.

How Cryptocurrencies Use Blockchain

Cryptocurrencies utilize blockchain technology to achieve several key objectives:

- Transaction Verification: Transactions are verified by network nodes through consensus algorithms.

- Immutability: Once a transaction is added to the blockchain, it cannot be altered.

- Anonymity: Transactions can be conducted pseudonymously, protecting user identities.

- Decentralization: No single entity has control over the cryptocurrency, as it’s distributed across multiple nodes.

Prominent Cryptocurrencies

While Bitcoin is the most well-known cryptocurrency, several others have gained prominence, each with its unique features and use-cases.

Some of these include Ethereum, which introduced smart contracts, and Ripple (XRP), known for its digital payment protocol more than its digital currency.

For a comprehensive list of popular cryptocurrencies and their unique features, you can visit our guide on Popular Cryptocurrencies.

Regulatory Aspects

The regulatory landscape for cryptocurrencies is complex and varies by jurisdiction. Some countries have embraced it, while others have imposed restrictions or outright bans. Understanding the regulatory environment is crucial for anyone involved in cryptocurrency trading or investment.

Blockchain in Financial Services

Blockchain technology is set to profoundly impact the financial services sector by enhancing efficiency, reducing costs, and increasing transparency. From streamlining payments to revolutionizing asset management, blockchain is paving the way for significant disruptions.

In this section, we’ll explore the various applications of blockchain in financial services and discuss some real-world examples.

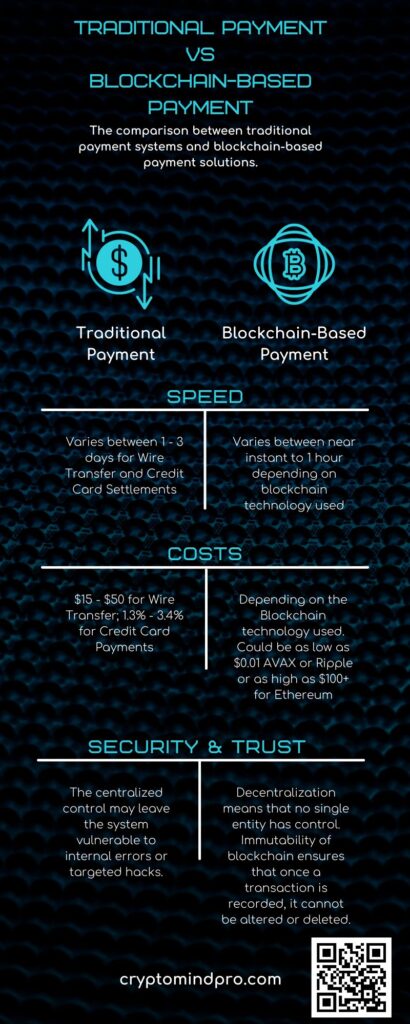

Payment Solutions and Transfers

Blockchain technology can facilitate quicker and more cost-effective payments and money transfers. Traditional banking systems often involve multiple intermediaries, which lead to delays and extra costs.

Blockchain can eliminate these intermediaries, allowing for near-instantaneous transactions, even for international transfers.

Asset Management and Tokenization

Tokenization involves converting rights to an asset into a digital token on a blockchain. This makes it easier to transfer and divide assets, creating liquidity and enabling fractional ownership.

Real estate, fine art, and other illiquid assets can be tokenized to allow for smaller, more accessible investment opportunities.

Smart Contracts in Financial Services

Smart contracts can automate various financial processes, like the execution of trades, the issuance of insurance policies, and even the payment of bonds. These contracts enhance efficiency and reduce the risk of human error.

Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is perhaps the most revolutionary application of blockchain in the financial sector. DeFi platforms allow users to borrow, lend, trade, and earn interest on their assets without relying on traditional financial institutions.

For those interested in diving deeper into this area, our Rise of DeFi section provides comprehensive insights.

| Criteria | Traditional Financial Systems | DeFi Platforms |

|---|---|---|

| Ownership | Centralized, owned by corporations or governments | Decentralized, owned by the community |

| Accessibility | Restricted; requires identity verification | Open to anyone with an internet connection |

| Transparency | Limited; most operations are not transparent | High; all transactions are public |

| Flexibility | Low; services are predefined by institutions | High; smart contracts allow customization |

| Regulation | Highly regulated by government agencies | Generally less regulated |

| Interest Rates | Generally low and set by the institution | Can be high; set by smart contracts |

| Security | Centralized security measures, prone to single point of failure | Decentralized, reliant on cryptographic security |

| Financial Products | Standard products like loans, savings, etc. | Innovative products like yield farming, liquidity pools, etc. |

Regulatory Considerations

Just like cryptocurrencies, the application of blockchain in financial services also faces regulatory scrutiny. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is essential.

Blockchain in Supply Chain

The supply chain industry has long been plagued by inefficiencies, lack of transparency, and potential for fraud. Blockchain technology offers robust solutions to these problems, bringing unparalleled visibility and security to the intricate networks of production, distribution, and retail.

In this section, we will examine how blockchain technology is reinventing supply chain management, from traceability to smart contracts and beyond.

Enhancing Traceability

One of the most promising applications of blockchain in the supply chain is enhanced traceability. With a blockchain-enabled supply chain, every transaction, movement, and status update of a product can be recorded in real-time on a tamper-proof ledger.

Streamlining Inventory Management

Blockchain technology can significantly streamline inventory management by providing real-time, accurate data about the stock levels at each point in the supply chain.

This reduces the chances of overstocking or understocking, thus saving costs and improving efficiency.

| Criteria | Traditional Inventory Management Systems | Blockchain-based Systems |

|---|---|---|

| Accuracy | Prone to human errors and manual adjustments | Highly accurate due to immutable ledger |

| Speed | May experience delays due to manual processes | Real-time updates and automated processes |

| Cost-Efficiency | High overhead costs for manual labor and audits | Reduced costs due to automation and reduced need for audits |

Smart Contracts for Automated Compliance

Smart contracts can be programmed to automatically enforce compliance with various regulations and quality standards.

For instance, a smart contract could automatically reject a shipment if it does not meet predefined quality criteria, thus eliminating the need for manual inspections.

Fraud Prevention and Security

The immutable nature of blockchain makes it extremely difficult for any party to alter or falsify records. This feature dramatically reduces the potential for fraud, ensuring that all parties can trust the data within the supply chain.

| Common Types of Fraud | Traditional Supply Chains | How Blockchain Prevents It |

|---|---|---|

| Counterfeit Goods | Difficult to verify the authenticity of products. | Immutable records and verification processes can prove product authenticity. |

| Invoice Frauds | Invoices can be manipulated or duplicated. | Smart contracts automate invoice generation, ensuring legitimacy. |

| Quality & Compliance | Compliance documents can be falsified. | Immutable records can prove compliance and quality. |

| Shipment Tracking | Shipment details can be tampered with. | Real-time, immutable tracking ensures shipment integrity. |

| Vendor Frauds | Fraudulent vendors can enter the system. | Vendor verification through blockchain increases transparency. |

Real-World Examples and Case Studies

Numerous companies have already started integrating blockchain into their supply chain operations. These range from large corporations like IBM and Walmart to startups focusing solely on blockchain-based supply chain solutions.

For those who are interested in practical applications of blockchain, our guide on Popular Cryptocurrencies includes examples of blockchain platforms specifically designed for supply chain management.

Blockchain in Governance

Blockchain technology is increasingly being recognized for its potential to revolutionize governance systems.

By offering enhanced transparency, security, and efficiency, blockchain can address many of the challenges associated with bureaucratic red tape, corruption, and inefficiency. In this section, we will explore the various ways blockchain can be applied in governance, from electoral systems to public records management.

Electoral Systems and Voting

One of the most groundbreaking applications of blockchain in governance is in the realm of electoral systems.

Blockchain can secure the voting process, making it tamper-proof and transparent, thereby increasing trust in electoral outcomes.

Public Records and Identity Management

Managing public records such as birth certificates, property deeds, and business licenses can be streamlined using blockchain.

The immutable nature of the technology ensures that records are secure and cannot be tampered with, enhancing trust in public databases.

| Types of Public Records | Current Management Issues | How Blockchain Could Improve |

|---|---|---|

| Land Records | Prone to tampering and fraud | Immutable records, transparent ownership |

| Birth Certificates | Require physical verification | Digital, verifiable, and secure |

| Voting Records | Susceptible to manipulation | Transparent, tamper-proof records |

| Legal Documents | Not easily accessible | Smart contracts for instant verification |

| Tax Records | Complex and hard to audit | Transparent and easy to audit |

Taxation and Financial Monitoring

Blockchain can bring unprecedented transparency to financial transactions, making it easier for governments to track and collect taxes.

It can also reduce fraud and errors in tax collection, thereby increasing public revenue.

Smart Contracts for Government Services

Smart contracts can be applied to automate a range of government services, from social welfare disbursements to procurement processes.

This not only speeds up service delivery but also reduces the chance of corruption and malpractice.

Regulatory and Ethical Considerations

While blockchain offers numerous advantages, it also poses regulatory and ethical challenges, especially concerning data privacy and security. Governments must balance the benefits of blockchain with the need to protect citizens’ rights.

Blockchain in Healthcare

The healthcare sector is ripe for innovation, and blockchain technology is emerging as a powerful tool to address some of its most pressing challenges.

From securing patient records to streamlining the drug supply chain, blockchain is poised to make a transformative impact on healthcare systems worldwide. In this section, we delve into the various applications of blockchain in healthcare.

Securing Patient Records

One of the most promising applications of blockchain in healthcare is the secure and efficient management of patient records.

By using blockchain, hospitals and healthcare providers can offer a higher level of security and privacy for sensitive patient data.

Drug Traceability and Authenticity

Counterfeit drugs are a significant problem in the healthcare industry.

Blockchain can provide an immutable, transparent ledger that tracks the journey of pharmaceuticals from manufacturer to consumer, ensuring authenticity and safety.

| Pharmaceutical Supply Chain Steps | How Blockchain Enhances Traceability |

|---|---|

| Raw Material Sourcing | Verifies the authenticity of raw materials by tracking their origin. |

| Manufacturing | Ensures that manufacturing processes are compliant with regulations. |

| Quality Testing | Provides immutable records of quality tests and their outcomes. |

| Distribution | Tracks the movement of drugs from manufacturers to distributors. |

| Retail | Authenticates the source and checks the history of medicine being sold. |

| Consumption | Tracks and verifies the medication from manufacturing to end-user. |

Clinical Trials and Research

Data integrity is crucial in clinical trials and research. Blockchain can ensure that once data is recorded, it cannot be tampered with, thus enhancing the credibility of research outcomes.

Telemedicine and Remote Monitoring

With the rise of telemedicine, secure and efficient data exchange is more important than ever.

Blockchain can facilitate this by providing a secure, transparent platform for sharing medical records and other critical information between healthcare providers and patients.

Regulatory Compliance and Auditing

Blockchain can simplify the complex and time-consuming processes involved in regulatory compliance and auditing in healthcare. Smart contracts can automate many compliance-related tasks, reducing administrative overhead.

Blockchain and Internet of Things (IoT)

The convergence of Blockchain and Internet of Things (IoT) promises to be a game-changer in driving operational efficiencies, enhancing security, and enabling new business models. As IoT devices continue to proliferate, the need for a secure and scalable infrastructure to manage them becomes increasingly critical.

In this section, we will explore how blockchain can complement IoT to overcome challenges and open up new opportunities.

Ensuring Device Security

Security is a significant concern in IoT, with devices often being vulnerable to hacking and unauthorized access. Blockchain’s immutable ledger can offer enhanced security by ensuring that each device in the IoT network is authenticated and authorized.

Data Integrity and Transparency

IoT devices generate massive amounts of data, and ensuring the integrity and transparency of this data is paramount. Blockchain can provide a secure, immutable ledger for storing this data, ensuring that it is accurate and tamper-proof.

Smart Contracts for Automated Interactions

IoT devices often require automated interactions, such as triggering an action based on sensor data. Smart contracts on a blockchain can automate these interactions, executing predefined actions when specific conditions are met.

Supply Chain and Asset Tracking

IoT devices are often used for tracking assets in a supply chain. Combining this with blockchain ensures that the tracking is not only real-time but also immutable and transparent.

| Aspect | Traditional Supply Chain | Blockchain & IoT Enhanced |

|---|---|---|

| Real-Time Tracking | Limited to certain checkpoints, often lacks real-time information. | Real-time tracking of goods through IoT sensors and blockchain-secured data. |

| Authentication | Relies on physical documents and manual verification. | Digital certificates on the blockchain ensure the authenticity of products. |

| Compliance | Often cumbersome due to manual processes, prone to human error. | Smart contracts automatically enforce compliance, reducing human error. |

Decentralized IoT Networks

One of the most innovative applications of combining blockchain with IoT is the creation of decentralized IoT networks. In these networks, decision-making is distributed, enhancing resilience and reducing single points of failure.

For a deeper understanding of decentralized networks, consider reading our section on the Rise of DeFi.

Blockchain and Real Estate

The real estate industry is traditionally viewed as slow-moving and laden with bureaucracy. However, blockchain technology has the potential to disrupt this sector by enhancing transparency, reducing fraud, and speeding up transactions.

In this section, we explore how blockchain is poised to revolutionize various aspects of the real estate industry, from property transactions to asset tokenization.

Property Transactions and Smart Contracts

One of the most immediate applications of blockchain in real estate is the automation of property transactions through smart contracts. These contracts can automatically execute, enforce, or verify legally-relevant actions, drastically reducing the need for intermediaries like notaries or settlement companies.

Asset Tokenization and Fractional Ownership

Tokenization allows real estate assets to be divided into tokens that can be easily and securely transferred among owners. This can create opportunities for fractional ownership, making real estate investment more accessible to the general public.

Transparent and Immutable Property Records

Blockchain can serve as a secure and transparent ledger for recording property records, making it easier to verify ownership and transaction history. This transparency can significantly reduce the potential for fraud.

Efficient and Cost-effective Due Diligence

The due diligence process in real estate transactions can be time-consuming and costly. Blockchain can streamline this process by providing a single, immutable record of all relevant property information, accessible to all stakeholders.

Regulatory and Compliance Aspects

Like any disruptive technology, blockchain faces regulatory challenges in the real estate sector. However, its transparency and immutability make it easier for regulatory bodies to audit transactions and ensure compliance.

Blockchain and Media

The media industry is undergoing significant changes, driven by digital transformation, the rise of social media, and changing consumer behavior. Amidst these shifts, blockchain technology has emerged as a powerful tool that can address various challenges such as content piracy, lack of transparency in advertising, and secure distribution.

This section explores the impact and applications of blockchain in the media industry.

Content Ownership and Copyright Protection

Blockchain can create immutable records of content creation and ownership, which can be publicly verified. This drastically reduces the scope for copyright infringement and unauthorized distribution.

Transparent Advertising Models

The advertising sector within media is often criticized for its lack of transparency. Blockchain can track every component of the advertising process, from impression to conversion, ensuring that each stakeholder gets fair compensation.

| Model | Transparency | Efficiency | |

|---|---|---|---|

| Traditional Advertising | Limited: Advertisers and publishers have limited visibility into ad performance and user engagement. | Lower: Requires intermediaries, resulting in delays and additional costs. | |

| Blockchain-Based Advertising | High: Advertisers and publishers can verify all transactions and user engagements, ensuring full transparency. | Higher: Eliminates the need for intermediaries, speeding up transactions and reducing costs. | ods. |

Secure and Efficient Content Distribution

Blockchain can facilitate secure, direct transactions between content creators and consumers.

This eliminates the need for intermediaries like distributors and platforms, which often take a large cut of the revenue.

Crowdfunding and Tokenization for Media Projects

Blockchain enables new ways of funding media projects through tokenization. It allows creators to issue tokens that represent a stake in a project, enabling a more democratic and transparent funding mechanism.

Combating Fake News and Ensuring Journalistic Integrity

Blockchain can be used to verify the authenticity of news articles and media releases, which is especially crucial in the era of fake news. The immutable nature of blockchain ensures that once a news item is recorded, it can’t be altered, thereby maintaining the integrity of journalism.

For readers interested in the subject of blockchain’s impact on verification processes, our article on Cryptocurrency Security may offer some relevant insights.

Rise of DeFi

Decentralized Finance, commonly known as DeFi, is one of the most disruptive and transformative trends in the financial sector.

Powered by blockchain technology, DeFi aims to democratize finance by bypassing traditional intermediaries like banks and financial institutions. In this section, we delve into the meteoric rise of DeFi, its core principles, and its impact on the financial ecosystem.

What is DeFi?

DeFi refers to a set of financial services, such as lending, borrowing, and asset trading, that are built on blockchain technologies.

These services operate without the need for centralized intermediaries, offering a more inclusive and transparent financial system.

Core Principles of DeFi

The DeFi movement is built on a few core principles such as decentralization, transparency, and interoperability.

These principles are enabled through smart contracts and decentralized applications (dApps).

Table Explaining the Core Principles of DeFi

| Core Principles | Explanation | Examples of Implementation |

|---|---|---|

| Decentralization | Eliminates central authorities to enable peer-to-peer transactions. | Uniswap for decentralized trading. |

| Transparency | All transactions and code are visible on the blockchain. | MakerDAO, whose smart contracts are open-source and auditable. |

| Interoperability | Ease of integration and interaction between different platforms and services. | Compound, integrated with multiple decentralized apps. |

| Accessibility | Open to anyone with an internet connection. | AAVE, open to all without any need for registration or KYC. |

| Financial Inclusion | Provides financial services to unbanked or underbanked populations. | Ox Protocol, enabling global access to credit and loans. |

Types of DeFi Applications

DeFi applications vary widely, ranging from decentralized exchanges (DEXs) and lending platforms to insurance protocols and stablecoins. Each has its unique benefits and risks.

Benefits and Risks

While DeFi offers numerous advantages like increased accessibility and reduced costs, it also comes with its own set of risks, including smart contract vulnerabilities and regulatory uncertainties.

Regulatory and Ethical Considerations

As DeFi gains mainstream acceptance, it faces increasing scrutiny from regulatory bodies. Ensuring compliance while maintaining the decentralized ethos is a significant challenge.

For readers interested in the regulatory landscape of blockchain and cryptocurrency, our Crypto Regulations guide provides in-depth insights.

Navigating NFTs

Non-Fungible Tokens (NFTs) have captured the collective imagination, extending their impact beyond the blockchain community to mainstream artists, collectors, and even casual internet users. From digital art to collectibles, NFTs offer a new way to own, buy, and sell unique digital assets on the blockchain.

This section aims to guide you through the labyrinthine world of NFTs, covering what they are, how they work, and how you can engage with them.

What Are NFTs?

NFTs are unique digital assets verified using blockchain technology. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are unique and can’t be exchanged on a like-for-like basis.

| Aspect | Fungible Tokens | Non-Fungible Tokens (NFTs) |

|---|---|---|

| Uniformity | All tokens are identical in specifications. | Each token is unique, having distinct information or attributes. |

| Interchangeability | Tokens are interchangeable with others of the same type. | Tokens are not interchangeable on a 1:1 basis. |

| Divisibility | Can be divided into smaller units. | Not divisible; traded as whole items. |

| Ownership | Ownership of a quantity, not individual units. | Ownership of distinct, individual units. |

| Use Cases | Used for general digital currencies like Bitcoin, Ether. | Used for unique digital assets like digital art, collectibles. |

| Example | Bitcoin, Ether | CryptoKitties, NBA Top Shot |

| Smart Contracts | Often simpler and more straightforward. | May contain complex metadata and attributes. |

How Do NFTs Work?

At their core, NFTs are digital tokens that represent ownership of a unique item or piece of content, secured on a blockchain. They can be bought, sold, and traded much like physical assets but exist only in the digital realm.

Types of NFTs

NFTs come in various forms, from digital art and collectibles to virtual real estate and even tweets. Each type of NFT has its unique attributes and value proposition.

How to Buy and Sell NFTs

The process of buying and selling NFTs involves a few steps, including setting up a digital wallet, connecting to an NFT marketplace, and executing transactions using cryptocurrencies like Ether.

Legal and Ethical Considerations

Ownership of an NFT doesn’t necessarily grant ownership of the underlying intellectual property. Moreover, the environmental impact of minting NFTs is a growing concern.

For a deeper dive into the unique characteristics of NFTs, you may find our article on Create and Sell NFTs useful.

Tokenomics

Tokenomics, a portmanteau of “token” and “economics,” is the study of the economic models surrounding tokens, particularly cryptocurrencies and other blockchain-based assets. Understanding tokenomics is crucial for anyone looking to invest in, use, or create a new token.

In this section, we’ll delve into the essential elements that make up tokenomics, from token distribution and utility to governance and value creation.

What is Tokenomics?

Tokenomics refers to the economic model that governs a token’s distribution, utility, and management. It lays out the rules and conditions under which tokens are minted, burned, distributed, and how they can be used.

Token Distribution

One of the first aspects to consider in tokenomics is how tokens will be distributed. This includes the initial distribution, as well as any subsequent releases, buy-backs, or burns.

Utility and Functionality

The utility of a token defines its purpose within its ecosystem. Tokens can have various utilities, such as serving as a medium of exchange, offering access to certain services, or representing an underlying asset.

Governance Models

Tokenomics often includes governance models to decide how decisions are made within the token ecosystem. This could be centralized, decentralized, or a hybrid approach.

Value Creation and Capture

The economics of a token are fundamentally tied to its ability to create and capture value. Factors like supply and demand, utility, and network effects can influence a token’s value.

For a deeper understanding of value creation in blockchain technology, our Cryptocurrency Trading article offers some valuable insights.

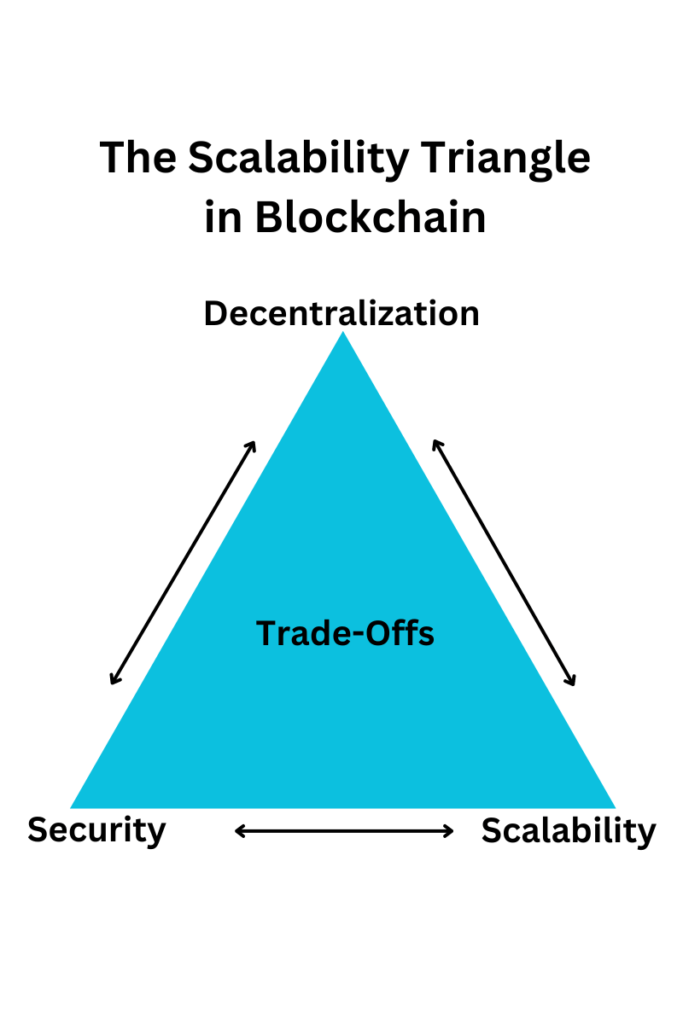

Blockchain Scalability

One of the most discussed challenges facing blockchain technology today is scalability. As blockchain networks grow in usage and adoption, the question of how to handle an increasing number of transactions becomes critical.

This section will explore the issue of blockchain scalability, its implications, and the various solutions that have been proposed to tackle it.

What is Blockchain Scalability?

Scalability refers to a system’s capability to handle a growing amount of work and its potential to accommodate growth. In the context of blockchain, scalability is often measured by the number of transactions a network can process per second (TPS).

The Scalability Problem

Most blockchains, including Bitcoin and Ethereum, face limitations in scalability.

The decentralized nature of these networks, while providing security and transparency, also results in slower transaction times and higher costs as the network grows.

Layer 1 vs. Layer 2 Solutions

To address scalability issues, solutions can be categorized into Layer 1 and Layer 2. Layer 1 solutions involve changes to the blockchain protocol itself, while Layer 2 solutions are built on top of existing blockchains.

Popular Scalability Solutions

Several solutions have been proposed and implemented to improve blockchain scalability. These include sharding, off-chain transactions, and state channels, among others.

Future of Blockchain Scalability

Advancements in technology and consensus algorithms continue to emerge, promising higher scalability and lower costs. However, achieving scalability without compromising on decentralization and security remains a challenge.

Blockchain Security

Security is a cornerstone of blockchain technology, designed to offer decentralized, transparent, and immutable transactions. However, like any technology, it’s not entirely immune to threats and vulnerabilities.

This section delves into the critical aspects of blockchain security, including its strengths and potential weak spots, as well as measures to bolster it.

Inherent Security Features

Blockchain technology comes with built-in security features like cryptographic hashing and consensus algorithms that make it resistant to hacking and fraudulent activities.

Common Security Threats

Despite its robust nature, blockchain is not impervious to threats. Issues like 51% attacks, smart contract vulnerabilities, and phishing scams are real concerns.

Security Protocols and Measures

Various security protocols and measures like multi-signature wallets, hardware wallets, and secure key management can enhance blockchain security.

Regulatory Aspects of Blockchain Security

Regulatory frameworks are slowly catching up with blockchain technology. Adherence to these can provide an additional layer of security and legitimacy to blockchain projects.

Best Practices for Ensuring Security

From regularly updating software to conducting security audits, several best practices can help in maintaining a secure blockchain environment.

Blockchain and Regulations

Regulation is a complex and ever-evolving aspect of the blockchain landscape. As the technology gains prominence and starts interacting with traditional financial systems, legal frameworks are becoming increasingly necessary. This section aims to provide an overview of the regulatory landscape surrounding blockchain, the challenges involved, and the impact of these regulations on various stakeholders.

Regulatory Objectives and Challenges

The primary goal of blockchain regulation is to provide a safe and secure environment for users while fostering innovation. However, the decentralized nature of blockchain presents unique challenges for regulators.

Types of Regulations

Various types of regulations focus on different aspects of blockchain technology, from cryptocurrencies and ICOs to data protection and compliance.

Global Regulatory Landscape

Regulatory attitudes towards blockchain vary considerably from one jurisdiction to another. While some countries have embraced it with open arms, others are more cautious or restrictive.

Regulatory Bodies and Frameworks

Multiple regulatory bodies, both national and international, are responsible for framing and enforcing blockchain-related laws.

Impact of Regulation on Blockchain Adoption

Regulations can have both positive and negative impacts. While they can lend credibility and attract institutional participation, excessive regulation could stifle innovation.

Ethical Concerns

As blockchain technology gains widespread adoption, it brings along not just technological advancements but also ethical concerns. From environmental sustainability to issues related to privacy and governance, the ethical implications of blockchain are increasingly becoming a topic of discussion.

This section explores these issues to provide a balanced perspective on blockchain technology.

Environmental Sustainability

One of the most debated ethical issues related to blockchain is its environmental impact, particularly with Proof-of-Work (PoW) cryptocurrencies like Bitcoin.

Data Privacy and Ownership

Blockchain technology promises enhanced data privacy but also presents challenges like the immutable storage of sensitive information.

Governance and Centralization

While blockchain aims for decentralized governance, the reality often shows centralization risks, such as a single entity or a small group having undue influence.

Economic Inequality

The rise of blockchain technology has the potential to either bridge economic inequality or widen the gap, depending on how it’s implemented and adopted.

Ethical Use of Technology

Blockchain can be a tool for both good and bad. While it can bring transparency to supply chains, it can also be used for illegal activities like money laundering.

| Ethical Uses | Unethical Uses |

|---|---|

| Supply chain transparency | Illicit trade |

| Identity verification | Tax evasion |

| Smart contracts for fair trade | Smart contract scams |

| Decentralized voting systems | Market manipulation |

| Financial inclusion through DeFi | Privacy invasion through data analytics |

For those interested in understanding the ethical implications in greater detail, our Crypto Regulations article provides a regulatory perspective on many of these issues.

Future of Blockchain

Blockchain technology is not just a passing trend; it’s a revolutionary technology with the potential to disrupt various sectors and create new paradigms.

This section aims to explore the future prospects of blockchain, covering advancements, potential use-cases, and the challenges that lie ahead.

Technological Advancements

The blockchain landscape is continuously evolving with advancements like Layer 2 solutions, interoperability, and more sophisticated consensus algorithms.

Emerging Use-Cases

Beyond cryptocurrencies and financial transactions, blockchain has the potential to redefine various industries such as healthcare, real estate, and supply chain management.

| Sector | Emerging Use-Case | Brief Description |

|---|---|---|

| Healthcare | Telemedicine Verification | Securely verify telemedicine consultations and prescriptions. |

| Education | Credential Verification | Verify the authenticity of educational credentials. |

| Agriculture | Supply Chain Tracking | Track the movement of agricultural products from farm to table. |

| Energy | Decentralized Grids | Create decentralized energy grids for more efficient energy use. |

| Transportation | Ticketing Systems | Eliminate ticket fraud through blockchain-secured ticketing systems. |

| Retail | Loyalty Programs | Create transparent and easily manageable customer loyalty programs. |

| Media | Royalty Distribution | Fairly distribute royalties to content creators and rights holders. |

Challenges and Obstacles

While the future looks promising, several challenges like scalability, regulatory hurdles, and public perception must be overcome for widespread adoption.

The Role of Governance and Regulation

The future of blockchain is closely tied to how it will be governed and regulated. Striking a balance between innovation and consumer protection will be crucial.

Economic Impact

Blockchain has the potential to create new economic models and redefine transactional relationships, which could have a significant economic impact globally.

Investing in Blockchain

Investing in blockchain is no longer confined to simply buying cryptocurrencies. With the advent of various blockchain-based financial products and services, investment opportunities are becoming increasingly diverse.

This section outlines the various facets of investing in blockchain, from understanding the basics to managing risks.

Understanding Investment Options

Blockchain investments are not limited to cryptocurrencies. There are various other vehicles like blockchain ETFs, tokenized assets, and venture capital investments.

Risk Assessment

Like any investment, blockchain carries its set of risks. Understanding market volatility, regulatory changes, and technological vulnerabilities is crucial for informed investment.

Strategies for Blockchain Investment

Several investment strategies, such as diversification and dollar-cost averaging, can be particularly effective when applied to blockchain assets.

Tax Implications and Regulations

Blockchain investments also come with their unique tax implications and regulatory requirements, which vary from jurisdiction to jurisdiction.

Future Prospects

With the constant evolution of blockchain technology, it’s essential to stay updated on the latest trends and market indicators for making informed investment decisions.

Blockchain Jobs and Careers

The burgeoning field of blockchain technology offers an array of job opportunities that go beyond coding and development. From blockchain consulting to legal expertise, the career landscape is as diverse as it is promising.

This section aims to guide you through the various career paths in blockchain, the skills required, and the prospects for growth.

Types of Blockchain Jobs

There are numerous roles in the blockchain sector, including blockchain developer, data analyst, project manager, and legal advisor, among others.

Required Skills and Qualifications

Different blockchain careers require various skill sets, ranging from coding languages like Solidity to understanding regulatory frameworks.

Job Market Trends

The demand for blockchain professionals is rising, but the supply of skilled workers has not yet caught up, leading to lucrative salary packages and job opportunities.

Career Growth and Advancement

With the rapid evolution of blockchain technology, continuous learning and adaptation are vital for career growth.

Education and Training

While traditional degrees in computer science or finance can be beneficial, specialized blockchain certifications and courses are becoming increasingly valuable.

Blockchain Communities

The significance of community involvement in the blockchain space cannot be overstated. A strong, engaged community can be the driving force behind a blockchain project’s success or failure.

This section will delve into the various types of blockchain communities, their roles, and how you can get involved.

Types of Blockchain Communities

Blockchain communities can be categorized into developers, traders, miners, and enthusiasts, each with their unique contributions and perspectives.

Importance of Community Involvement

A robust community can contribute to the development, adoption, and even the governance of a blockchain project.

Popular Platforms for Community Interaction

From forums like Reddit to messaging apps like Telegram, there are several platforms where blockchain communities congregate.

Case Studies: Community-Driven Success

Some blockchain projects owe their success largely to active community participation, showcasing the power of collective action.

How to Get Involved

Joining a blockchain community can be as simple as following a subreddit or as committed as contributing code to an open-source project.

For those looking to get more involved in specific blockchain sectors, our Popular Cryptocurrencies article provides a wealth of information to help you make informed decisions.

Blockchain in Emerging Markets

Emerging markets present a fertile ground for the adoption of blockchain technology. Whether it’s enhancing financial inclusivity or improving supply chain transparency, blockchain can address several challenges these markets face.

This section explores how blockchain is revolutionizing various sectors in emerging economies.

Financial Inclusion

One of the significant challenges in emerging markets is the lack of access to traditional banking systems. Blockchain can help bridge this gap through decentralized finance (DeFi).

Land Ownership and Registry

Blockchain can provide immutable, transparent land registries that can solve disputes and encourage investments in real estate.

Supply Chain and Agriculture

Blockchain can enhance transparency and traceability in supply chains, particularly in the agriculture sector, which is often the backbone of emerging economies.

Energy Sector

In emerging markets, where energy supply can be inconsistent, blockchain can facilitate decentralized energy grids and trading platforms.

Digital Identity

Blockchain can provide secure, immutable digital identities, thereby streamlining various services like healthcare, voting, and social benefits.

For further insights into the financial applications of blockchain, consider visiting our Rise of DeFi section and Cryptocurrency Exchanges article.

Blockchain Tools and Platforms

In the fast-paced world of blockchain, having the right tools and platforms can make a significant difference. This section will guide you through the essentials, from development environments to analytics tools, to help you navigate the blockchain ecosystem more efficiently.

Development Environments

Various platforms facilitate the development of blockchain projects, each with unique features and limitations.

Analytics and Monitoring Tools

Understanding blockchain transactions and network health is crucial for any project. Analytics tools can provide these insights.

Wallets and Storage Solutions

Secure storage of digital assets is a primary concern. Wallets come in various forms, each with its pros and cons.

Smart Contract Platforms

Smart contracts are a cornerstone of blockchain utility. Various platforms specialize in creating and managing these contracts.

Decentralized Exchanges (DEX)

The rise of DEX platforms has made cryptocurrency trading more secure and transparent.

For those new to cryptocurrency trading, our Cryptocurrency Trading and Crypto Wallets articles offer beginner-friendly guides and tips.

Blockchain and Taxes

Taxation in the realm of blockchain and cryptocurrencies is an evolving landscape.

This section aims to provide you with an overview of the key tax considerations you should be aware of when dealing with blockchain transactions.

Tax Implications of Cryptocurrency Transactions

From buying to selling and even spending cryptocurrencies, each transaction has its own tax implications.

Reporting and Compliance

Understanding how to report your transactions is crucial for compliance with tax regulations.

Capital Gains and Losses

Both gains and losses from cryptocurrency transactions can affect your tax liability.

Tax Regulations by Country

Tax treatment of blockchain transactions varies significantly from one country to another.

Tax Tools and Software

Various tools and software can assist you in keeping track of your transactions for tax purposes.

For more on the intricacies of tax regulations in the crypto space, check out our comprehensive guide on Crypto Tax.

Blockchain and Lending

Lending in the blockchain space has experienced a paradigm shift, thanks to smart contracts and decentralized platforms.

This section will take you through how blockchain is revolutionizing traditional lending systems and what it means for you.

Decentralized Finance (DeFi) Lending

DeFi lending platforms are disrupting traditional financial systems by providing loans without intermediaries.

| Platform | Type | Interest Rates | Supported Cryptos | Security |

|---|---|---|---|---|

| Nexo | Centralized | Up to 8% | 30+ coins | 256-bit encryption, cold storage |

| Aqru | Centralized | Up to 3% | USDC, Ethereum | Two-factor authentication |

| CoinRabbit | Centralized | 5% | USDC, USDT, Binance USD, BSC, USD Coin | Cold Wallet Storage |

| Aave | Decentralized | 0-3% | ETH, MATIC, AVAX, etc. | Smart Contracts |

| Nebeus | Centralized | 5% or 8.2% | USDC, USDT, and others | Multi-signature wallets |

| YouHodler | Centralized | 7%-10% | 30 cryptos | Two-factor authentication, Cold storage |

| Compound | Decentralized | Variable | 10+ cryptos | Smart Contracts |

| Crypto.com | Centralized | 0.1-12.5% | 22+ cryptos | ISO/IEC 27001:2013, PCI:DSS |

| Binance | Centralized | Variable | 180+ cryptos | SAFU fund, Two-factor authentication |

| CoinLoan | Centralized | Up to 6.2% or 8.2% | 22+ cryptos | 256-bit encryption, Cold storage |

P2P Lending on Blockchain

Peer-to-peer lending has found a more secure and transparent platform through blockchain technology.

Risk Assessment and Smart Contracts

Smart contracts can automate the risk assessment process, making it faster and more efficient.

Asset Tokenization in Lending

Tokenizing real-world assets can make them easily transferable and divisible, simplifying the lending process.

Regulatory Challenges and Solutions

Navigating the regulatory environment for blockchain-based lending can be challenging but is crucial for long-term success.

Blockchain and Education

The blockchain is not just about cryptocurrencies and financial transactions; it’s also making inroads into the educational sector.

This section explores how blockchain technology is set to revolutionize various aspects of education, from credential verification to enhanced learning experiences.

Credential Verification

Blockchain can drastically simplify the process of verifying academic credentials, making it more secure and transparent.

Learning Management Systems (LMS)

Blockchain can be integrated into Learning Management Systems to make them more efficient and user-friendly.

Student Records and Data Privacy

Blockchain can ensure that student records are secure, transparent, and easily transferable between institutions.

Open Source Learning Platforms

Blockchain can facilitate the development of open-source learning platforms that are secure and transparent.

Decentralized Educational Resources

Decentralized educational resources can make quality education accessible to all.

For a broader understanding of blockchain’s impact on different sectors, you might find our guide on Blockchain in Emerging Markets to be helpful.

Wrapping Up the Blockchain Odyssey

As we close this comprehensive guide on blockchain technology, it’s clear that its impact extends far beyond just the financial sector.

From enhancing data security in healthcare to making educational credentials more verifiable, the applications are as varied as they are revolutionary.

We’ve navigated through the intricate world of blockchain, touching upon its integration in various industries and even diving into some of the more technical aspects.

As blockchain continues to evolve, it’s crucial to stay informed and prepared for the transformations it will inevitably bring about in various facets of our lives.

Whether you’re an investor, a professional, or just a curious reader, we hope this guide serves as a one-stop resource for all your blockchain-related queries.

For further reading, check out our deep dives into Cryptocurrency Trading and the Rise of DeFi.

Here’s to embarking on a blockchain journey that’s informed, secure, and full of potential!